In 2025, decentralized finance (DeFi) is making a strong comeback, with platforms like PancakeSwap playing a key role. These high-liquidity crypto exchanges attract traders by handling large trading volumes quickly and rewarding those who provide liquidity with steady earnings. This means people can trade digital assets efficiently, and others can earn by supplying tokens that keep the markets running smoothly.

A standout story this year is PancakeSwap’s performance. As a leading decentralized exchange (DEX) on the BNB Chain, it has been setting impressive records. In June 2025, PancakeSwap reported a record-breaking monthly trading volume of $325 billion, the highest in its history. This not only surpassed its previous achievements but also demonstrated its strength against competitors. Earlier in the year, PancakeSwap processed about $205.3 billion in trades, largely due to its expansion to other blockchains like Solana and improved cross-chain functionality.

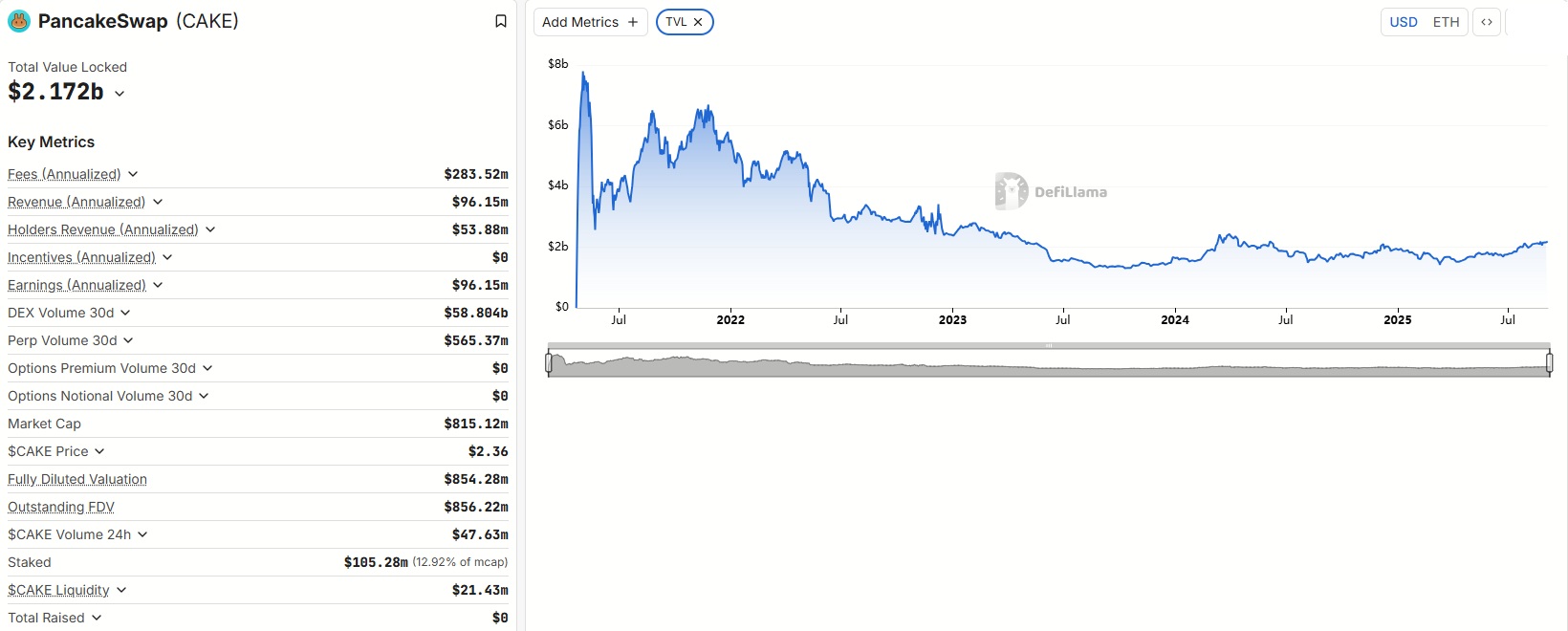

Data from DeFiLlama shows that PancakeSwap’s total trading volume has now surpassed $1.65 trillion, with over $58 billion processed in just 30 days. These figures show that even when the crypto market experiences ups and downs, activity on PancakeSwap remains steady. This growing popularity is also reflected in the price of its native token, CAKE, which has increased by about 20% this year. In late July, CAKE rose another 28% as more capital entered the ecosystem and technical upgrades boosted trader confidence.

