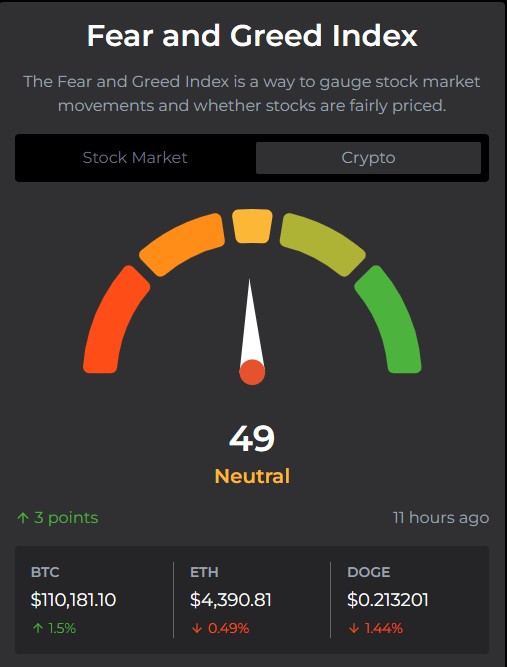

In late August 2025, the mood in the crypto market has become more cautious. The Crypto Fear & Greed Index, which measures investor emotions, is at a neutral score of 49. This is quite different from July, when the index was at 73, showing that investors were much more confident and eager to invest. Now, due to global economic uncertainties and regulatory news, traders are being more careful.

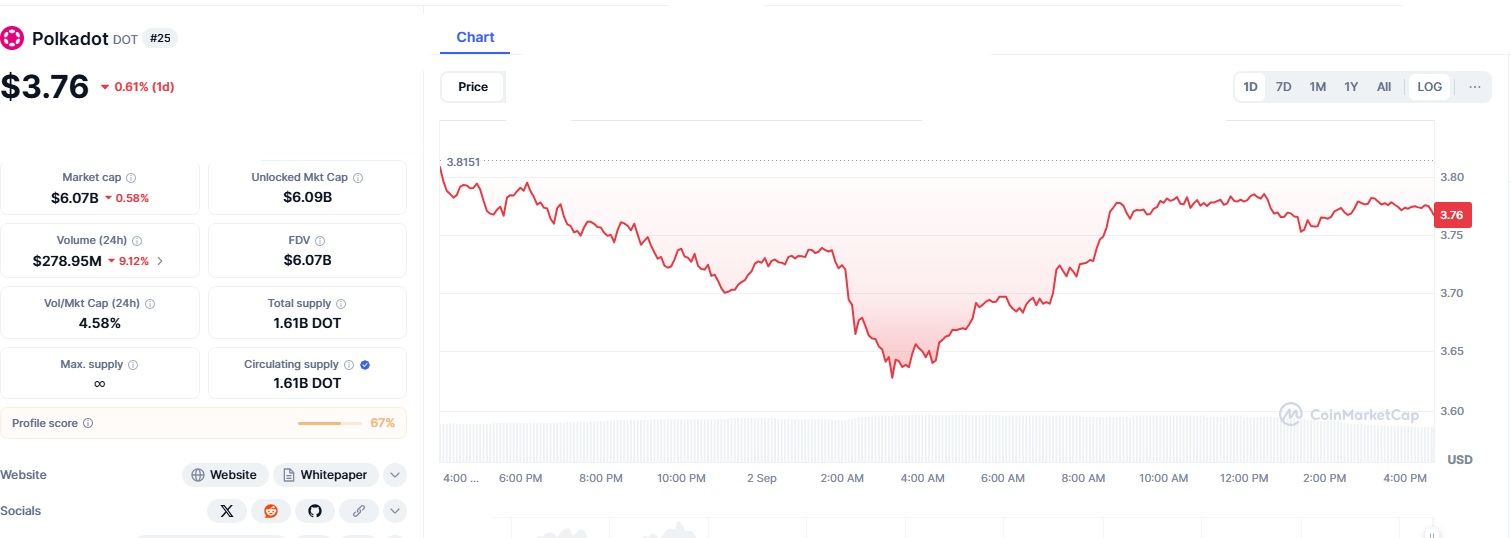

Polkadot (DOT), a well-known blockchain project, is in the middle of this cautious market. The token is currently priced at $3.76, showing small gains but not generating much excitement. Many investors are wondering if DOT has the potential to rise again or if it is losing momentum.

