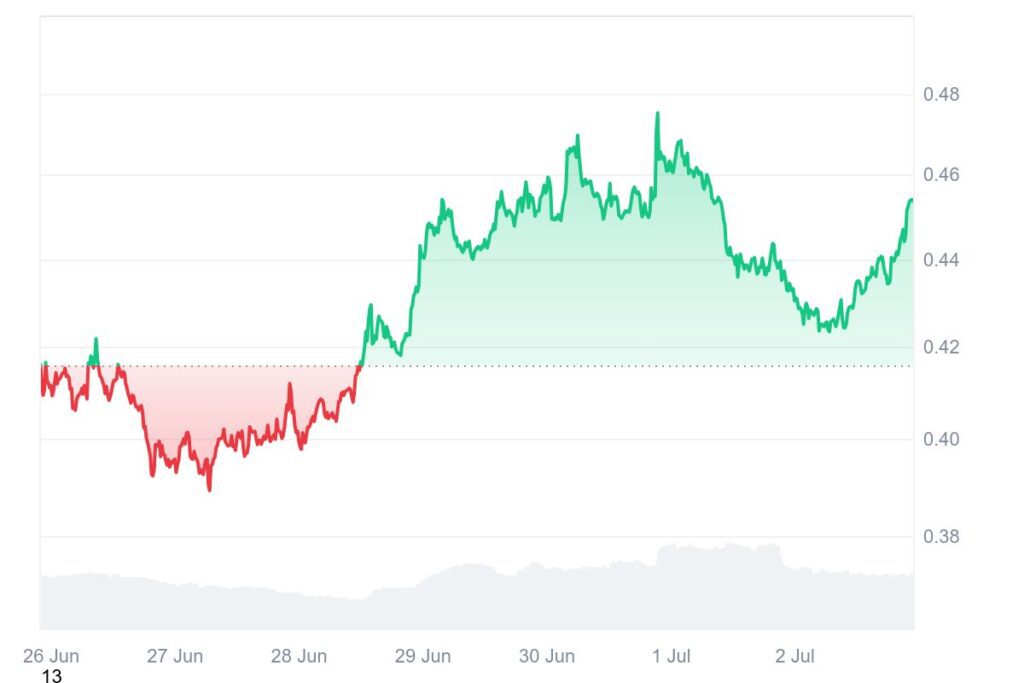

What if you could trade crypto with lightning speed and near-zero fees? Jupiter, the leading decentralized exchange (DEX) aggregator on Solana, is making this reality in 2025. With over $1 trillion in trading volume and 1.7 billion transactions, Jupiter’s JUP token surged 9% in a week, hitting $0.45 by June 29, 2025. Recent product launches, like Jupiter Lend, and partnerships with Sanctum for a SOL-based debit card have fueled optimism. As DeFi trading reshapes finance, can Jupiter crypto dominate the decentralized future? Let’s explore its technology, JUP token performance, and potential to lead the DeFi revolution.

Source: CoinMarketCap

What Is Jupiter Crypto?

Jupiter crypto is a Solana-based DEX aggregator that optimizes trades by routing them across multiple liquidity pools for the best prices and lowest fees. Launched in 2021, it’s Solana’s largest DeFi platform, with over $2.3 billion in Total Value Locked (TVL). The JUP token powers staking, governance, and fee distribution. Jupiter’s ecosystem includes Jupiter Lend (leveraged lending), Jupiter Studio (token launchpad), and a mobile app with 100,000+ downloads and a 5.0-star rating. Backed by the Solana Foundation and integrated with players like Fireblocks, Jupiter is a cornerstone of Solana DEX innovation.

In 2025, DeFi is booming, with Solana’s scalability driving adoption. Jupiter crypto stands out by simplifying DeFi trading, offering fast swaps and competitive pricing.

Features That Set Jupiter Apart

Jupiter crypto’s unique features drive its DeFi leadership:

-

DEX Aggregator: Routes trades across Solana pools for optimal pricing, saving users fees.

-

Jupiter Lend: Enables leveraged lending, boosting returns for Solana assets.

-

Jupiter Studio: A token launchpad sharing up to 50% of fees with creators.

-

Mobile App: Supports USDC, JUP, and Solana tokens with Apple Pay integration.These make Jupiter a user-friendly Solana DEX, blending accessibility with advanced DeFi tools.

Read More: Metaverse & Blockchain Connection ?

Challenges & Risks

Jupiter faces hurdles. The DAO voting pause until 2026, citing a “breakdown in trust,” raises centralization concerns, potentially impacting JUP’s governance value. Solana’s occasional outages (e.g., 2022) could disrupt trading, though 2025 upgrades mitigate this. JUP’s significant drop in April/May and declining perp volumes signal volatility. Competitors like Uniswap and emerging Solana DEXs (e.g., Solaxy) challenge market share. Adoption depends on restoring community trust and navigating regulatory scrutiny, like the SEC’s ETF rules.

What’s Next for Jupiter?

Jupiter’s 2025 roadmap is ambitious. The J.U.P. Rally (June 19, 2025) announced new tools, including JupNet for interoperability and a SOL-based debit card with Sanctum. Plans to resume DAO voting in 2026 aim for a unified governance model.

Major Updates for the Jupiverse and Jupiter Platform | JUP Rally https://t.co/HoOiY10Ymt

— Jupiter (🐱, 🐐) (@JupiterExchange) June 19, 2025

Analysts predict JUP could hit $1 if it breaks the 200-day EMA,. Long-term, JUP may reach $46 by 2030 with growing Solana adoption. However, whale rotations to tokens like SOLX could pressure prices.

Jupiter is a DeFi powerhouse, leveraging Solana’s speed to redefine trading. Its $1 trillion volume, innovative lending, and mobile app make it a top Solana DEX. Despite governance hiccups and volatility, JUP’s 30% rally and $580M market cap signal upside potential.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.