Avalanche (AVAX) is making headlines again and this time, it’s not just about fast transactions or low fees. On July 29, 2025, a major development dropped, $250 million worth of real-world credit assets is being added to the Avalanche network through something called the Sky’s Grove protocol. That’s a big deal. It shows that more traditional, institutional players are starting to take Avalanche seriously and they’re putting real money behind it. AVAX has always stood out for being fast and scalable, but this new momentum could take things to another level. Some people are even wondering if AVAX could shoot up to $140, which would be a huge leap from where it’s priced right now. Of course, crypto is always unpredictable. Some see this as a golden opportunity, while others are waiting to see how it plays out. Either way, this move is sparking tons of hype in crypto chats, forums, and investor circles. So will Avalanche break new ground or cool off after the hype? One thing’s for sure: this $250M infusion just turned the spotlight back on AVAX in a big way.

$250M in Real-World Assets Hits the Blockchain

Let’s take a step back and look at what’s brewing on the Avalanche network. Known for its speed and low fees, Avalanche has become a go-to platform for decentralized finance and now, it’s making another big move.

The latest spark? Grove, part of the Sky ecosystem (formerly MakerDAO), is bringing up to $250 million worth of real-world assets onto Avalanche. These aren’t just any assets they include on-chain credit through a partnership with Centrifuge, and U.S. Treasury funds in collaboration with Janus Henderson, a major player in global finance. Why does this matter? Because it blends traditional finance with blockchain tech making things like loans, yields, and asset management faster, more transparent, and more accessible. It’s not just hype. Tokenizing real-world assets gives them new life in the crypto space, opening up liquidity and real use cases.

