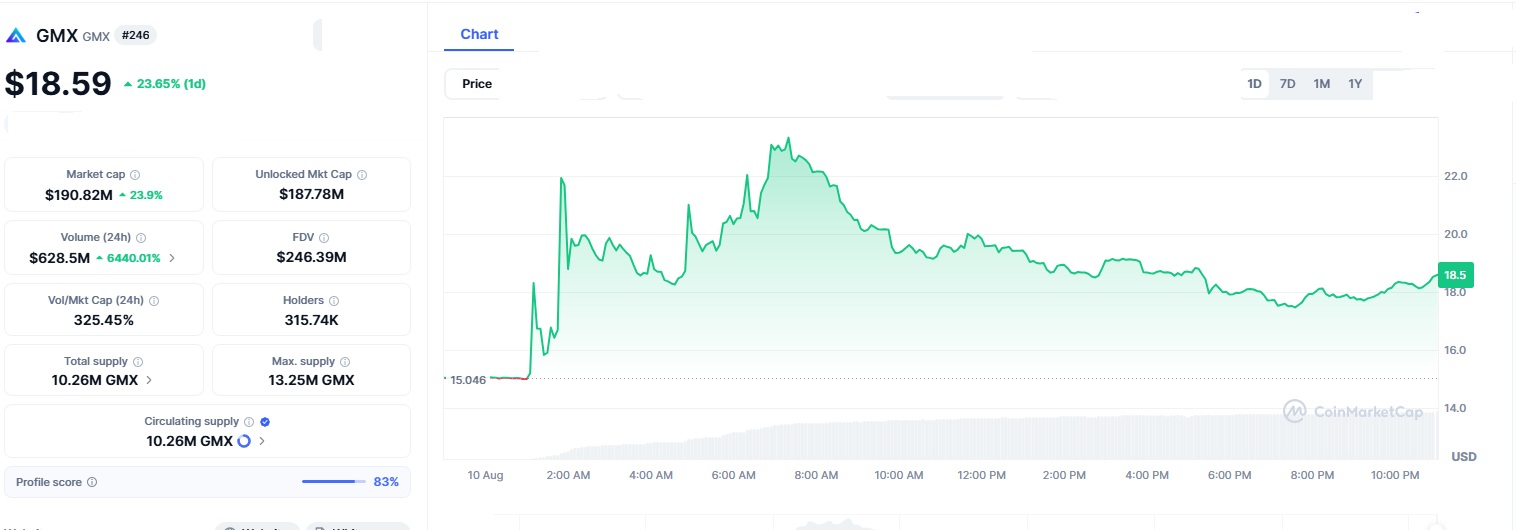

GMX has long been an underdog in the crypto space. It’s a decentralized token for trading on platforms like Arbitrum and Avalanche, allowing traders to use leverage without relying on centralized exchanges. Recently, GMX has gained attention, jumping 23% to $18.59 due to the launch of its new cross-chain ecosystem, which is shaking up the market.

Back in 2021, GMX was priced around $2 and then soared to $91 in 2023 during the surge of decentralized finance (DeFi). This current rise to nearly $20 feels reminiscent of those high points. The big question is whether this increase will last or if it’s just a temporary spike.

With a market cap of $190 million and trading volume reaching $628 million in just 24 hours, this 23% rise is significant. It’s driven by a new feature that allows traders to move easily between different blockchains, attracting both developers and users. This development could spark discussions in trading communities, with many debating if GMX’s surge is a sustainable rally or just a short-lived bubble.

GMX’s recent surge comes from its smart cross-chain expansion, letting users trade perpetual contracts on Arbitrum and Avalanche with lower fees and better liquidity solving DeFi’s usual fragmentation headaches. GMX stands out by sharing real trading fee yields with stakers, earning 30% of V1 and 27% of V2 fees, with strong APRs around 35% on Arbitrum and 37% on Avalanche. On-chain data shows a big jump in users, with daily active addresses up 50% since the launch, and total value locked (TVL) hitting $1 billion as traders flock to its no-slippage trading model.

At $18.59, it’s price mirrors this momentum. The RSI is at 63, signaling bullish strength without being overheated, and support around $14 is holding strong. If this rally continues, analysts are eyeing $30 as the next big target, backed by the ecosystem’s potential to attract $4 billion in secured value through integrated proofs.

GMX Surges 23% – Bubble or the Real Deal?

GMX has experienced both high and low phases. In 2022, it skyrocketed by 4,500% during a boom in perpetual trading, but, it dropped 90% due to bear markets and some security breaches. Recently, GMX saw a 23% increase, which is notable given a recent hack that had shaken confidence. The team quickly recovered by adding new features like Chainlink pricing, helping to restore trust.

GMX operates in a fully decentralized manner, no KYC, all transactions on the blockchain, which appeals to many crypto enthusiasts. However, its leverage trading can be risky if trading volumes decrease. With Bitcoin steady around $120,000, GMX’s rise seems to be based on actual utility rather than just excitement. Additionally, as perpetual contracts reach $50 billion in open interest, more institutional players might get involved.

The current rise of GMX to $18.59 is drawing attention. It’s a token that has survived tough times and is now gaining traction due to technology that could change decentralized finance (DeFi) trading. However, it’s important to remember that the hype can fade if adoption slows. Competition from platforms like dYdX or Perpetual Protocol might limit gains to around $25.

GMX’s 23% jump to $18.59 captures the excitement of crypto could this be a bubble or the start of something big? With strong momentum behind its ecosystem, it’s looking like the real deal, but caution is still key. Share this if you’re betting on the surge because tomorrow it might just change your portfolio.

FAQs

- What is GMX’s current price?

As of August 11, 2025, It trades at $20.64, up 23% with a market cap of $188 million. - Why did GMX surge 23% today?

The launch of GMX’s cross-chain ecosystem boosted trading volumes to $625 million, enhancing liquidity and user adoption. - Is GMX a bubble or sustainable?

GMX’s decentralized perp trading and high yields (34.77% APR on Arbitrum) suggest real value, though leverage risks persist. - What supports GMX’s price growth?

Its no-slippage model, $1 billion TVL, and fee-sharing with stakers drive demand for GMX in DeFi markets. - What risks could limit GMX’s rally?

Competition from other perp platforms and potential market dips could cap gains at $25 or below.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.