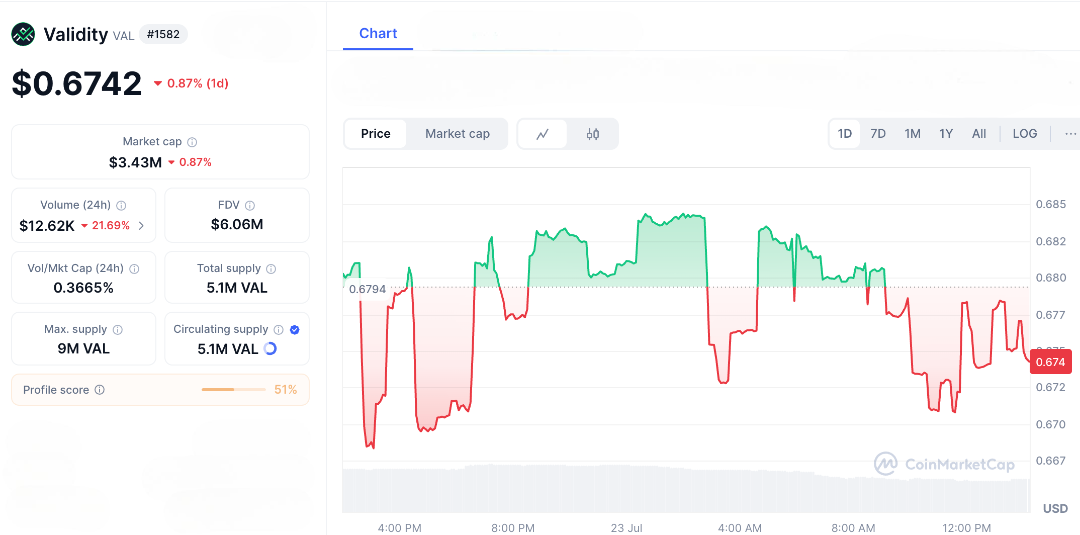

In the fast-changing world of crypto where tokens can soar overnight or vanish with a tweet Radium Crypto is carving out a path of its own. It’s not loud. It’s not flashy. But it’s persistent. As someone who’s watched the wild ride of 2017’s ICO mania and the DeFi summer of 2020, I’ve seen it all from tokens that made people rich to those that disappeared faster than you could say “rug pull.” But Validity stands out for a different reason, it blends decentralised finance with secure digital identity something the crypto world has long needed. It’s not just about trading and staking; it’s about building a more secure and eco-friendly infrastructure for how identity works on the blockchain. With the token trading at around $0.67 and a modest market cap of $3.43 million, Validity has quietly climbed in the past year even while many other tokens struggled. Now, whispers are spreading across the community, Could this be a hidden gem on the edge of a 10x breakout? Is Validity the next underdog story that turns its believers into crypto legends? Only time and execution will tell. But it’s one to keep on your radar.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.