LINK crypto, often considered the backbone of decentralized finance (DeFi), is gaining attention for a potential major comeback. Analysts describe it as “very undervalued,” and technical charts indicate it could rise to $30. Chainlink’s technology provides essential services like price feeds and verifiable randomness for various DeFi protocols and tokenized assets, supporting billions in value.

During the last bull run, LINK’s price surged past $50, thanks to partnerships with major companies like Google and Swift. However, market crashes, regulatory issues, and competition from new projects caused its value to drop significantly. Now, some savvy observers believe this could be the perfect time for a reversal. Given crypto’s many ups and downs, is this the right moment to invest in LINK? The potential for growth is certainly there. Share this with others who might be interested in joining the journey.

Looking at its origins, LINK crypto stands out as a visionary force. Launched amid Ethereum’s scaling woes, it introduced decentralised oracles that aggregate data from multiple sources, dramatically reducing manipulation risks. This reliability quickly attracted heavyweights: banks experimented with its tech for cross-chain transfers, insurers used it for automated payouts, and even governments considered it for transparent elections.

The Potential of Chainlink (LINK) Explained

Innovations like the Cross-Chain Interoperability Protocol (CCIP) allow assets to move easily across different networks, while the Functions service gives developers better access to data. Despite securing over $90 billion in value, Chainlink’s token has been trading in the mid-$20s due to broader market uncertainties. Unlike flashy meme coins, Chainlink focuses on real substance rather than hype. However, this is starting to change. The community is becoming more vocal about its benefits, and institutional adoption is growing. This suggests that LINK might soon gain more attention and increase in value.

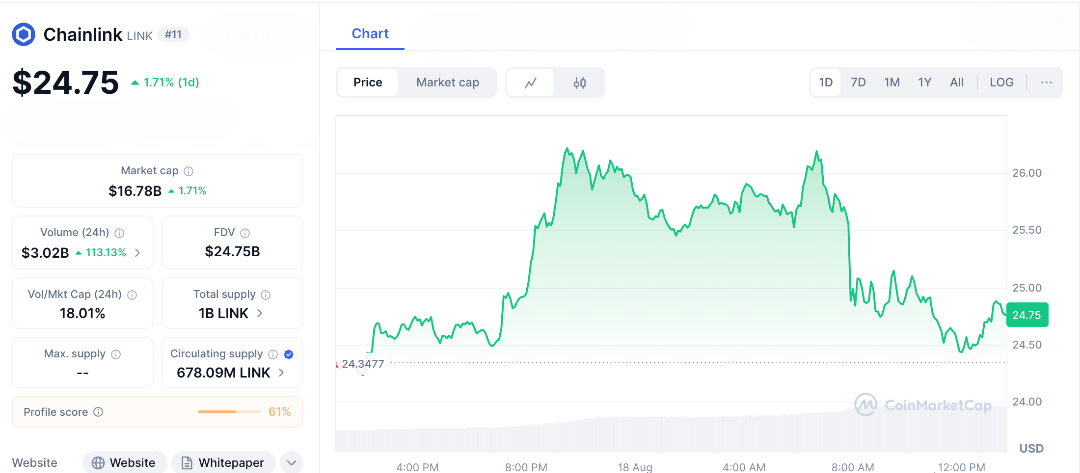

Fast-forward to the present, and the Chainlink crypto hype is electric. Whales have been buying heavily, withdrawing millions of LINK from exchanges as prices surged 12% recently, signalling accumulation ahead of a potential breakout.

Analysts are touting Chainlink as a top performer among major tokens, with some calling it “very undervalued” given the ecosystem’s maturity. Chart enthusiasts are equally bullish: LINK is testing a four-year trend-line resistance, and a decisive break could catapult it toward $30, supported by momentum indicators like the Relative Strength Index (RSI) climbing into bullish territory.

This isn’t blind optimism institutional demand is swelling, with reports of banks like JPMorgan and Deutsche Bank integrating Chainlink feeds for tokenized funds. The DAO’s recent buyback program, snapping up hundreds of millions in tokens from revenue streams, adds a mechanism for direct value accrual. Even amid broader banking pushes and competition from peers like Ripple, Chainlink stands out for its oracle dominance, positioning it to capture a share of the trillions in real-world assets moving toward blockchain adoption.

The Road to $30

The journey for Chainlink (LINK) reaching $30 is full of potential opportunities. Technical analysis shows strong support at $18, suggesting that if this level holds, a rally could push LINK toward its yearly highs around $31. As the crypto market becomes more institutional, oracles like Chainlink are crucial for creating compliant and scalable financial solutions. If market sentiment shifts positively, LINK could potentially double in value from its current levels.

Staking rewards, now boosted by revenue sharing, offer attractive yields, drawing in long-term investors. However, there are risks, such as market volatility and rising competition. Despite these challenges, Chainlink is securing more value and forming new partnerships, making the case for its undervaluation stronger. Chainlink’s story is one of steady progress, relying on its utility and reliability rather than hype. As it edges closer to $30, LINK stands as a solid bet on infrastructure over speculation.

Is now the time to invest in LINK? With the technical signals aligning and growing interest from major investors, this could be a good opportunity. In the ever-changing world of crypto, those who spot the right opportunities early often reap the biggest rewards.

FAQs

- What is Chainlink crypto?

Chainlink crypto (LINK) is the token powering Chainlink’s decentralized oracle network, connecting smart contracts to real-world data. - Why is Chainlink crypto considered undervalued?

Despite securing over $90 billion in value, LINK’s price lags due to market volatility, but strong fundamentals suggest untapped potential. - Can Chainlink crypto reach $30?

Technical charts and whale accumulation point to $30 if LINK breaks key resistance, though market risks remain. - What makes Chainlink unique?

Chainlink’s reliable oracles and CCIP enable secure data feeds and cross-chain interoperability, vital for DeFi and tokenized assets. - Is Chainlink crypto a good investment?

With growing institutional adoption and staking rewards, LINK has potential, but crypto’s volatility demands careful research.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.