As Bitcoin approaches $100,000 in 2025, Merlin Chain (MERL), listed on platforms like Kraken, OKX, and Bybit, is redefining its potential as a scalable DeFi hub. Launched in Q1 2024, this Layer-2 solution uses ZK-Rollups and decentralized oracles to enable fast, low-cost transactions on Bitcoin’s secure network. With a market cap of $79M and a recent 8% trading volume surge, MERL is drawing attention.

What Is Merlin Chain (MERL)?

Merlin Chain is a Bitcoin-native Layer-2 protocol launched in Q1 2024 by Bitmap Tech, led by Jeff (a Web2 entrepreneur backed by Sequoia Capital) and Eason (a 2016 Bitcoin developer). It enhances Bitcoin’s scalability for DeFi and dApps, rivaling Ethereum and Solana. The MERL token drives governance, staking, and transaction fees, with a circulating supply of 725M from a 2.1B total supply. Merlin’s ecosystem supports Bitcoin-native assets like M-BTC and fosters dApps through a $210M grant program.

Merlin’s Pricing and Tokenomics

Merlin Chain’s tokenomics and market performance are:

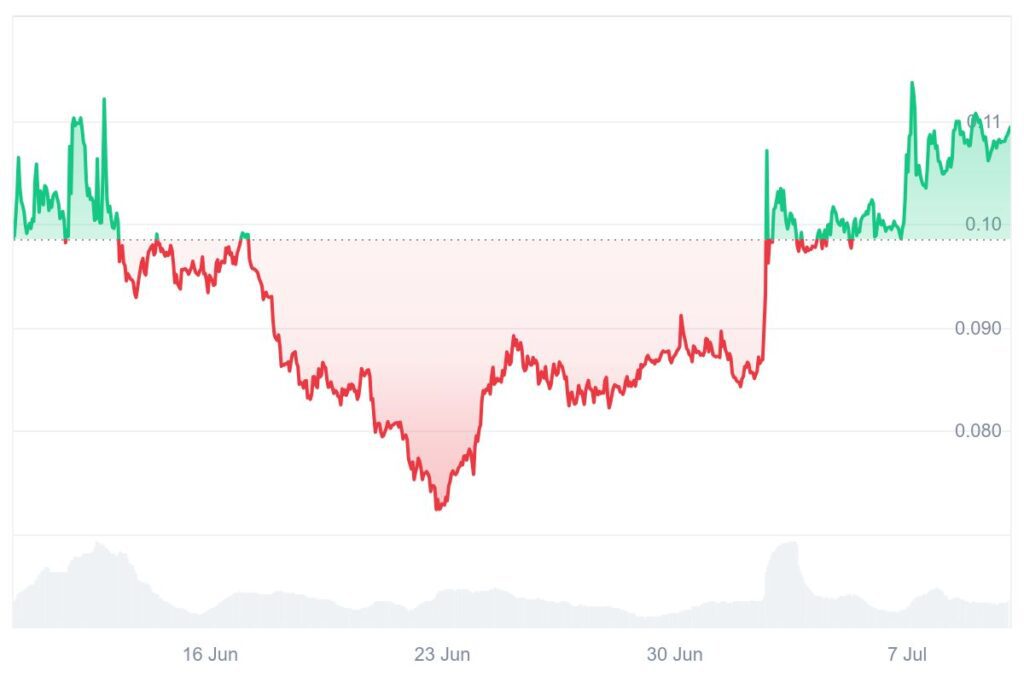

- Price: $0.1095 USD, reflecting volatility with a 6% weekly gain.

- Market Cap: $79M

- 24h Trading Volume: $11.23M (up by 8.4%)

- Circulating Supply: 725M MERL

- Total/Max Supply: 2.1B MERL (fully diluted valuation: $229.63M)

- All-Time High: $1.2

Source: CoinMarketCap

Tokenomics Breakdown:

- Distribution: 20% airdropped to Merlin’s Seal participants, 40% allocated to ecosystem grants, 15.23% to private investors, and the rest to public sales and core contributors.

- Vesting Schedule: User airdrops circulate immediately; team and investor tokens are locked for 24–48 months, reducing sell-off pressure.

- Utility: MERL supports governance (voting on upgrades), staking (securing the network with collator rewards), transaction fees, liquidity provision, and collateral for DeFi protocols like M-BTC.

MERL’s high TVL/FDV ratio (indicating low bubble risk) and $3.6B TVL in Merlin’s Seal suggest strong community adoption, making it appealing for risk-tolerant investors eyeing Bitcoin’s DeFi growth. However, its 93.1% drop from its peak, unaudited ZK circuits, and competition from Ethereum Layer-2s (e.g., Arbitrum) and Solana demand caution.

