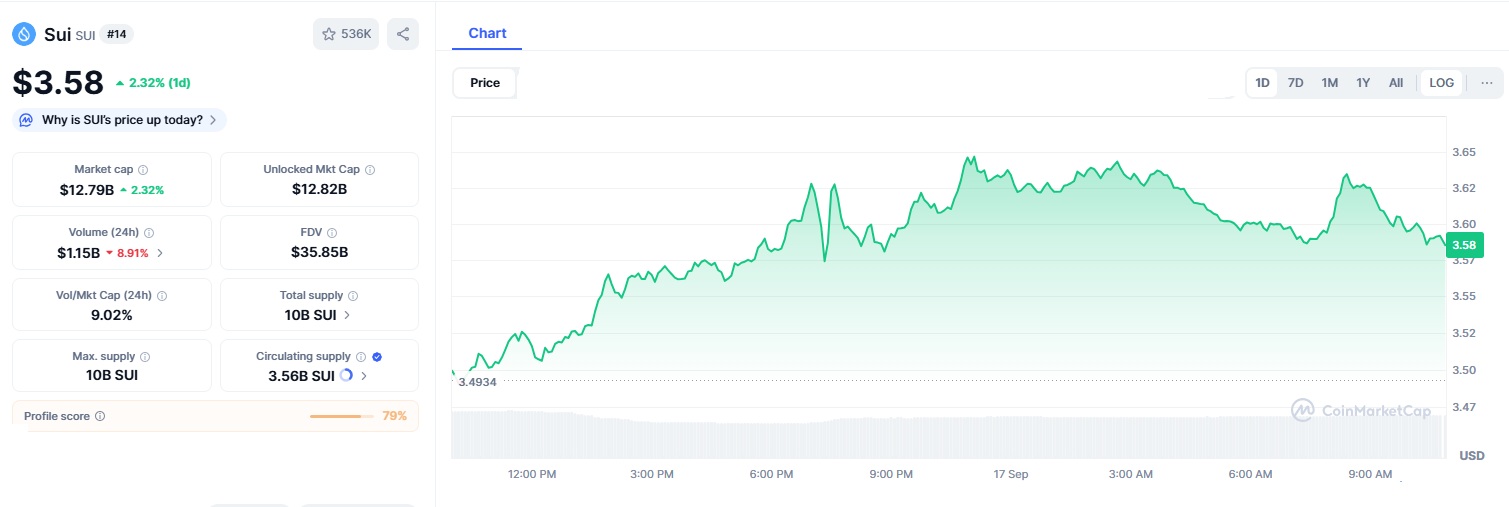

Google has taken an important step in connecting artificial intelligence with blockchain technology by choosing the Sui network as a launch partner for its new Agentic Payments Protocol (AP2). This protocol is an open-source standard that allows AI agents to carry out financial transactions on their own. The announcement on September 16 pushed the price of Sui’s token up by 4% to $3.50, sparking new discussions on whether the cryptocurrency could rise to $5 before the end of the year.

The Agentic Payments Protocol expands on Google’s earlier work with AI by adding the ability to complete payments instantly and securely. Sui was selected because of its technical design, which is different from most other blockchains. It uses an “object-based” system that allows many transactions to be processed at the same time. This means transactions can finish in less than a second, which is especially useful for AI-driven tasks such as automated shopping, loan applications, or even negotiating real estate deals.

Sui was created by Mysten Labs, and it has already introduced zkLogin, a feature that protects user privacy by letting people log in using services they already know, such as Google or Facebook, while still keeping their identity safe. With this setup, AI agents can act on behalf of users only when they give permission. The announcement had a quick impact on the market. Trading volume for Sui jumped to $1.1 billion in just 24 hours after the news, far above its usual weekly average. Its market capitalization reached $9.6 billion, placing it in the top 20 cryptocurrencies.

This is not the first time Google and Sui have worked together. Back in April 2024, Google Cloud integrated Sui’s blockchain data into BigQuery, a tool for analyzing large amounts of information. That collaboration allowed developers and businesses to study Sui’s network activity in real time. Now, the partnership is moving beyond data into the world of programmable payments.

The payments protocol already has wide industry support. More than 60 companies, including big names like Salesforce and American Express, contributed to building it. The goal is to make payments work smoothly across both traditional systems like credit cards and blockchain systems that use stablecoins such as USDC and USDT. This hybrid approach is expected to make adoption much easier.

To encourage developers, Sui made its AP2 software development kits (SDKs) available to the public on September 17. This means programmers can begin building their own applications that work with the new protocol. Early projects already show creative uses such as privacy-focused micropayments for gaming groups.

A timeline sketches Sui’s ascent:

| Milestone | Date | Impact |

|---|---|---|

| Mainnet Launch | May 2023 | Parallel execution debuts; TVL hits $100M in weeks. |

| Google Cloud Integration | April 2024 | BigQuery datasets enable AI analytics; dev grants flow. |

| Mysticeti Consensus | March 2025 | Latency drops to 390ms; TPS triples to 297K. |

| AP2 Partnership | Sept. 16, 2025 | AI payments unlock; SUI +4%, volume x4. |

| SDK Open-Source | Sept. 17, 2025 | Agentic dApps proliferate; 500+ GitHub stars overnight. |

Can Sui Reach $5?

The possibility of Sui reaching $5 depends on both technical and market conditions. Current charts show the token holding above the $3.20 support level, with indicators suggesting there is room for further growth. Analysts forecast that if demand continues and new funds flow in similar to the way Solana surged after ETF approvals in 2024 Sui could average around $5.45 by December. The network has also benefited from its Mysticeti upgrade, which reduced transaction delays by 80% and boosted speed to nearly 300,000 transactions per second in testing. These improvements make Sui competitive in the race among blockchain networks to become the fastest and most reliable option for real-world applications.

Despite the optimism, Sui still faces challenges. Cryptocurrency markets are volatile, and if Bitcoin experiences a major drop, Sui could also fall, possibly testing levels near $2.80. Another issue is regulation. While the European Union’s MiCA framework and U.S. bills such as the GENIUS Act are starting to provide clearer rules, the combination of AI and blockchain payments is still a new area that regulators may approach cautiously. There are also concerns about centralization since Sui’s validator set is smaller compared to some competitors. This could raise questions about fairness and long-term decentralization. Additionally, large token unlocks scheduled for later this year could add selling pressure unless balanced by token burns or increased demand.

The partnership between Google and Sui shows how blockchain and AI are beginning to merge. For years, cryptocurrencies were often seen only as speculative assets. Now, they are being woven into systems that could support a much larger digital economy. Sui’s focus on speed, privacy, and integration with familiar payment methods positions it well for this next stage. Developers can already experiment with new applications, such as AI-powered shopping bots that negotiate discounts or financial tools that settle stablecoin trades in a fraction of a second. If these use cases expand, the long-term demand for Sui could grow well beyond short-term price movements.

Industry analysts suggest that Sui’s partnership with Google may turn it from a promising project into a cornerstone of AI-driven finance. If adoption of the Agentic Payments Protocol reaches millions of AI agents by 2026, the $5 target for Sui may even look conservative. However, broader market conditions and regulatory developments will play a major role in determining how fast this growth happens.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.