On September 17, the U.S. Federal Reserve reduced interest rates by 0.25%, bringing the federal funds rate down to 4.00%–4.25%. This was the first cut in nearly two years, and it immediately caught the attention of financial markets. The Fed explained that the decision was based on signs of a cooling job market and broader economic uncertainty. Officials also suggested that there could be one or two more small cuts before the end of the year if economic data supports the move. This change in monetary policy matters to crypto because lower interest rates often push investors toward riskier assets. With less appeal in holding cash or government bonds, more capital tends to flow into assets like stocks and digital currencies.

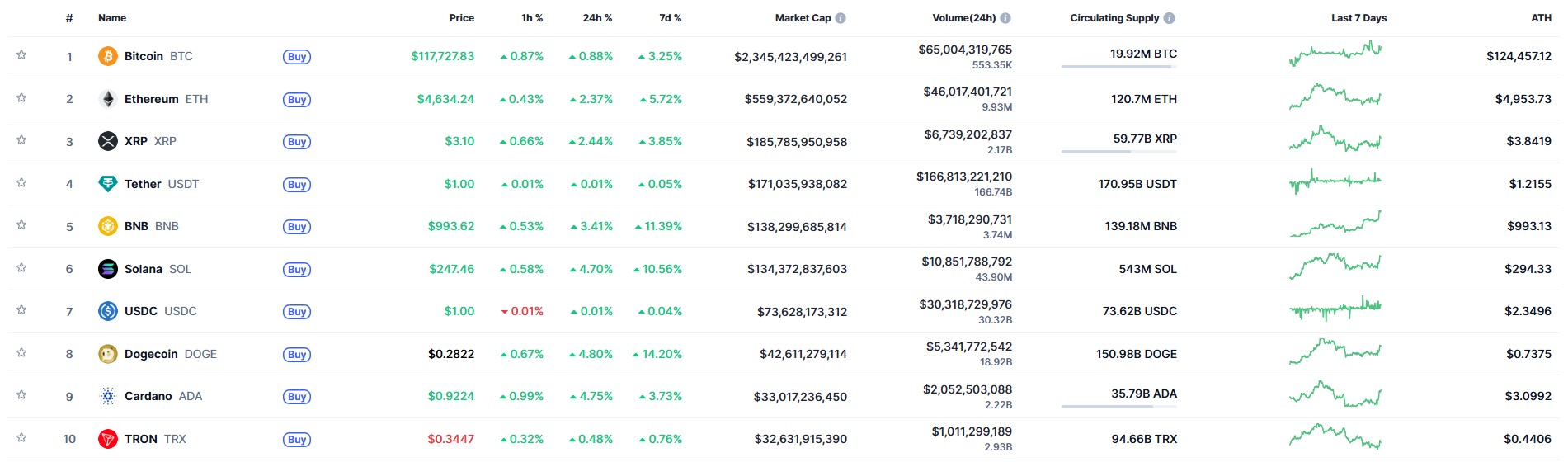

The reaction from the crypto market was swift. Solana jumped 4% to $247. Binance Coin (BNB) set a new record of $993 after rising 3.4%. Dogecoin also saw a 5% gain, trading at $0.28. Meanwhile, Bitcoin managed to stay above $117,000 despite some price swings. Ethereum slight rise 2.3% to $4,634. Still, many expect a recovery if Ethereum can break above the resistance level of $4,956. On-chain activity tells a more optimistic story Ethereum transactions rose 12% to 1.2 million per day, while Solana’s total value locked in decentralized finance hit a new record.

Altcoins in general outperformed Bitcoin after the announcement. Data showed that capital rotated from Bitcoin into alternative tokens, with the Altcoin Season Index climbing to 72, well above Bitcoin’s share at 25.

This rate cut marks a turning point after nearly two years of tighter financial conditions. During that period, crypto’s market value was cut in half, dropping to around $1 trillion at its lowest. Now, with rates starting to ease, the total market capitalization has recovered to over $4 trillion. However, inflation remains a concern. The most recent report showed core producer prices rising 2.6%. If inflation stays high or starts climbing again, the Fed may hesitate to cut further, or even consider raising rates again. This uncertainty could bring volatility back into both traditional and crypto markets.

Big players in the market are also making bold moves. Shortly after the Fed’s announcement, one long-dormant wallet swapped more than $100 million worth of stablecoins into Ethereum, signaling confidence in its long-term potential. Whales, often influence market direction because of the size of their trades. At the same time, regulatory clarity has improved with the approval of new ETF products and updated stablecoin frameworks. These changes give institutions more confidence to enter the market, which could fuel additional growth if conditions remain favorable.

Fed Rate Cut and Crypto

Looking forward, Solana is approaching a resistance level near $250, while XRP continues to trade above $3.01. Analysts remain cautious, pointing out that altcoins historically face corrections of 15–20% after the first rate cuts. Overbought indicators, such as the Relative Strength Index (RSI) sitting near 70 for many top tokens, suggest that a short-term pullback is possible. Still, the overall trend remains positive. New financial products, such as upcoming Solana and XRP options on the CME exchange, are expected to bring in more liquidity. If inflation does not flare up again, many experts believe altcoins could see gains of 20–30% before the year ends, with some even projecting increases of over 50% by December.

The Fed’s rate cut has re-energized crypto markets, especially altcoins, which are drawing capital away from Bitcoin’s dominance. The decision highlights how closely crypto is tied to global financial policy. For now, optimism is running high, but the shadow of inflation still hangs over the market. If consumer prices climb again, the Fed could pull back on further easing, which might cool the current rally.

In short, altcoins are soaring on the back of cheaper money and renewed investor appetite. But whether these gains hold through the end of the year will depend on the delicate balance between economic growth, inflation, and the Federal Reserve’s next moves.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.