Nexo, the crypto platform changing the way we manage digital wealth, has just announced its big plans for 2025. These plans include AI-powered trading to help users make smarter investment decisions and a crypto-backed card that allows you to use your Bitcoin to buy everyday items, like your morning coffee, without actually spending your Bitcoin.

Founded by Antoni Trenchev and his team, Nexo has long been a safe haven for HODLers, offering loans, savings, and trading tools to protect your assets. With $7 billion under management, the platform is now pushing to make crypto part of everyday life, blending innovation with practicality. After a decade of crypto’s wild rollercoaster from Mt. Gox to ETF surges Nexo’s roadmap feels like a leap toward mainstream adoption, sparking excitement among investors and users alike.

Nexo started in 2018 by allowing users to borrow against their crypto assets without having to sell them, which was especially helpful during bear markets. They then introduced the Nexo Card, a crypto-backed debit card that lets users spend their digital assets at millions of merchants worldwide.

Now, their 2025 plan aims to build on that success. The Nexo Card has already seen 62% adoption among eligible users in Europe and is now targeting new markets like Switzerland and Andorra, with a goal to expand globally by the end of the year. This card isn’t just for spending; it connects the world of crypto with everyday life, making it a trusted name for people both inside and outside the blockchain community.

Nexo’s AI: Turning Traders into Strategists

Nexo isn’t stopping at cards they’re bringing AI into crypto trading. In a market where every second counts, tools like Automated Portfolio Management and an AI Assistant help users make smarter moves. These tools analyze huge amounts of data, spotting trends and giving insights that can help beginners trade like pros.

Experienced traders aren’t left out either. It offers futures with up to 100x leverage, automated OTC trading for big players, and even access to traditional assets like gold and forex. This mix of tech and market options makes Nexo a one-stop platform for anyone looking to grow wealth, not just crypto fans. And the results speak for themselves: In 2024, Nexo processed $1.5 billion in loans and paid out $250 million in interest. With AI leading the way, it is ready to stay ahead of the curve.

At the heart of Nexo’s plan is the NEXO token, and 2025 is shaping up to be a big year. A revamped Loyalty Program means holders can enjoy higher interest rates, lower borrowing costs, and exclusive access to new token Launchpools turning them into active participants in emerging projects.

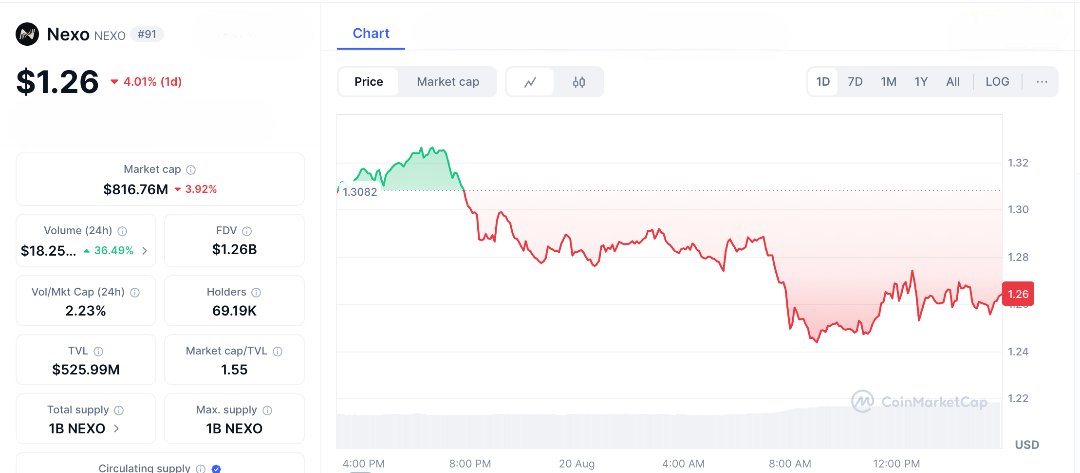

With 646 million tokens circulating out of a 1 billion max supply, NEXO has bounced back from bearish lows under $0.60 to around $1.24, reflecting confidence in the platform’s growth. Social media is hyping, with Reddit users praising the roadmap’s transparency and perks like the global card rollout and cashback rewards.

It’s ambition doesn’t stop at individual users. Its Payments Gateway and White Label solutions aim to make crypto seamless for businesses, from easy on-ramps to cross-border transfers, offering a faster, cheaper alternative to traditional banks.

Of course, challenges remain. Regulatory hurdles, especially in the U.S., could slow it’s ambitious plans remember the $45 million SEC settlement? Competition is heating up too, with rivals like BlockFi and new AI-driven platforms vying for attention.

Even though NEXO bounced from $0.90 to $1.24, it’s still far from its $4.63 all-time high, a reminder that crypto is volatile. But it’s history is impressive surviving bear markets while competitors like Celsius faltered. Signals of mainstream recognition are emerging too. Events like The Crypto Ball in Washington, D.C., attended by figures such as Donald Trump Jr., show that crypto is moving from niche to foundational finance.

Nexo’s 2025 Vision: A Bold Bet on the Future

Nexo’s 2025 plan is making waves with its bold, exciting vision. Combining AI-powered tools, global expansion, and user-friendly features, it aims to change how we manage wealth. Key elements include:

1. A card that lets you spend crypto like cash.

2. AI that helps you trade like a professional.

3. A token that rewards your loyalty.

These elements are designed to bring crypto and everyday finance closer together. Will it work? The plan looks promising, with all the right pieces in place. Share this story with your friends. This might be the moment where crypto starts to blend seamlessly with everyday money management.

FAQs

- What is Nexo?

It is a crypto platform offering loans, savings, trading, and a crypto-backed card, with the token powering rewards and governance. - What’s new in Nexo’s 2025 plan?

It’s 2025 plan includes global card expansion to markets like Switzerland and AI-powered trading tools like portfolio management. - How does Nexo’s AI trading work?

Nexo’s AI Assistant uses predictive models to analyze market trends, aiding traders with strategies for crypto, forex, and futures. - What benefits does the Nexo Card offer?

The Nexo Card allows spending crypto globally with cashback, discounts on Netflix/Spotify, and no need to sell assets. - Is Nexo a good investment?

It’s growth and token utility are promising, but regulatory risks and market volatility require careful research before investing.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.