Talk of a massive Crypto Bull Run is becoming more widespread. Bitcoin has shot past $121,000, and institutional investments through ETFs are pouring in like never before. Many are asking, Could 2025 be the biggest bull run in crypto history? Bitcoin is taking the lead, reaching its highest prices ever again. Spot ETFs, such as BlackRock’s iShares Bitcoin Trust, have brought in over $40 billion. This creates the perfect conditions for a historic bull run, one that could turn early investors into major winners and bring skeptics into the fold.

Bitcoin, often called digital gold, has been climbing steadily and just hit $121,000. This rally is partly thanks to talk of Federal Reserve rate cuts easing up on money flow. But this isn’t just a wave of retail buyers it’s big institutional players flexing their muscles. ETF inflows hit a massive $5 billion in just one week, pushing total inflows over $100 billion since these funds got approved. Big names like Fidelity’s Wise Origin Bitcoin Fund and ARK 21Shares are seeing record trading volumes, while whales are locking up their coins, tightening supply.

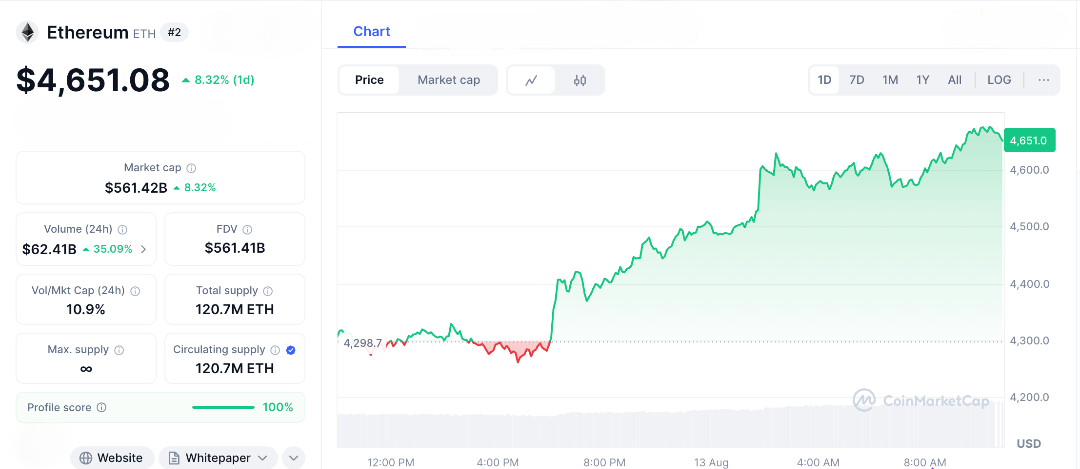

Ethereum is keeping pace, trading around $4,651, boosted by ETFs pulling in $20 billion and upgrades that make it easier and cheaper to use for DeFi and tokenized assets. The real excitement? The altcoin scene is heating up too. Solana’s blazing speed is attracting developers, XRP’s legal wins are opening doors for payment use cases, and all signs point to a Crypto Bull Run where every corner of the market benefits a rising tide lifting all boats.

What makes this potential Crypto Bull Run feel so big? It’s all about the fundamentals falling into place perfectly like stars lining up in the sky. First, global adoption is picking up speed. Countries like Brazil and Nigeria are using crypto for sending money across borders, while big brands like Tesla and Starbucks are starting to accept digital payments. This shows crypto is moving from niche to mainstream.

On the tech side, Bitcoin’s network is stronger than ever with its hash rate hitting record highs, keeping things secure. Ethereum’s Layer-2 solutions now hold over $50 billion in assets, making transactions faster and cheaper for everyone. Experts, are bullish predicting Bitcoin could hit $200,000 by the end of the year if ETF momentum continues. That would mean the entire crypto market could double in size again.

History backs this up too, after Bitcoin’s recent halving, new supply slows down, creating scarcity a key factor that often kicks off big bull runs. Throw in exciting trends like AI merging with blockchain and the explosion of Web3 gaming, and you have all the fuel needed for a record-breaking Crypto Bull Run.

🚨 BREAKING 🚨

THE TOTAL CRYPTO MARKET CAP HIT A NEW ALL TIME HIGH OF $4.2 TRILLION.

BIGGEST BULL RUN IS COMING 🔥 pic.twitter.com/Aj4ivJxilA

— Ash Crypto (@Ashcryptoreal) August 12, 2025

Risks and Reality Checks

Every major success story has its challenges. Some experts are worried that Bitcoin’s Relative Strength Index (RSI) around 51 suggests it might be overbought, meaning a price drop could happen soon. Economic concerns like rising inflation could also cause market corrections. Regulations are still unclear in some areas. While better rules in the U.S. and EU are helping attract more investments, there are still uncertainties, meaning the journey might have some bumps.

We’ve seen volatile times before. The 2018 crash after the ICO boom and the 2022 fallout from FTX showed that crypto markets can be very unpredictable. But now, the market is maturing. ETFs provide safer, regulated ways for big investors like pension funds and everyday people to get involved without taking as much risk. Whales, are buying and holding their Bitcoin. Addresses with over 1,000 BTC are at record levels, indicating that these confident investors believe the market could keep growing.

Is the Biggest Crypto Bull Run in History Coming?

With the rise of crypto from Satoshi’s groundbreaking whitepaper to countries like El Salvador adopting Bitcoin, it looks like this current Crypto Bull Run has real strength. If ETFs continue to bring in billions and Bitcoin stays above $100,000, 2025 could see the biggest bull run ever, creating new millionaires and making blockchain technology even more mainstream.

However, some advice is important, diversify your investments across Bitcoin, Ethereum, and promising altcoins; use dollar-cost averaging to handle price changes; and always keep your coins secure with hardware wallets. While no market surge is guaranteed, the signs are promising, trading volumes are increasing, charts look positive, and more countries and companies are getting into crypto every day.

If you’re already invested, hang on. If not, now might be a good time to start. Share this if you’ve experienced both bear and bull markets, because in the ongoing story of crypto, the next chapter could redefine wealth for a new generation. The 2025 Crypto Bull Run might just be the biggest one yet.

FAQs

1. Why is the Crypto Bull Run gaining momentum in 2025?

The Crypto Bull Run is fueled by Bitcoin hitting $121K, $100B+ in ETF inflows, and global adoption in payments and DeFi.

2. How do ETFs impact the Crypto Bull Run?

Spot Bitcoin and Ethereum ETFs, like BlackRock’s, absorb billions weekly, tightening supply and boosting prices in the Crypto Bull Run.

3. Could 2025 be the biggest Crypto Bull Run ever?

Analysts predict Bitcoin at $200K and a $10T market cap, driven by halving scarcity and institutional demand, making it potentially historic.

4. What risks could derail the Crypto Bull Run?

Overbought signals (RSI at 75), inflation spikes, or regulatory shifts could trigger corrections, testing the Crypto Bull Run’s strength.

5. Should I invest during this Crypto Bull Run?

Consider diversifying with ETFs, use dollar-cost averaging, and only invest what you can afford to lose due to volatility risks.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.