Outperforming the Competition

In July, PancakeSwap had a significant moment. It recorded $188 billion in trading volume, double what its main competitor, Uniswap, handled in the same month. This success was due to two main reasons: low transaction fees and large liquidity pools. For traders, this meant they could exchange tokens at lower costs with less risk of prices changing unexpectedly. For those providing liquidity, meaning they deposit tokens to support trading, it resulted in competitive annual returns of 8–12% from trading fees and platform rewards.

PancakeSwap has also introduced important upgrades. The Infinity V4 update brought new features like modular hooks, which let developers create custom trading strategies, and advanced fee controls to boost efficiency. These changes have reduced transaction errors and made the platform more appealing to both casual traders and large investors.

Although the platform’s total value locked (TVL) was around $2.1 billion earlier this year, it has seen some declines due to broader fluctuations in the DeFi space. This indicates that while PancakeSwap excels in trading volumes, it still faces the same challenges as the wider market.

Why High-Liquidity Crypto Exchanges Matter

Exchanges with high liquidity, like PancakeSwap, are doing well because they offer speed and affordability. In traditional finance, more liquidity means smoother transactions and lower costs, and the same applies in crypto. A larger pool of assets available for trading means that a single large trade doesn’t affect market prices as much. As the crypto market recovers from the regulatory issues and downward trends of 2024, platforms that are efficient and cost-effective are gaining an advantage. PancakeSwap’s growth indicates that big players are becoming more comfortable using decentralized platforms instead of centralized ones.

However, there are risks to consider. Liquidity providers deal with the challenge of impermanent loss, where the value of deposited assets can change compared to just holding them. There are also concerns about smart contract vulnerabilities, as flaws in the code could lead to hacks. These risks highlight the importance of being cautious, even in successful ecosystems.

Key Developments in 2025

To better understand PancakeSwap’s rise, here’s a timeline of its major achievements this year:

- Q1 2025: Trading volumes reached $205.3 billion, supported by PancakeSwap’s expansion to multiple blockchains. The CAKE token gained 20% during this period.

- May 2025: Monthly trading volumes climbed to $173 billion, with new partnerships expanding the platform’s ecosystem.

- June 2025: A record-breaking $325 billion was traded, setting a new all-time high.

- July 2025: PancakeSwap processed $188 billion in trades, double the volume of Uniswap, while CAKE jumped 28%.

- August 2025: The platform teased major announcements, with analysts predicting CAKE could reach $5.83 by the end of the year.

- September 2025: PancakeSwap’s 24-hour trading volume stood at $2.15 billion, with cumulative trading volume exceeding $1.65 trillion.

This steady growth shows not only resilience but also a clear trajectory toward greater adoption in the DeFi sector.

Broader DeFi Trends

PancakeSwap’s growth is part of a bigger trend where decentralized exchanges are gaining more market share. Low fees are a key factor. PancakeSwap charges just 0.01% for stablecoin pairs, making it very competitive against platforms like Uniswap and Curve. Analysts think that if conditions like lower inflation and increased investor interest continue, high-liquidity platforms might see even more growth. For early users, this could mean returns of 50% or more. However, experts remind investors to diversify, as the DeFi sector can be unpredictable.

PancakeSwap’s impressive performance in 2025 shows how high-liquidity decentralized exchanges are changing the trading scene. With low fees, quick transactions, and steady rewards for those providing liquidity, PancakeSwap has stayed ahead of competitors and attracted interest from both individual and institutional investors. While there are still challenges like impermanent loss, market ups and downs, and regulatory uncertainty, PancakeSwap’s path indicates the increasing importance of decentralized exchanges in finance. If these trends continue, platforms like PancakeSwap could keep growing and become key parts of the global crypto ecosystem.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.