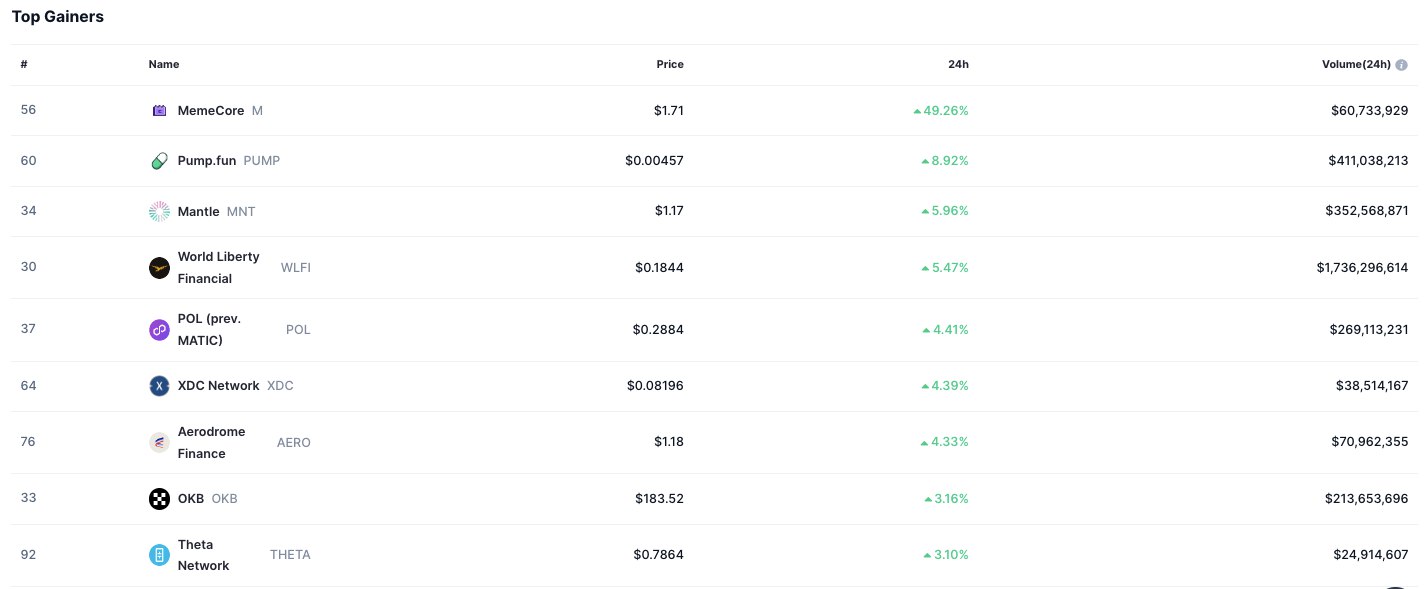

- MemeCore surged 49% to $1.71, becoming the top gainer with $60.7M in trading volume.

- WLFI rose 5.47% to $0.1844, recording $1.73B liquidity, the highest among the gainers.

- DeFi and large-cap tokens like POL, OKB, and THETA posted steady growth with strong volumes.

The crypto market recorded a strong performance over the past 24 hours, with MemeCore leading the gainers. The token rose 49.26% to $1.71, supported by $60.7 million in trading activity. The surge positioned MemeCore as the session’s top performer, contrasting with steady gains across several other major and emerging assets.

Investor appetite extended beyond MemeCore. Pump.fun (PUMP) advanced 8.92% to $0.00457, supported by $411 million in turnover. Mantle (MNT) also delivered solid results, rising 5.96% to $1.17 with $352.5 million in daily trades. The momentum reflected heightened activity across both speculative and ecosystem-focused tokens.

MemeCore Tops Daily Gainers List

MemeCore’s rise stood out against broader market moves. Its 49% daily increase not only secured its place as the leading gainer but also displayed renewed interest in meme-oriented digital assets. With daily volume surpassing $60 million, MemeCore accounted for a significant portion of speculative trading during the session.

Source: CoinMarketCap

Alongside MemeCore, World Liberty Financial (WLFI) recorded a 5.47% gain, reaching $0.1844. More notably, WLFI posted the highest liquidity among the listed assets, with $1.73 billion in 24-hour turnover. The surge in trading volume highlighted substantial market participation, even as the project faced concerns about governance and investor relations.

DeFi and Network Tokens Show Momentum

Several decentralized finance and network tokens also moved higher. POL, formerly known as MATIC, rose 4.41% to $0.2884, supported by $269 million in daily volume. XDC Network (XDC) climbed 4.39% to $0.08196, with $38.5 million changing hands. Aerodrome Finance (AERO) advanced 4.33%, bringing its price to $1.18 on $70.9 million in turnover.

The gains extended into larger networks as well. OKB posted a 3.16% increase, closing at $183.52 with $213.6 million in trades. Theta Network (THETA) rose 3.10% to $0.7864, recording $24.9 million in activity. These moves reflected steady interest in high-liquidity tokens, balancing speculative trading in MemeCore with consistent flows into established ecosystems.

Broad-Based Gains Shape Session

The trading session reflected broad engagement across market categories. MemeCore’s outsized performance contrasted with measured increases in tokens like OKB, POL, and Theta. Meanwhile, WLFI’s liquidity dominance placed it at the center of market activity despite ongoing concerns tied to governance.

Overall, the session pointed to sustained investor participation across both speculative and institutional-grade tokens. With MemeCore leading the gains and trading volumes remaining high across multiple assets, the market demonstrated continued resilience and active positioning across diverse segments.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.