- Metaplanet awaits a Dec. 22 EGM that will decide governance steps shaping its Bitcoin buying strategy.

- Share issuance and capital reduction proposals align with a target of holding 100,000 BTC by 2026.

- Metaplanet shares and Bitcoin prices slipped as markets weighed EGM uncertainty and crypto volatility.

Metaplanet’s shares traded lower as investors awaited an unusual general meeting that will determine how the Japan-listed firm approaches Bitcoin accumulation next year. The company has described the upcoming vote as a key moment for its long-term strategy, while market participants remain cautious amid ongoing volatility in Bitcoin prices.

Metaplanet issued a convocation notice for an online extraordinary general meeting scheduled for Dec. 22, urging shareholders to exercise their voting rights in advance. The company stated that the agenda includes decisions tied to governance and capital structure that could influence its future Bitcoin purchases. According to the notice, voting must be completed by Friday using the provided electronic process.

📢 12月22日開催のオンライン臨時株主総会の招集通知は案内済みです。

本議案は当社の将来にとって重要です。皆さまの声が必要です。

未行使の方は、速やかにQRコードによる事前の議決権行使をお願いします。

特典もご用意しています。

本投稿のリポストにもご協力ください。📢

— Metaplanet Inc. (@Metaplanet) December 15, 2025

The company characterized the meeting as critical to its direction and said participation from shareholders is necessary to move forward with the proposed measures. Metaplanet also confirmed that the meeting will focus on items directly linked to its Bitcoin treasury approach for the coming year.

Capital Measures and Bitcoin Accumulation Plans

Chief Executive Officer Simon Gerovich reiterated that the EGM will cover proposals with implications for Metaplanet’s medium- and long-term planning. Among the items to be considered are plans related to the issuance of preferred shares. The company has previously announced two classes of preferred shares, identified as Class A (MARS) and Class B (MERCURY).

メタプラネットの株主の皆さまへ

来週12月22日(月)に開催される臨時株主総会に向けて、ぜひ議決権の行使をお願いいたします。本総会では、今後の優先株式の発行に関する重要な議案が含まれており、当社の中長期戦略にとって非常に重要な内容となっています。… pic.twitter.com/1b7rY3noBo

— Simon Gerovich (@gerovich) December 15, 2025

Another proposal involves reducing capital stock and capital reserves. Metaplanet has stated that these measures align with its stated objective of expanding total Bitcoin holdings to 100,000 BTC by the end of 2026, as outlined in its accumulation strategy.

Stock Performance Ahead of the Meeting

Metaplanet’s Japan-listed shares fluctuated in recent sessions after its net asset value moved back above 1. Despite a recent rebound, the stock softened as the meeting approached. The shares closed 1.36% lower at 436 yen, after trading between 408 yen and 439 yen during the session.

In the United States, Metaplanet’s over-the-counter listing under the ticker MTPLF also declined. The stock closed down 2.8% at $2.71, giving back earlier gains amid uncertainty tied to both the EGM and broader digital asset market conditions.

Bitcoin Market Reaction and Movement

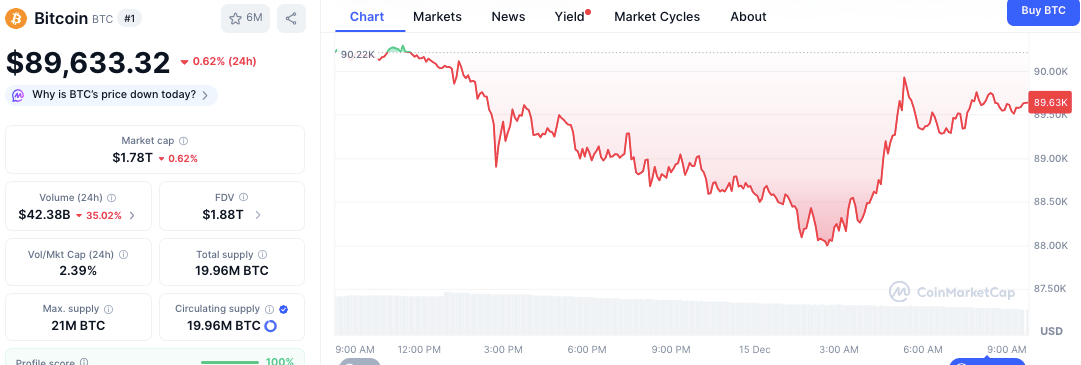

Bitcoin traded lower over the past 24 hours, reflecting elevated intraday volatility. Bitcoin price opened near $90,200 before falling throughout the session and briefly touching the $88,000–$88,200 range. Buying activity during early Asian hours lifted prices back above $89,000, though Bitcoin remained below the $90,000 level. At the time of writing, Bitcoin was priced at $89,633.32, down 0.62% on the day.

Source: CoinMarketCap

The total cryptocurrency market capitalization stood at $1.78 trillion, also down 0.62%, while 24-hour trading volume fell 35.02% to $42.38 billion. Bitcoin’s circulating supply was reported at 19.96 million BTC, with a volume-to-market-cap ratio of 2.39%.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.