- Mid-cap and AI-linked tokens led the market decline amid rising volatility.

- Aster and Virtuals Protocol saw sharp drops following multi-day rallies.

- Traders shifted to stable assets as funding rates and short activity increased.

The crypto market continued its downward trend over the past 24 hours, with a broad selloff hitting mid-cap and speculative assets particularly hard. Market data showed several leading tokens posting double-digit declines, signaling renewed volatility after a week of heightened trading activity.

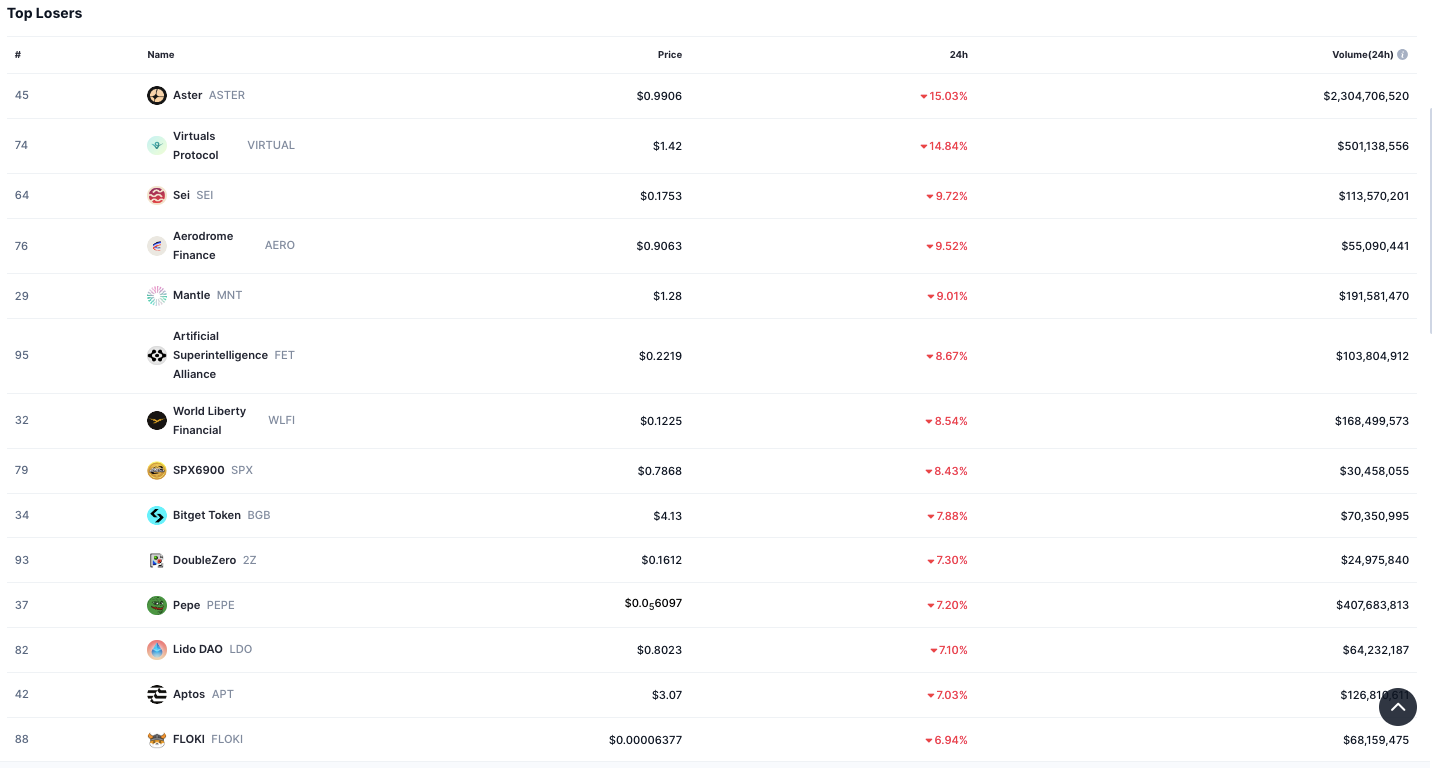

Aster (ASTER) registered the largest drop among major altcoins, falling 15.03% to $0.9906 on trading volume exceeding $2.3 billion. The reversal followed an extended rally that had pushed the token to multi-month highs, suggesting a phase of profit realization amid market uncertainty.

Virtuals Protocol (VIRTUAL) also recorded big losses, sliding 14.84% to $1.42. The decline marked its third consecutive daily drop, coinciding with reduced liquidity across trading pairs. Analysts attribute the continued weakness to tightening conditions in mid-cap segments, which often experience sharper moves during market corrections.

Broad Losses Across Mid-Cap and AI-Linked Assets

Several other altcoins mirrored the market downturn. Sei (SEI) and Aerodrome Finance (AERO) dropped by 9.72% and 9.52%, respectively, while Mantle (MNT) fell 9.01% to $1.28. The Artificial Superintelligence Alliance (FET) lost 8.67%, extending declines in AI-related tokens that had previously surged earlier in the week.

Source: CoinMarketCap

World Liberty Financial (WLFI) and SPX6900 (SPX) each retreated about 8.5%, though trading volumes indicated a measured pullback rather than large-scale liquidations. The synchronized movement across diverse sectors pointed to cautious positioning among traders amid shifting market sentiment.

Exchange and Meme Tokens Under Pressure

Tokens linked to exchanges and meme-driven communities were not spared. Bitget Token (BGB) dropped 7.88% to $4.13, while Pepe (PEPE) and Floki (FLOKI) fell 7.2% and 6.94%, respectively. Lido DAO (LDO) and Aptos (APT) each lost more than 7%, reflecting weaker activity across DeFi and Layer 1 networks as liquidity gravitated toward stable assets.

The declines across mid-cap tokens occurred against a backdrop of high funding rates and increased short activity in derivatives markets. Market observers have noted that, after weeks of capital inflows into Bitcoin and large-cap cryptocurrencies, traders appear to be consolidating their positions.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.