There’s been a lot of buzz about XRP potentially hitting $50, which would push its market cap to $3 trillion, an unimaginable figure even for early Bitcoin fans. Ripple Labs created XRP to speed up cross-border payments, but reaching such a high valuation would be comparable to the GDP of entire countries. With a fixed supply of 100 billion tokens and 59.4 billion already in circulation, XRP would need an incredible rise in value to hit $50 per coin. Is this likely to happen? Probably not anytime soon. Although XRP is strong and resilient, reaching $50 per coin would be extremely difficult, much like trying to climb Everest in flip-flops. The path to such a high valuation is full of challenges.

XRP’s Journey and the $50 Question

XRP started with a clear mission: to speed up payments through Ripple’s On-Demand Liquidity system, letting banks and payment providers settle transactions in seconds instead of days. Partnerships with major financial players gave it credibility, and a partial legal win against the SEC confirming XRP isn’t a security in secondary markets sparked more institutional interest.

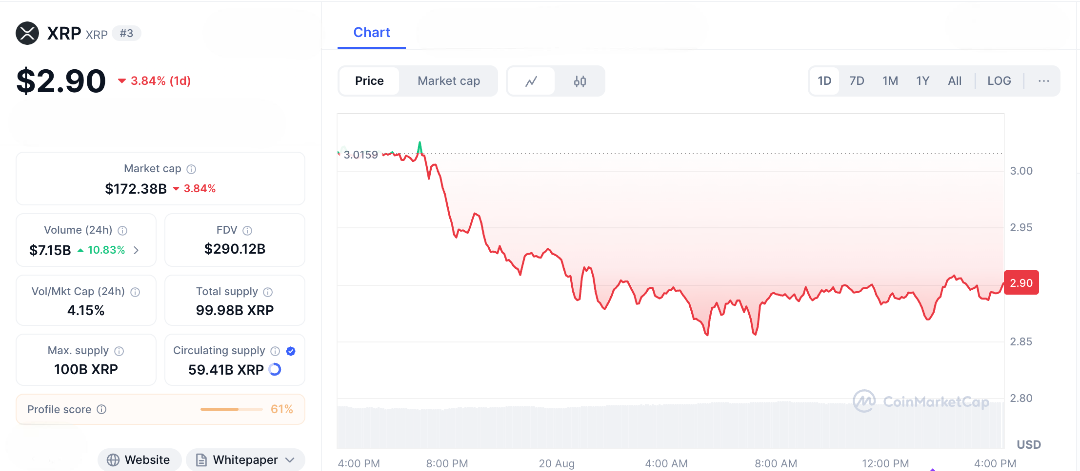

As of August 20, 2025, XRP trades around $2.90, down 3.84% in the last day, with a market cap of roughly $172 billion. That’s huge but to hit $50, XRP’s market cap would need to multiply 17 times, nearing $3 trillion. For perspective, Bitcoin’s cap is around $2.2 trillion, and the entire crypto market sits near $4 trillion. Reaching this milestone would mean XRP dominating global remittances roughly $800 billion a year or taking over tokenised assets in a way that beats all competitors.

Analysts are excited, and the numbers are impressive. With 59.4 billion circulating tokens, XRP hitting $50 would give it a market cap of nearly $2.97 trillion, higher than Apple’s valuation and close to the entire U.S. federal budget.

Skeptics worry about potential problems. Ripple currently holds 55% of its supply in escrow, and periodic releases could flood the market if demand doesn’t keep up. However, some believe $50 is achievable if XRP sees massive adoption. For example, Ripple is working on tokenized assets like RLUSD, which could bring trillions of dollars on-chain. If central banks use XRP for digital currency transfers, as seen in pilots with the Bank of England, liquidity could increase significantly. One analyst predicts XRP could reach $28 by next September, leading to a $1.66 trillion market cap, ambitious yet possible given XRP’s history of rapid gains.

The story gets more interesting. XRP fell below $3 after Ripple transferred $600 million, sparking sell-off fears. However, on-chain data shows that large investors bought 440 million tokens during the dip.

Meanwhile, the SEC has postponed its decision on an XRP ETF until October, creating short-term uncertainty but also hinting at increased mainstream acceptance. In Europe, new MiCA regulations favor compliant companies like Ripple, potentially strengthening XRP’s use in payments. Trading volumes remain strong at $3 billion daily, indicating continued interest despite market fluctuations. If Bitcoin’s next halving sparks a bull run, XRP’s strong historical correlation with Bitcoin could lead to significant gains. This sets the stage for another potential surge.

XRP to $50? The Numbers and Speculation

Hitting $50 for XRP is a huge goal and would need an incredible amount of investment. Even if spot ETFs are approved, they would likely bring in billions, not trillions. Competition is everywhere, from Swift’s blockchain trials to faster networks like Solana, and other cross-border solutions. Regulatory challenges also remain, with the SEC appeal and global crackdowns on crypto posing potential roadblocks.

On the plus side, XRP’s tokenomics help a bit, transaction fees are burned, gradually reducing supply, and staking yields around 4% encourage long-term holding. However, for XRP to reach $50, it would need to become the main choice for international payments, a process that took Visa decades. XRP’s journey has always been about persistence. Reaching $50 would be a major milestone, depending on many “what-ifs”, if adoption increases, if regulations are favorable, and if global payments go fully digital.

Right now, XRP is far from that target, but some projections suggest that a $3 trillion valuation is possible in a massive $100 trillion tokenized world. Large investors are watching closely, analysts are calculating, and the big question remains: will XRP reach new heights, or become a steady and reliable token?

FAQs

- What does xrp to 50 dollars mean for its market cap?

Xrp to 50 dollars would require a $3 trillion market cap with 59.4 billion circulating tokens, rivaling major global economies. - Why is xrp to 50 dollars considered ambitious?

Achieving xrp to 50 dollars needs massive adoption in payments and tokenized assets, far exceeding the current $170 billion cap. - What drives the xrp to 50 dollars speculation?

Whale accumulation, Ripple’s RWA integrations, and potential ETF approvals fuel hopes, though XRP’s price is currently $2.86. - What are the risks to xrp to 50 dollars?

Regulatory hurdles, competition from Swift or Solana, and token dilution from Ripple’s escrow could cap XRP’s ascent. - Is investing in XRP for $50 realistic?

Xrp to 50 dollars is a long shot but possible with hyper-adoption; volatility and regulatory risks demand careful research.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.