Highlights:

- Global liquidity tightens as $10T debt rollover drives market stress.

- U.S. shutdown limits spending, draining liquidity from risk assets.

- Treasury spending, QT end may trigger renewed liquidity inflows.

- Policy shifts and global stimulus could stabilize markets in 2025.

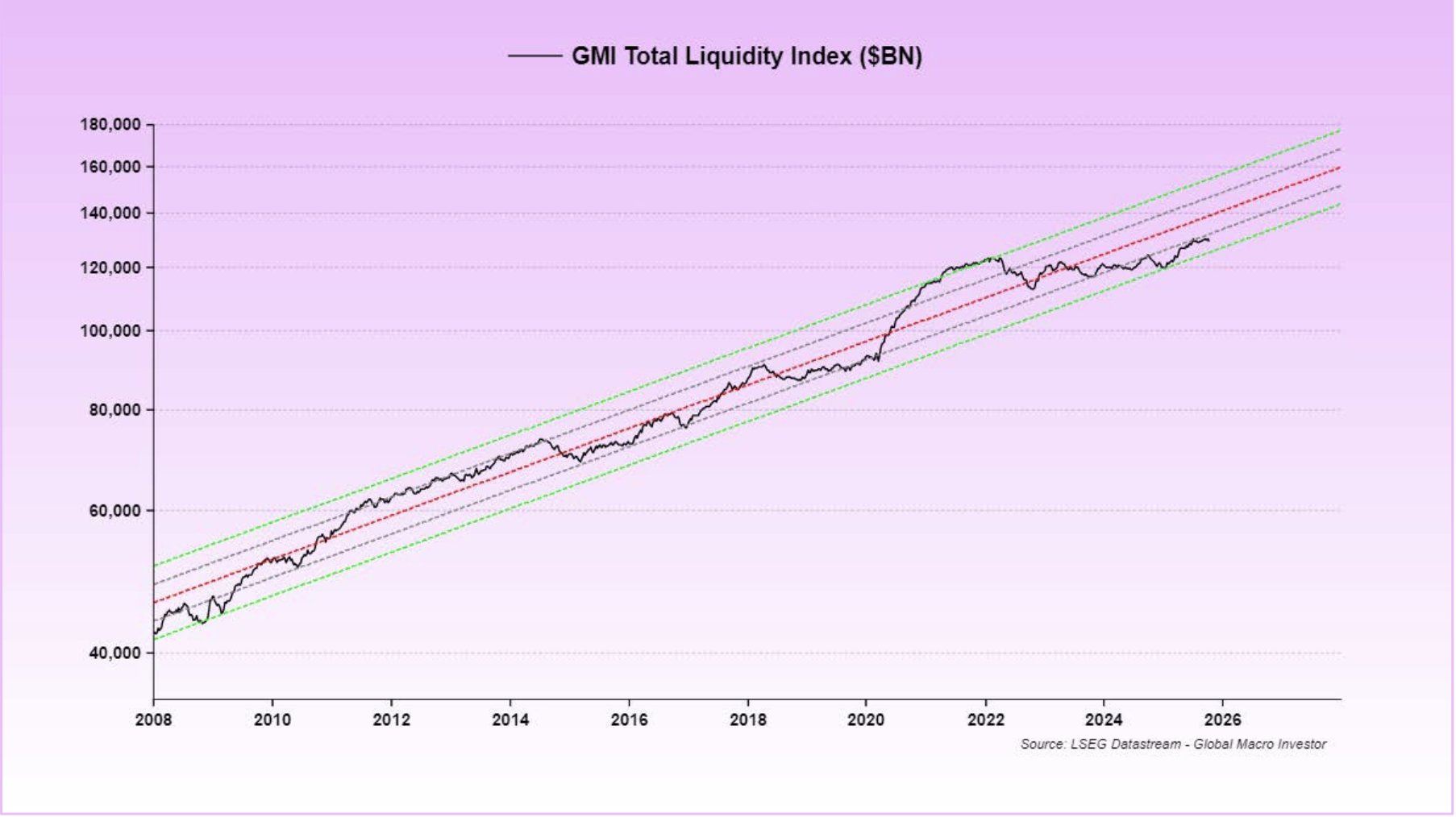

Global markets are currently facing a liquidity squeeze, with macro strategist Raoul Pal warning that conditions are being shaped by one of the most major debt rollovers in history. In a recent analysis shared on X, Pal stated that global liquidity remains the dominant macro factor and that the next 12 months will revolve around managing the $10 trillion in rolling debt obligations.

I know no one wants to hear bullish ideas and everyone is scared and wants to fling poo at each other… but the Road to Valhalla is getting very close.

If global liquidity is the single most dominant macro factor then we MUST focus on that.

REMEMBER – THE ONLY GAME IN TOWN IS… pic.twitter.com/WXhqd23ec9

— Raoul Pal (@RaoulGMI) November 4, 2025

According to Pal, the ongoing U.S. government shutdown has led to a contraction in liquidity as the Treasury General Account (TGA) builds up without accompanying spending. The situation is compounded by the exhaustion of the Federal Reserve’s reverse repo facility and continued quantitative tightening (QT), both of which remove liquidity from the financial system.

This tightening has hit risk assets hardest, particularly cryptocurrencies, which are highly sensitive to liquidity conditions. Traditional asset managers have also faced a difficult year, with many underperforming benchmarks and struggling to adapt to the sudden easing cycle. Equity markets have held more stability, supported by 401(k) inflows and institutional repositioning, but Pal cautioned that a prolonged liquidity drain could eventually pressure stocks as well.

Possible Turn in Liquidity Cycle

Pal’s analysis shows that the end of the government shutdown could mark a reversal in liquidity trends. Once the Treasury resumes spending, between $250 billion and $350 billion could flow into the economy within a few months. Simultaneously, QT is expected to conclude, leading to a technical expansion of the Federal Reserve’s balance sheet.

Source: X

This transition may weaken the U.S. dollar as global liquidity improves. Tariff negotiations are also expected to wrap up, removing uncertainties that have weighed on trade sentiment. Increased bill issuance would inject more liquidity through bank balance sheets, money market funds, and stablecoin systems, while changes to supplementary leverage ratio (SLR) rules could expand banks’ credit capacity.

Pal highlighted several additional macro shifts expected over the next year. Rate cuts may continue as post-shutdown economic weakness supports easing, while new U.S. Legislation, such as the CLARITY Act, could establish regulatory guidelines for crypto integration into traditional finance. He added that major economies including China and Japan are expected to boost fiscal and monetary stimulus.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.