In decentralized finance (DeFi), many users turn to liquidity pools as a way to earn passive income. By depositing tokens like USDC or ETH into these pools, users typically earn interest or rewards. However, as more people join the same pools, returns tend to shrink. This makes it harder for small and medium investors to see meaningful gains. This is where SushiSwap’s BentoBox vault changes the game. Instead of limiting users to a single stream of income, BentoBox allows the same deposited assets to be used across multiple strategies, creating opportunities for what many call “double-dipping.”

What Is BentoBox?

BentoBox is a token vault built inside SushiSwap, one of the leading decentralized exchanges. When users deposit cryptocurrencies like ETH, USDC, or DAI into BentoBox, the vault issues special tokens called bTokens. These bTokens act as a receipt, proving ownership of the deposited assets. The real innovation is that bTokens can be used in different parts of SushiSwap without requiring the user to withdraw the original assets. This makes it possible to earn yields in more than one place at the same time.

Here’s an example to make it clear. Imagine someone deposits DAI into BentoBox. That person earns a base yield because the asset is sitting in the vault. At the same time, BentoBox issues bDAI, which represents the deposit. The user can then take this bDAI and:

- Stake it in SushiBar to earn additional SUSHI tokens.

- Use it in Kashi, SushiSwap’s lending and margin trading platform, to borrow other assets or create leveraged positions.

This setup means one deposit works in multiple ways. Instead of choosing between staking or lending, users can do both simultaneously, essentially earning yields on top of yields.

Capital Efficiency and Gas Savings

One of BentoBox’s biggest strengths is capital efficiency. Normally, users have to move assets between different platforms, paying gas fees each time. With BentoBox, assets stay inside the same vault but can interact with multiple applications. This design reduces gas costs because there’s no need for repeated token approvals or transfers. It also avoids the problem of “idle assets,” since deposited tokens are always working in some capacity.

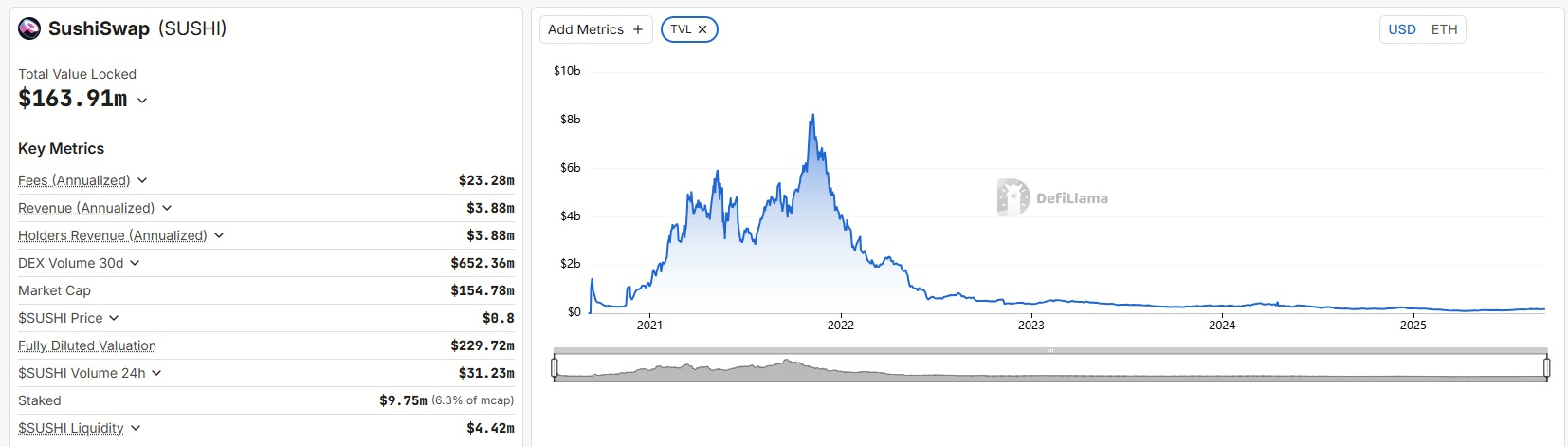

BentoBox has steadily grown since its launch. According to data from DeFiLlama, SushiSwap’s total value locked (TVL) reached $163 million in September 2025, and BentoBox alone contributed more than 40% of that. This shows that many DeFi users prefer strategies that make their assets more productive.

Rewards can also be attractive. Combining BentoBox with SushiBar staking has delivered returns of 15–20% APY, making it competitive with some of the best options in DeFi.

In the second quarter of 2025, SushiSwap introduced a major update, AI-driven yield optimizers for BentoBox. These tools automatically search for the most profitable strategies based on current market conditions. Instead of manually moving assets between staking and lending, users can let the optimizer handle it. This upgrade drew about 200,000 new users, reflecting growing interest in simpler ways to manage DeFi strategies. By reducing complexity, SushiSwap made double-dipping accessible to more people, not just advanced traders.

Timeline of Key Milestones

- March 2021: BentoBox launches with Kashi lending, enabling the first double-dip strategies.

- May 2021: Community strategies approved, raising yields on popular pairs to as high as 50–80% APY.

- November 2022: Integration with SushiBar expands opportunities for staking SUSHI tokens.

- April 2025: AI yield optimizers added, making automated strategies possible.

- September 2025:SHUSHI TVL surpasses $160 million on its own, BentoBox contributing heavily to SushiSwap’s overall ecosystem.

Risks and Challenges

While the idea of earning multiple rewards sounds appealing, BentoBox is not without risks. These include:

- Impermanent loss: When assets in a liquidity pool change value compared to simply holding them, returns may shrink.

- Smart contract vulnerabilities: Because DeFi relies on code, any flaw in BentoBox or related applications could be exploited by hackers.

- Oracle risks: Many DeFi platforms rely on price feeds from oracles. If these are manipulated, it can lead to unfair liquidations or losses.

- Liquidity shifts: If too many users withdraw at once, rewards may drop sharply.

These risks make it important for users to research before investing and to avoid putting in more than they can afford to lose.

Looking Ahead

Experts believe BentoBox has the potential to push SushiSwap’s TVL beyond $1 billion if adoption continues. Its combination of efficiency, composability, and user-friendly design makes it a strong contender in the evolving DeFi landscape. At the same time, regulators around the world are paying closer attention to staking and yield farming. SushiSwap’s future success may depend on how it adapts to compliance requirements while continuing to innovate.

The BentoBox vault within SushiSwap represents a major step forward in DeFi strategy. By allowing users to earn yields from multiple sources using the same deposit, it offers a way to maximize returns while reducing unnecessary costs. Although risks remain, BentoBox shows how creative design can make decentralized finance more rewarding and accessible. For many, it has become a clear example of how one platform can transform ordinary pools into powerful, multi-layered opportunities for growth.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.