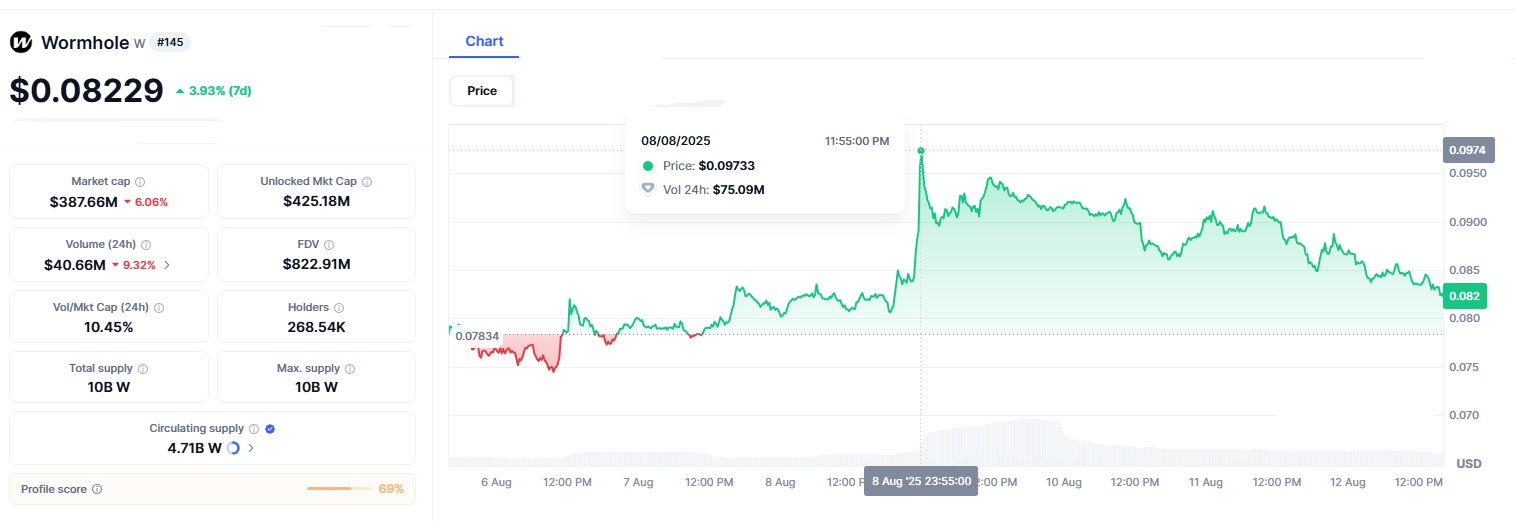

Wormhole Crypto is a cross-chain protocol designed to move funds between different blockchains like Ethereum and Solana. However, its price has dropped nearly 95% from its peak, leaving traders wondering if its best days are over. Currently trading around $0.083, it has shown a small weekly bounce, sparking interest among speculators who see potential in its recovery.

Wormhole Crypto launched with a lot of excitement, offering seamless connections between blockchains. Its native token ‘W’ quickly soared to an all-time high of around $1.61, driven by enthusiasm for multi-chain finance. But then, things took a downturn. A major hack drained $325 million from the protocol, regulatory scrutiny increased, and a tough bear market affected nearly every project. Wormhole Crypto’s market cap is now below $500 million, a shadow of its former self. Additionally, token unlocks have added selling pressure, keeping the price low and making recovery difficult.

The journey of Wormhole Crypto is marked by challenges and resilience, capturing the curiosity of traders who see opportunity amid the difficulties. This sharp drop isn’t unusual in crypto’s wild world, but it definitely hurts for those who believed in Wormhole early on. The project promised to fix one of the toughest problems, making it easy for assets to move smoothly between different blockchains without relying on clunky wrapped tokens or risking centralization.

