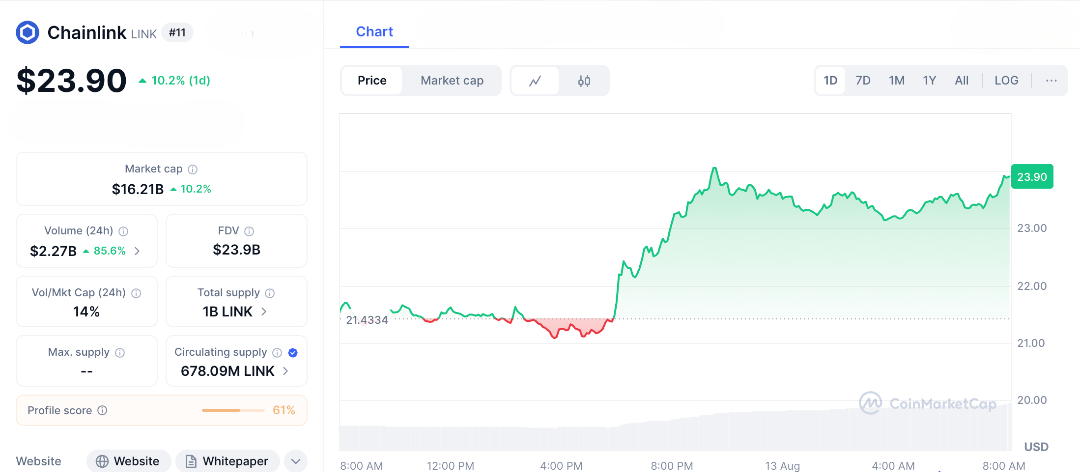

LINK Crypto is the essential part of Chainlink’s oracle network, which has been crucial for the DeFi world for years. Despite its importance, LINK is currently trading around $23.90, about 56% below its all-time high of $52.88. With Bitcoin stable and market activity picking up, some investors are wondering if LINK is set for a big move. LINK has survived tough market periods in the past and has always come back stronger, thanks to its role in providing secure and reliable data to blockchain projects. Now, with the total crypto market cap approaching $4 trillion and altcoins gaining attention, the question is: can LINK’s technology help it surpass $50 again? Whales are quietly accumulating LINK, retail traders are considering their entry points, and the story is clear, resilience, innovation, and the increasing demand for trustworthy data in a digital world.

Flash back to LINK Crypto’s origins it was born as Chainlink’s native token, powering a decentralized oracle system that delivers reliable off-chain data, like prices, weather, or event outcomes, into smart contracts across blockchains from Ethereum to Solana. Without it, DeFi would be blind, leaving billions vulnerable to manipulation.

Recently, Chainlink has seen a significant increase, jumping over 40% in the past week and surging 11% in just one day. What’s behind this rapid growth? First, Chainlink launched the Chainlink Reserve, an on-chain pool of LINK tokens aimed at enhancing network security and rewarding those who stake their tokens. This move shows a strong commitment to the long-term health of the ecosystem. Then, a major partnership with ICE, the company behind global exchanges, was announced. This partnership aims to improve data feeds for tokenized assets, attracting a lot of attention and boosting confidence in Chainlink’s future.

The results are already showing, Chainlink’s total value secured has climbed to $93 billion, as more protocols trust its oracles for everything from lending rates to insurance payouts. This isn’t just hype it’s real, tangible growth that could set it up for a major breakout.

Why LINK Crypto Still Hasn’t Reclaimed Its All-Time High

LINK Crypto has experienced a lot of ups and downs. It soared during the 2021 DeFi boom but then cooled off due to bear markets and regulatory pressures. One challenge has been the tokenomics, with over 678 million Chainlink tokens already in circulation and regular releases from the treasury, which has diluted some gains. However, there are positive signs. On-chain data shows that the number of Whales with 100,000 or more LINK is at a multi-year high. Additionally, more people are participating in staking, which locks up tokens and reduces the amount available for sale.

From a technical analysis viewpoint, things look promising. LINK recently broke through the key resistance level of $20, and its Relative Strength Index (RSI) is in bullish territory but not overbought, suggesting there’s more room for growth. If trading volume remains strong, LINK could push toward $30. And with a broader altcoin rally, some optimists are talking about a potential return to $44. Analysts are generally positive, with most end-of-year predictions ranging between $24 and $30, indicating a healthy climb if the current momentum continues.

Chainlink’s oracles are not just an added feature; they are essential for LINK Crypto’s future. As the market for tokenized real-world assets grows possibly into the trillions, these oracles will be crucial for verifying data like commodity prices and bond yields for smart contracts. Recent developments highlight this importance. Chainlink has started working with major banks for cross-chain settlements, which could bring in billions. Think of Chainlink as the reliable backbone of DeFi, enabling over $100 billion in daily transactions, while other projects chase short-term hype.

If Ethereum’s upgrades and institutional investments continue to attract capital into crypto, Chainlink could benefit and change the minds of skeptics, just as it has done in the past. However, challenges remain. Economic issues like interest rate hikes, security risks, or competition from rivals like Pyth could slow its progress. For now, though, Chainlink remains the top player in the oracle space.

From supporting smart contracts to powering pilots for major companies, LINK Crypto’s story is about providing lasting utility, not just hype. The current price dip feels more like a pause before a significant rise. Could LINK surpass $50? If Chainlink’s oracles become essential for a market worth trillions, the answer could be yes, possibly by 2026 in optimistic scenarios. This would reward long-term holders who have stayed invested through the ups and downs.

The strategy is clear, diversify your investments, stake for approximately 5% yields, and monitor adoption closely. This ongoing story suggests that the entities quietly building infrastructure might outshine those chasing quick fame. If you’ve held LINK through good times and bad, or if you believe in the potential of oracles to transform global finance, this could be your moment.

FAQs

1. Why is LINK Crypto 56% below its all-time high?

LINK Crypto, trading around $23, is down from its $53 peak due to market corrections, token dilution from treasury releases, and competition in the oracle space.

2. Can LINK Crypto reach $50 in 2025?

Analysts predict $24-$30 by year-end, with $44-$50 possible if DeFi adoption and Chainlink’s CCIP integrations drive demand, though $50 may take longer.

3. What drives LINK Crypto’s price potential?

Chainlink’s oracle network powers DeFi, RWAs, and cross-chain solutions, with partnerships like ICE and JPMorgan boosting adoption and LINK demand.

4. What are the risks for LINK Crypto’s price?

Volatility, competition from oracles like Pyth, macroeconomic pressures, and potential node operator issues could hinder LINK’s price growth.

5. How does Chainlink’s oracle network boost LINK Crypto?

Chainlink’s oracles secure $93B in DeFi by delivering reliable off-chain data, increasing LINK’s utility for staking and payments, potentially lifting its value.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.