360noscope420blazeit (MLG crypto) is a Solana-based meme token that has seen impressive momentum lately, sparked by its mission to channel the humor and camaraderie of classic gaming culture into the world of Web3. The project draws directly from the golden era of “MLG” memes, gaming tournaments, and iconic internet in-jokes, aiming to evoke a sense of nostalgia in anyone who remembers late-night matches, Mountain Dew marathons, and viral video edits. But MLG isn’t just about nostalgia, its creators actively cultivate new content and community activities, striving to bridge the “old web” culture with the participatory ethos of Web3 through ongoing initiatives, meme contests, custom gaming servers, and community-driven events1.

MLG’s token can be traded widely, with the most popular and liquid market found on Raydium (MLG/SOL), boasting a current 24-hour trading volume above $500 million. Other active venues for trading include LBank, XT.COM, and Meteora, with significant liquidity and tight spreads making it easy for both collectors and speculators to join in. The project is especially attractive for its accessibility – nearly all of its billion-token max supply is already in circulation, meaning holders face minimal inflation risk as the protocol matures.

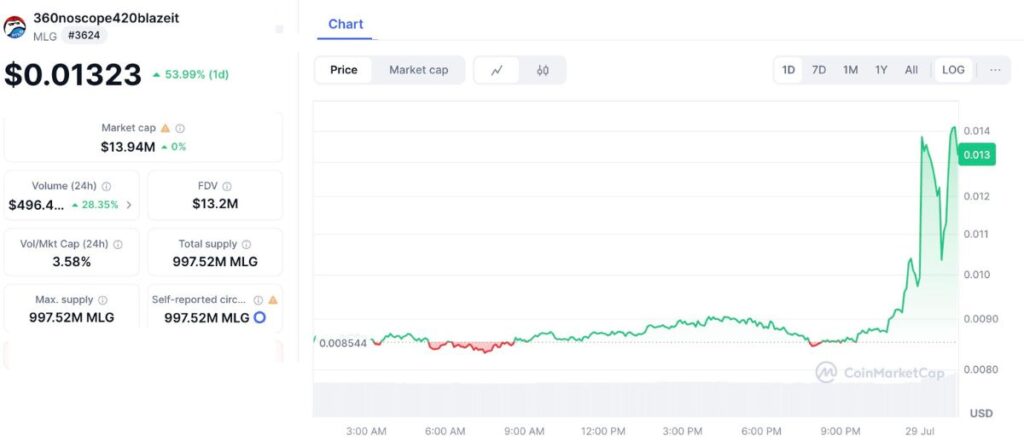

The numbers capture MLG’s recent acceleration. Its market capitalization is hovering around $13.94 million, with price action in the last day alone putting MLG up by more than 50%. Over the last week, the token has climbed 10–12%, outpacing both the broader crypto market (which is down slightly in the same period) and its Solana ecosystem peers, which have been flat. Daily trading volume recently crossed $2 million, a 330%+ jump that underscores a fresh wave of interest from speculators and true fans alike. MLG is currently up more than 1,100% from its all-time low, though still 92% off its $0.18 all-time high, a signal that, like most meme coins, volatility is the rule.

Source: CoinMarketCap

Possible Factors Driving the Price Increase for MLG Crypto

While exact causes are not confirmed, several factors speculated from posts found on X might be contributing to this rapid rise:

- Influencer Impact: It is speculated that endorsements or activity from esports influencers, potentially including FaZe Banks, may have sparked renewed interest.

- Community Activity: The MLG community, with over 25,000 holders, might be driving a buying frenzy.

- Market Sentiment: The broader Solana ecosystem’s strength, combined with meme coin trends, could be lifting MLG.

- Speculative Trading: High-profile buying or selling events (e.g., past accusations of using influencers as “exit liquidity”) might be triggering short-term pumps, though this remains unverified.

The appeal and risk of MLG mirrors the meme coin category. Its value relies on a mix of communal fun, nostalgia, and speculative momentum, rather than a formal “utility.” While there are community-run gaming servers and meme competitions, there’s no roadmap promising yield, protocol fees, or real-world asset links. That means MLG’s price can soar when buzz is high, but also drop sharply if attention fades or broader market sentiment sours.

In sum, MLG is a community project that taps into the enduring power of gaming and internet memes, and its blistering rise over the past days shows there is real appetite for nostalgia-themed tokens in 2025’s market cycle. For those willing to embrace the ride, MLG offers both throwback vibes and the excitement of real, high-volume trading action. But, as with all meme coins, caution is warranted. The fun and gains can be as fleeting as the memes themselves, making it essential to approach with both optimism and wise risk management

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.