Its Native Token Transfer (NTT) technology was a game-changer, letting assets move securely thanks to a network of guardians keeping everything safe. But after the massive hack and a tough market, excitement faded. Big holders sold off, everyday investors pulled back, and rivals like LayerZero and Axelar started eating into W’s market share. Are Wormhole’s best days over? Critics say yes, pointing to the fact that over 80% of its tokens are still locked up and won’t fully unlock until 2028. Plus, with so many competing bridges, trust is fragile. One more security slip-up could turn it into a warning story for others.

The story of Wormhole Crypto isn’t over yet. Recent developments suggest things might be improving. Strategic partnerships with big names like BlackRock’s BUIDL fund and Ripple’s XRP network indicate growing institutional support and practical uses. This week, Wormhole also collaborated with Boundless to use zero-knowledge proofs powered by RISC Zero technology. This could lead to faster, safer, and cheaper cross-chain apps, benefiting both users and developers.

🤝 @Wormhole unveils a partnership with @Boundless_xyz#Wormhole $W partners with #Boundless, a protocol that enables off-chain zero-knowledge verification of arbitrary computations for any blockchain. Through this partnership, Wormhole is adding a Boundless NTT verifier for… pic.twitter.com/V3sgsYepnO

— PHOENIX – Crypto News & Analytics (@pnxgrp) August 12, 2025

On-chain data supports the optimism, prices have climbed 13% in the last week, breaking out of a downtrend and testing resistance near $0.095. Trading volumes have surged over 230%, signaling renewed interest. Analysts are watching closely, with some predicting a short squeeze that could push the price to $0.10 by the end of the month if this momentum continues. Looking back, Wormhole Crypto has survived a massive hack and has become a leader in governance innovation. The project still offers attractive staking rewards and plays a significant role in the growing multi-chain DeFi space. This could attract new interest, especially as Bitcoin stabilizes and altcoins gain traction.

Big institutional money is flowing into cross-chain bridges, with Wormhole’s technology supporting the potential movement of trillions in assets. Some critics point to the 95% price drop as a sign that Wormhole has peaked. However, history shows that strong projects like Polkadot and Chainlink have bounced back from similar setbacks. If Wormhole successfully implements upcoming upgrades like improved zero-knowledge technology and expands support to new blockchain types, it might just reclaim its position as a top player. Only time will tell if it can rise from the ashes. Keep an eye on this space and share your thoughts!

The Heart of Wormhole Crypto

The real story lies with the people involved. The founders are working hard to rebuild trust after the hack, communities are coming together on forums, and big investors are quietly buying tokens when prices dip. It’s a story of determination and perseverance in the unpredictable world of crypto. Will W Crypto make a major comeback, turning today’s buyers into legends? Or will it fade away, just another overhyped project lost to time? This uncertainty is part of what makes it exciting. Traders are encouraged to do their own research and proceed with caution.

In this ever-changing ecosystem, the best days might still be ahead, connecting to the next big trend. Share if you’ve held on during tough times or if you’re looking out for a rebound, Wormhole Crypto’s journey could be your next significant win.

FAQs

1. Why has Wormhole Crypto lost 95% since its ATH?

Wormhole Crypto dropped from $1.60 due to a $325M hack, token unlocks, and bearish market trends, now trading around $0.085.

2. Is Wormhole Crypto’s bull run over?

Not necessarily. Recent partnerships and a 13% weekly gain suggest recovery potential, though token supply pressures linger.

3. What is Wormhole Crypto’s purpose?

Wormhole Crypto is a cross-chain protocol enabling secure asset and data transfers across 40+ blockchains, supporting DeFi and NFTs.

4. What’s driving Wormhole Crypto’s recent gains?

Partnerships with Ripple, BlackRock’s BUIDL, and Algorand, plus new tech like zero-knowledge proofs, boost adoption and sentiment.

5. Could Wormhole Crypto rebound to $0.10?

Analysts see $0.10 by month-end if it breaks $0.095 resistance, with $0.15-$0.20 possible by late 2025 with strong adoption.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.