Where Polkadot Stands Right Now

Polkadot’s price action looks steady, but not spectacular. On September 2, DOT’s price was down just 0.61% in 24 hours, with a market capitalization of $6.07 billion and a daily trading volume of around $128 million. Over the last 30 days, the token gained 4.8%, which is decent but nowhere near the explosive growth of some competitors.

Analysts say the important support level is around $3.44, which has been holding well, while the next big resistance is near $4.40. Unless DOT can break past this resistance, it risks being stuck in a sideways trend.

On-chain data shows that staking remains strong, with approximately 782.5 million DOT tokens locked up. Staking yields between 14% and 16% APY, which keeps long-term holders interested. However, transaction volumes on Polkadot’s parachains (its special side networks) are not showing much growth. Compared to faster-moving ecosystems like Solana, Polkadot appears quieter, which feeds into the cautious sentiment.

The Sentiment Shift

The change in the Fear & Greed Index captures the broader mood. In July, when the index stood at 73, the market was optimistic and DOT saw strong gains. By August 29, the index had fallen as low as 39 (fear) before stabilizing at 49 (neutral). Neutral readings often mean the market is waiting for a trigger, something positive that could tilt sentiment toward greed, or a negative event that could push it back to fear.

The recent decline is due to larger market factors. The U.S. Federal Reserve’s decisions on interest rates have made investors uneasy, and regulatory pressure, especially on staking programs, has added to the caution. Interestingly, Polkadot has been able to avoid some of the stricter regulations because it focuses on compliance. However, the overall mood in the market still affects its performance.

Predictions and Possible Scenarios

Experts remain divided about where DOT goes next.

- Optimistic forecasts see DOT rising to $10 in 2025 if momentum builds, with near-term goals of $4.40 and then $5.50 by September. Much of this optimism is tied to upgrades like JAM (Join-Accumulate Machine), which aims to make Polkadot more scalable and efficient.

- Cautious outlooks see DOT struggling to break out in the short term, with some analysts predicting a September maximum of just $3.90.

- Longer-term projections stretch wider, ranging between $4.01 and $13.90 depending on how the broader crypto cycle plays out.

Technical charts show DOT’s Relative Strength Index (RSI) at 44, which suggests it is neither overbought nor oversold. The 200-day Exponential Moving Average (EMA) is around $4.50, and this is viewed as an important level, if DOT breaks above it, more traders could turn bullish. Polkadot’s ecosystem continues to grow, even if slower than some rivals.

There are positive developments, though. For example, Paraguay announced an investment in Polkadot technology to tokenize an innovation hub project that includes a hotel, university, and data center. Real-world adoption like this shows that Polkadot’s use cases extend beyond just trading and speculation, which could prove valuable in the long run.

Timeline of DOT in 2025

To understand DOT’s journey, here’s a quick timeline of its major moves this year:

- January 2025: Price dips to $3 during a winter sell-off.

- April 2025: DOT peaks at $5.50 following the release of the JAM whitepaper.

- July 2025: Fear & Greed Index hits 73, pushing DOT up by 20%.

- August 2025: Index drops to neutral 48, with DOT stabilizing at $3.82. The Paraguay adoption news provides some support but does not spark a breakout.

The Bigger Picture

Polkadot’s future relies on a mix of feelings, technology, and outside factors. If upgrades like JAM bring real improvements and more people start using it in everyday situations, DOT could see its price rise. However, if the global economy stays uncertain and competitors like Ethereum Layer 2s or Solana keep growing, Polkadot might struggle to gain momentum.

Currently, the market is cautious. Investors haven’t given up on DOT, but they’re waiting for a reason to feel positive. If the support level holds and upgrades show progress, Polkadot might surprise those who doubt it. However, without a strong boost, there’s a risk that DOT’s price could remain stagnant, leaving traders unsure about its potential to rise.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.