Merlin’s Technological Edge

Merlin Chain enhances Bitcoin’s capabilities with advanced features:

Zero-Knowledge Rollups

- High Throughput: Processes thousands of transactions per second (TPS) off-chain, submitting ZK proofs to Bitcoin, far surpassing Bitcoin’s 7 TPS.

- Low Costs: Reduces fees compared to Bitcoin’s $1–$10, competing with Solana’s $0.01–$0.05

Decentralized Oracle Network

- Reliable Data: Delivers tamper-proof data for smart contracts, enabling Bitcoin-native DeFi and dApps.

- EVM Compatibility: Supports Ethereum-based apps, bridging Bitcoin and Ethereum ecosystems.

On-Chain Fraud Proofs

- Security: Ensures transaction integrity, reducing risks of malicious activity

Community Governance

- MERL Voting: Holders shape protocol upgrades, fostering decentralization.

Advantages of Merlin Chain

Merlin offers compelling benefits:

- Bitcoin-Native DeFi: Enables DeFi protocols (e.g., M-BTC with 14% APR on VelodromeFi), expanding Bitcoin’s utility beyond a store of value.

- Scalable Infrastructure: ZK-Rollups support high-volume dApps, rivaling Solana’s scalability (noted in ICP’s advantages).

- Developer Support: The $210M grant program funds dApp innovation, attracting developers like Axiom’s ZK ecosystem.

- Growing Adoption: Listings on Kraken and OKX, plus $3.6B TVL, signal market confidence, unlike Cryptomus’s limited user base.

Challenges and Criticisms

Merlin faces significant risks:

- Severe Price Volatility: A 93.1% drop from its $1.45–$1.55 peak mirrors ICP’s 99% crash and DEGE’s 511% surge volatility, risking rapid losses for investors.

- Unaudited Technology: ZK-Rollups are open-sourced but unaudited for production use, posing vulnerabilities.

- Past Security Incidents: The 2023 Merlin DEX hack ($1.1M–$1.82M) due to private key mismanagement, despite CertiK audits, highlighting security concerns.

- Limited Grant Transparency: The $210M grant program lacks clear allocation details, risking mismanagement,

- Competitive Pressure: Ethereum Layer-2s (Arbitrum, Optimism) and Solana offer established ecosystems, potentially overshadowing Merlin’s Bitcoin focus

- Scam Risks in Related Entities: Merlin Exchange’s limited reviews (3 on Trustpilot) and Merlin Protocol’s sparse data raise concerns.

Merlin Chain’s 2025 Milestones

Merlin’s 2025 developments showcase its ambition:

- Kraken Listing (July 4, 2025): Expanded access for North American traders, boosting liquidity and visibility.

- BNB Chain Bridge (Q2 2025): Enables cross-chain transfers of MERL and M-BTC, enhancing interoperability with BNB Chain’s DeFi ecosystem.

- M-BTC Incentives (July 2025): Offers 14% APR on VelodromeFi’s WBTC/M-BTC pool, driving DeFi adoption with $3.6B TVL in Merlin’s Seal.

- Merlin Wizard 0.1 (Q1 2025): An AI assistant for user interaction, improving dApp accessibility

- $210M Grant Program (Ongoing): Funds Bitcoin-native dApps, with projects like staking pools and NFT marketplaces emerging, though transparency on fund use remains limited.

- TOKEN2049 Presence (Q1 2025): Showcased Merlin’s ZK technology to global stakeholders, securing partnerships with exchanges and DeFi protocols.

- Price Outlook: Analysts predict $0.564–$0.70572 by end-2025, with speculative long-term highs of $6.62 by 2031. Investors should avoid hype-driven forecasts, focusing on fundamentals like TVL growth and grant impact.

Merlin Chain’s Potential and Pitfalls

Merlin Chain (MERL) is a trailblazer in Bitcoin’s Layer-2 space, leveraging ZK-Rollups and EVM compatibility to unlock DeFi and dApps. Its $50.7M–$140.63M market cap, $210M grant program, and 2025 milestones (Kraken listing, BNB Chain bridge) position it as a high-potential project. However, a 93.1% price crash, unaudited tech, and the 2023 Merlin DEX hack echo risks. Can Merlin redefine Bitcoin as a DeFi powerhouse, or will its volatility and security gaps limit it to a speculative niche? With Bitcoin’s ecosystem expanding, MERL’s success hinges on audits, transparency, and sustained adoption. Investors should approach cautiously, prioritizing verified data over hype to balance its innovative promise with crypto’s inherent risks.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.