IOTA, a pioneering distributed ledger designed for the Internet of Things (IoT), is gaining attention again with its latest upgrade, sparking interest about whether it can reach the $1 mark. Imagine a network specifically built to enable machines to communicate, trade, and interact without the high fees or energy consumption of traditional blockchains. From smart factories to self-driving cars, IOTA’s unique Tangle structure, a directed acyclic graph becomes more efficient as it grows. This design allows it to handle billions of device-to-device transactions while remaining lightweight and eco-friendly.

The founders, including Dominik Schiener, envisioned a future where connected devices could exchange data and value in real time. However, early challenges like security issues and centralization concerns caused setbacks. Now, after years of improvements and upgrades, the rebased protocol is drawing interest again, converting skeptics into believers and positioning IOTA as a significant player in our increasingly interconnected world.

IOTA’s comeback reads like a classic underdog story. Born during the 2017 bull run, it initially soared thanks to partnerships with giants like Bosch and Volkswagen, who saw the promise of a machine-to-machine economy. But early hurdles scalability issues and a controversial coordinator node led to criticism, denting trust and value.

Fast forward through the crypto winters, and the team hasn’t just survived they reinvented the network. The rebased mainnet is a ground-up overhaul, moving to a delegated proof-of-stake model that’s fully decentralised. Smart contracts now run on the Move Virtual Machine, known for speed and security, while EVM compatibility makes onboarding developers a breeze.

Validator nodes for IOTA have increased from 50 to 80, which makes the network more resilient. Transaction speeds are now faster than ever, almost instant. Holders can earn staking rewards of 10-15% annually, and the token is useful for governance, ecosystem benefits, and zero-fee transactions. This isn’t just excitement, it’s IOTA connecting the physical and digital worlds for practical uses.

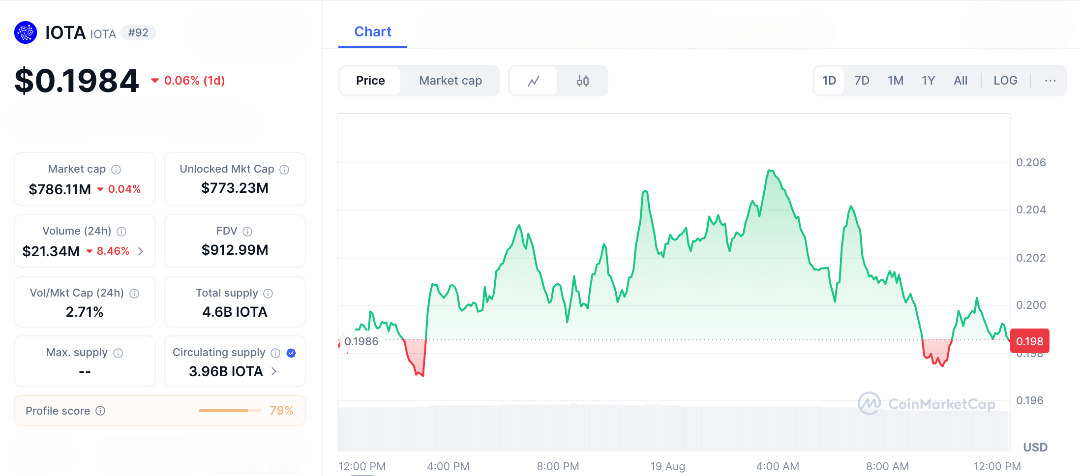

IOTA is gaining momentum. Since its latest upgrade, the total value locked has reached a record $36 million, indicating growing trust in its DeFi and real-world asset capabilities. The token itself has risen nearly 50% from its yearly lows and is now trading around $0.19. Monthly transactions have increased by more than 30%.

Institutional interest is picking up, particularly in Africa and Europe, where pilots in supply chain traceability like verifiable trade documents via TLIP are cutting costs by 25% and earning government attention. Meanwhile, IOTA Identity, a privacy-first framework compliant with W3C standards, is enabling secure, self-sovereign digital IDs. This means hospitals can share patient data safely, and cities can run smart grids with tamper-proof authenticity all powered by IOTA’s ledger. Developers are taking note, flocking to it’s SDKs to build apps for everything from carbon tracking to automated IoT payments. The hype isn’t just about tech it’s about real-world impact, with IOTA steadily proving its worth beyond the hype.

$IOTA has been coiling for 7 years. Still in the buy zone.

ISO 20022. Big enterprise adoption. Real-world utility.

This weekly chart is a spring. When it snaps, it won’t ask permission.

I’m not sleeping on this. pic.twitter.com/GO0Oy25AW2

— X Finance Bull (@Xfinancebull) August 18, 2025

Can IOTA Reach $1?

The big question is whether IOTA can hit $1. Its future is closely tied to the booming Internet of Things (IoT) sector, where trillions of devices are coming online. With no transaction fees and strong security, IOTA is designed for this growth, giving it an advantage over competitors that struggle with fees or centralization.

Analysts are cautiously optimistic. Some predict it could reach $0.54 by the end of the year with steady adoption, while others believe it could surpass $2 if smart city projects and decentralized physical infrastructure networks (DePIN) take off. Technically, if IOTA breaks above $0.28, it could gain momentum, especially with staking rewards and token burns reducing supply.

However, challenges remain. IOTA faces competition from platforms like Solana and Polkadot, which offer high scalability. Regulatory changes or broader economic issues could also slow its progress. But if major IoT companies adopt IOTA to power machine-to-machine transactions, long-term investors could see significant gains, turning past losses into future rewards.

IOTA’s journey has been remarkable, overcoming technical challenges to aim for dominance in the IoT space. The recent network upgrade is more than just an improvement; it’s a step toward a future where data and transactions move seamlessly together. With pilot projects becoming real-world applications, reaching $1 might just be the beginning for IOTA. Share this story because in the interconnected world of tomorrow, IOTA could be the key link.

FAQs

- What is IOTA?

IOTA is a feeless distributed ledger for the Internet of Things, using the Tangle for scalable, eco-friendly machine-to-machine transactions. - What’s new with IOTA’s rebased upgrade?

The rebased IOTA mainnet offers decentralized PoS, smart contracts, EVM compatibility, and enhanced scalability for IoT and DeFi. - Can IOTA reach $1?

With rising IoT adoption and bullish technicals, IOTA could hit $1 if partnerships and usage grow, though risks remain. - Why is IOTA unique?

IOTA’s Tangle, zero-fee transactions, and quantum-resistant design make it ideal for IoT, from smart cities to supply chains. - Is IOTA a good investment?

IOTA’s utility and IoT potential are promising, but crypto volatility and competition require careful research before investing.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.