Global money transfers are a massive business, with remittances now topping $800 billion every year. Traditional methods like bank wires are often slow and expensive, creating a strong demand for faster and cheaper solutions. This is where blockchain payment systems step in, and institutions such as Uphold and Circle are actively building on this shift. Their growing focus on digital rails is drawing attention to Zebec Network and its ZBCN token, which many see as a possible centerpiece in the movement toward streaming crypto payments.

Zebec has designed its system to support instant payroll and payments, making it different from traditional methods that take days to clear. One of its pilots, built with Emida, has already processed around $500 million in cross-border transfers between the United States and Mexico. Building on this success, the company is looking to expand into other major markets, including Thailand and Nepal, which alone has a remittance market worth about $50 billion.

The platform’s WageLink tool integrates with Circle’s USDC stablecoin and Stellar’s network to make transfers nearly free. Beyond payments, Zebec also offers features such as early access to wages and debit cards linked to cryptocurrency balances. Its native token, ZBCN, powers the system by covering fees, rewarding stakers with up to 15% annual yields, and enabling voting through a decentralized governance structure. Following a recent migration that converted the older ZBC token into ZBCN at a 10:1 ratio, more users have been able to participate in the ecosystem.

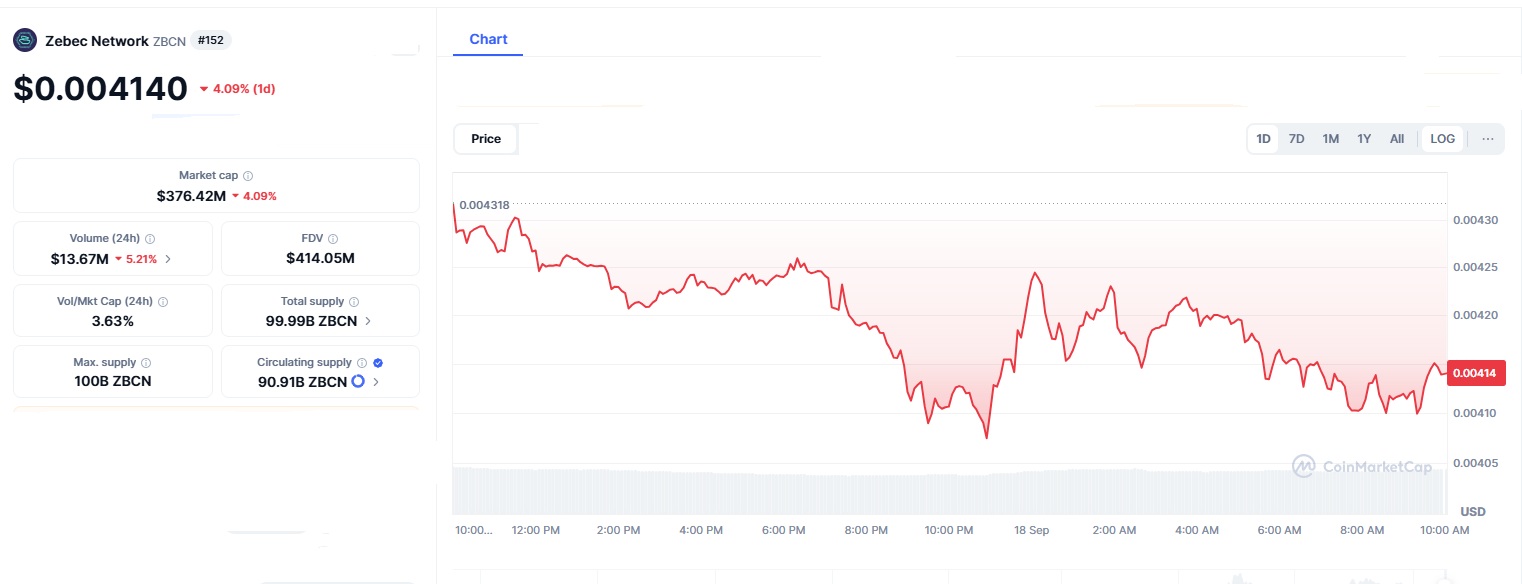

As of mid-September, ZBCN was priced at $0.0041 with a market capitalization of $376 million, despite a small dip that day. Blockchain data also shows strong support, with over 4 billion tokens staked, signaling confidence from holders.

Institutional Interest Gains Momentum

Institutional activity is playing a key role in Zebec’s growth. In May, Uphold revealed a $35 million position in ZBCN and hinted at an upcoming airdrop to its users. The exchange’s research team described Zebec’s design as forward-looking and suggested possible use cases for corporate treasuries and payroll. At the same time, Zebec is preparing for broader adoption in Europe. Its acquisition of compliance firm Gatenox ensures alignment with MiCA, the European Union’s regulatory framework for digital assets. This move positions the platform well for fintech partnerships in a region that is opening up to blockchain-based payments.

Zebec has also expanded its partnerships with projects such as World Mobile, which provides decentralized mobile connectivity, and OctaSpace, which focuses on cross-chain computing. These collaborations allow Zebec to connect payments with services like NFC-enabled point-of-sale devices, broadening its potential use cases across borders. The growing interest in Zebec comes at a time when regulation around cryptocurrencies is becoming clearer. The GENIUS Act has provided guardrails for stablecoins, while some regulatory probes have been paused, creating space for more institutional pilots.

Evolution of the Zebec Network

Since its mainnet launch in 2022, Zebec has steadily moved from a niche DeFi project to a platform supporting real-world finance. Its timeline includes the $500 million U.S.–Mexico pilot, the ZBC to ZBCN token migration in April 2025, and the institutional stake revealed by Uphold in May. By August, Zebec had released a whitepaper outlining its approach to MiCA compliance, further strengthening its case for institutional use. This growth reflects a wider trend of blockchain networks expanding into real-world applications, particularly in remittances and payroll sectors that touch millions of lives globally.

Despite the strong momentum, Zebec faces challenges. Its heavy reliance on Solana’s blockchain performance means that any congestion on Solana could impact transaction speed. There are also risks tied to oracles, which provide real-time price data and can be vulnerable to exploits. Even with these risks, Zebec has gained a wide user base. More than 36,000 holders support the network, and ZBCN is listed on 14 different exchanges. The token’s deflationary model, which includes a 20% burn on fees, helps to build confidence among long-term backers.

Looking Ahead

Zebec offers open-source software tools that help developers easily add payment solutions. One feature, WageLink APIs, allows USDC currency exchanges to happen in less than 200 milliseconds, which is perfect for quick financial transactions. Zebec also has two types of crypto cards: a Silver card for regular spending and a Black card for unlimited transactions, which could be useful for many gig economy workers. Experts think Zebec’s ability to connect traditional institutions with crypto tools could lead to major growth. If they receive regulatory approval and expand partnerships, the value of their token might increase significantly.

Zebec Network is becoming an important blockchain project by combining rules, speed, and easy access into a financial system that both companies and individuals can trust. It has already processed large money transfers and created partnerships in different areas, positioning itself as a key player in global payments. Zebec’s focus on instant and continuous money transfers makes it different from traditional methods and a leader in the new world of international finance.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.