As of July 11, 2025, Omni Network (OMNI) has seen a notable 108% increase in its price over the past 24 hours, drawing quiet interest in the crypto space. Launched in 2025 with its Omni Core mainnet, this relatively new Layer 1 blockchain aims to unify Ethereum rollups but remains in its early stages. While the surge sparks curiosity, its recent emergence suggests a need for careful consideration.

Omni Network is a Layer 1 blockchain, introduced in 2025, designed to address Ethereum rollup fragmentation by enabling cross-rollup applications without extensive smart contract changes. Founded by Austin King and Tyler Tarsi, both with Ethereum Foundation backgrounds, it relies on EigenLayer restaking for security. Supported by investors like Coinbase Ventures and Pantera, Omni is a young project with a vision to enhance Ethereum’s ecosystem, though its track record is still developing.

Omni seeks to connect rollups like Arbitrum and Optimism, offering a unified platform for developers. Its recent mainnet launch and upgrades, such as SolverNet and Magellan, aim to improve cross-chain functionality. With early partnerships like HOT Labs (1M+ users), it’s building an ecosystem, but as a newcomer launched in 2025, its stability and long-term impact are yet to be fully proven. This context frames its current market activity.

Factors Behind the Recent Surge

- Binance Wallet Staking Support: The introduction of native staking support on Binance Wallet, rolled out on July 11, 2025, may have encouraged some interest. This feature allows users to earn rewards, potentially increasing OMNI demand.

- Mainnet Launch and Upgrades: The Omni Core mainnet launch, alongside upgrades like native staking (April 2025) and Magellan (March 2025), has drawn attention. A $10 million “Hello, New World” rewards program and a 6.77% token buyback (May 2025) suggest efforts to build value, but the untested nature of these features on a young network invites caution.

- Surge in Trading Volume and Open Interest: A reported 6,000%+ rise in 24-hour trading volume to $971 million and a nearly 300% increase in open interest to $34 million indicate heightened activity. With $5.69 million in liquidations, this volatility could reflect speculative interest.

- Investor and Community Hype: Backing from investors like Jump and Spartan Group, combined with some buzz on social media may have contributed to the surge. However, the enthusiasm around a new project like OMNI should be tempered with an awareness of its limited history since its 2025 launch.

- Ecosystem Growth: Early partnerships with HOT Labs (1M+ users) and Symbiotic ($1.5B TVL), along with a $500,000 bug bounty, hint at ecosystem potential. Yet, as a fledgling network launched this year, the real-world impact of these developments remains uncertain and merits careful observation.

Pricing Analysis and Tokenomics

Pricing Analysis

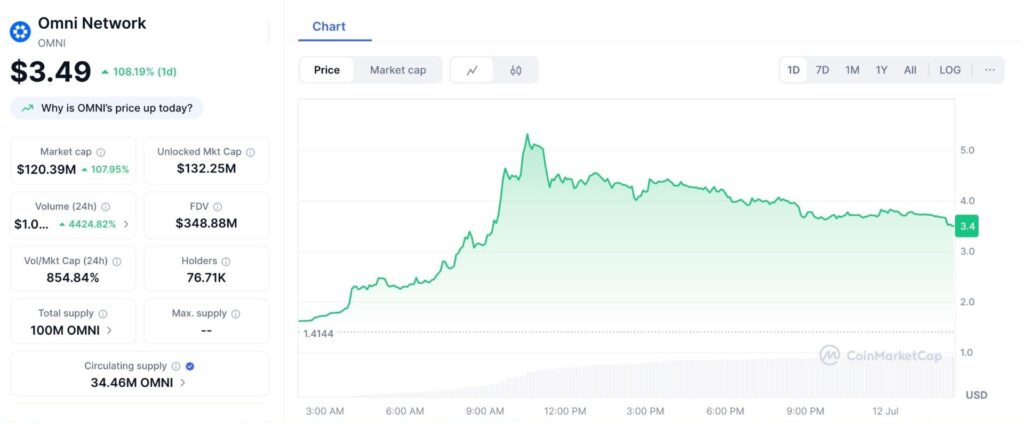

Omni’s price has fluctuated from $1.56 to $3.3 in the last 24 hours, reflecting the 108%. The market cap is $115.5million, based on a circulating supply of 34.47 million tokens out of a 100 million max. The $1 billion trading volume suggest a volatile market for this new token. Such swings, given its 2025 launch, highlight the risks of investing in an unestablished asset, with potential resistance and support levels yet to stabilize. Investors should be vary of this as well.

Source: CoinMarketCap

Omni’s total supply is capped at 100 million tokens, with a circulating supply estimated at 34.47 million, indicating a large portion remains locked or unvested. The 6.77% buyback in May 2025 aims to reduce supply, while staking rewards via Binance Wallet could encourage holding. However, the allocation details (e.g., team, investors) are unclear, and the potential release of locked tokens could dilute value,.

Omni’s Competitors

Omni operates in a competitive space alongside established Ethereum Layer 2 solutions and other rollup-focused projects. Key competitors include:

-

Arbitrum: A leading rollup with a mature ecosystem and higher transaction volume, posing a challenge to Omni’s growth.

-

Optimism: Known for its OP Stack and strong developer adoption, it offers a robust alternative to Omni’s unification approach.

-

Polygon: A versatile Layer 2 with a broad range of dApps, potentially overshadowing Omni’s niche.

-

zkSync: Focuses on zero-knowledge rollups, competing with Omni’s cross-rollup vision. As a 2025 launch, Omni faces an uphill battle against these players with longer histories, and its success may depend on differentiating its technology and partnerships, though this remains unproven.

Omni Network’s 108% price rise in 24 hours, linked to staking support and upgrades, offers an intriguing glimpse into its potential. However, as a token launched in 2025, its volatility and untested technology suggest caution.

FAQs

-

What is Omni Network’s purpose? It aims to unify Ethereum rollups for cross-chain apps, using EigenLayer security, though it’s still emerging.

-

Why the 108% rise? Staking support and volume spikes may play a role, but its newness adds uncertainty

-

What risks should I note? Volatility, dilution, and unproven tech are concerns for a young token

-

Could OMNI grow long-term? Potential exists, but its early stage makes outcomes unpredictable.

-

What supports its ecosystem? Partnerships and upgrades are promising, yet their impact on a new network is untested.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.