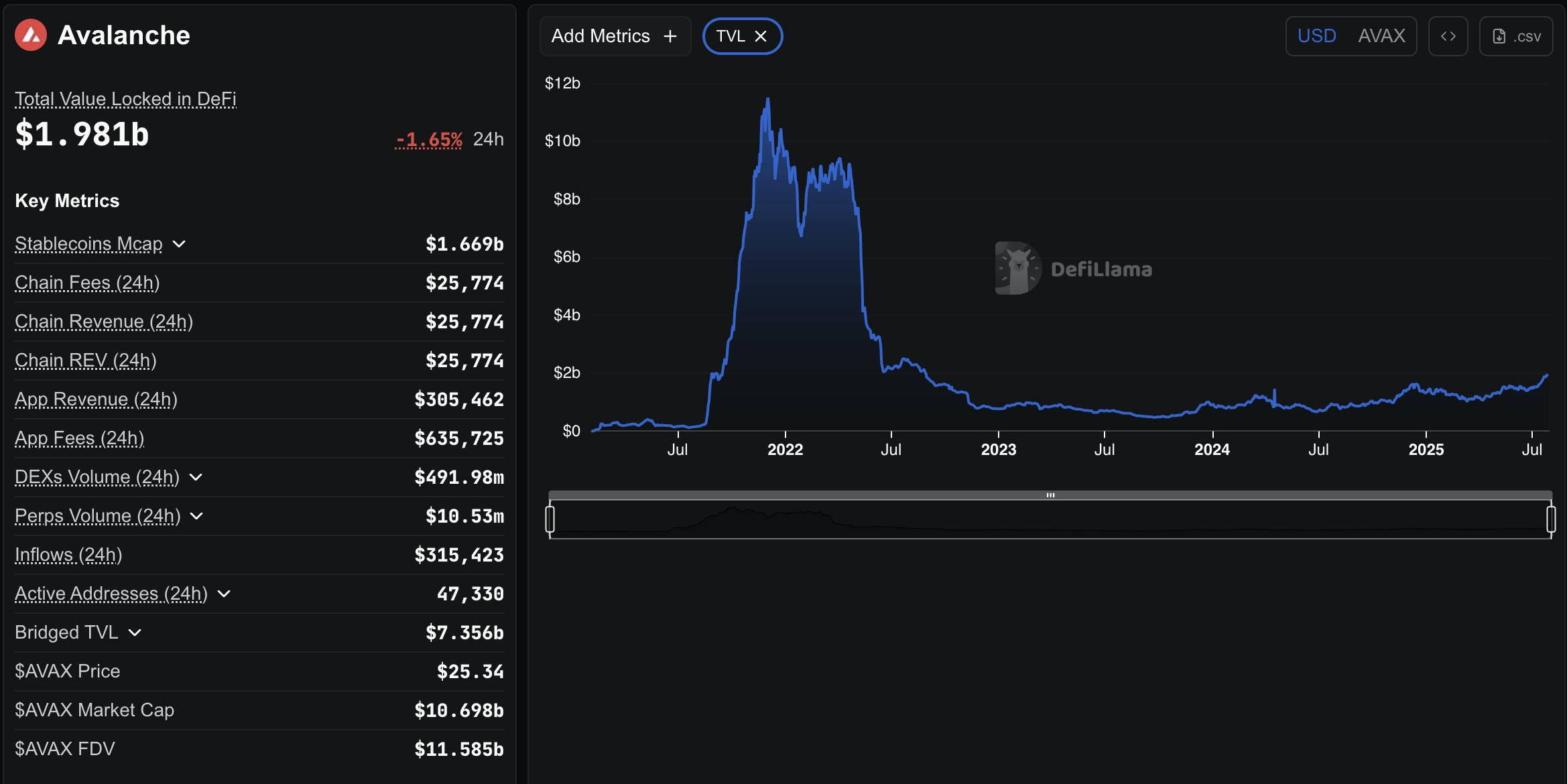

We’re already seeing the impact, Avalanche’s total value locked (TVL) is rising, showing that adoption is growing fast. This isn’t Avalanche’s first time attracting big value either it has a strong track record of pulling in billions through earlier tokenized fund initiatives. Avalanche is doubling down on bringing real finance onto the blockchain and it’s doing it with serious partners and serious capital.

Can AVAX Bounce Back? Here’s Why Holders Are Hopeful

Right now, AVAX is trading around $25.35, dipping about 4.37% in the past 24 hours thanks to a shaky broader market. But despite the recent drop, many AVAX holders are staying optimistic. Why? Because the surge in real-world asset (RWA) tokenization is starting to show serious potential. With Grove bringing tokenized credit onto the Avalanche network, activity could pick up fast. That means more demand for AVAX since it’s used to pay gas fees and earn staking rewards. Speaking of staking, current yields are sitting at a healthy 8%, and if more assets come on-chain, Avalanche’s total value locked (TVL) could climb significantly. Historically, when TVL rises, AVAX prices tend to follow.

It’s not just hope there’s history. In past bull markets, AVAX exploded more than 4,000% when the Avalanche ecosystem hit major milestones. Now, analysts are excited again. Some are predicting AVAX could reach $100 by the end of 2025, especially if RWA adoption gains momentum. Others are even bolder, eyeing $140, citing key developments like the Octane upgrade, which recently pushed DeFi TVL up 37% and nudged AVAX up 9%. Of course, a lot depends on the bigger picture Bitcoin’s price stability, ETF inflows, and overall market sentiment. But if things align, AVAX might just be gearing up for another big run.

The Risks Behind AVAX’s Rise — What Could Go Wrong?

Every great story has its twists, and Avalanche’s journey isn’t without challenges. Some skeptics point out that AVAX has struggled to break through key levels like $20 before, and it faces stiff competition from Ethereum’s layer-2 solutions gaining traction. There are also potential roadblocks ahead regulations around tokenizing real-world assets (RWAs) could slow down the flow of funds, and big economic changes might cause price drops.

But despite these risks, the excitement is real. This $250 million move by traditional finance heavyweights shows serious confidence in Avalanche, pushing it beyond just a fast blockchain to a powerhouse with real-world impact. Across crypto communities, you’ll find memes and charts plotting AVAX’s climb talk of hitting $140 based on technical signals like Fibonacci levels and volume spikes. It’s the kind of story crypto fans love, a token that was once overlooked now gearing up for a breakout that could turn early believers into winners.

Innovation Meets Opportunity

As the blockchain world continues to grow, AVAX is at the center of new ideas and exciting opportunities. Whether it shoots up to $140 or pauses before its next big move, now is a time full of possibilities and perfect for careful planning. In the crypto world, one partnership or breakthrough can trigger a rally. Sharing this story could give your friends and network a real edge. In this unpredictable market, timing is everything.

FAQs

- What is the $250 million real-world credit inflow to Avalanche?

It’s tokenized credit and U.S. Treasuries from Grove (Sky ecosystem), partnered with Centrifuge and Janus Henderson, to enhance on-chain institutional finance. - How could this inflow impact AVAX?

It may boost network TVL, transaction activity, and AVAX demand through staking and fees, potentially driving price upward. - What is AVAX’s current price?

As of July 29, 2025, AVAX trades around $25, following a recent 6% decline amid market conditions. - Is $140 a realistic target for AVAX?

Some analysts predict it based on RWA adoption, historical gains, and upgrades, but it depends on market trends and volatility. - What risks are involved with AVAX?

Price swings, competition from other chains, regulatory challenges for RWAs, and economic factors could hinder growth.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.