The rules for stablecoins in the United States are changing, and those changes could reshape the future of decentralized finance (DeFi). A major new law, the GENIUS Act, is forcing stablecoin issuers to meet strict requirements, while protocols like AAVE, one of the largest DeFi lending platforms, must figure out how to adapt. Depending on how the law is enforced, AAVE could either gain new opportunities from regulated money flowing in, or face serious challenges that threaten its model.

Stablecoins are digital tokens designed to track the value of the U.S. dollar. They are essential for the crypto economy because they make trading and lending more predictable compared to highly volatile assets like Bitcoin or Ethereum. On July 18, 2025, President Trump signed the Guiding and Establishing National Innovation for U.S. Stablecoins Act, known as the GENIUS Act. The law requires every stablecoin to be fully backed by safe reserves, such as U.S. dollars or short-term government bonds. It also forces issuers to follow anti-money laundering checks, provide clear redemption rights, and operate under federal oversight.

Importantly, only banks and licensed financial institutions will be allowed to issue stablecoins. This carves them out from securities laws but also imposes stricter transparency. By January 2026, the rules will fully apply, once regulators like the OCC and FDIC set the final details. The United States is not alone. The EU’s MiCA rules, enforced in January 2025, required exchanges to remove unregulated stablecoins, and Hong Kong has demanded similar full-reserve backing. Around the world, regulators are pushing the same message, stablecoins must operate like safe, transparent financial products.

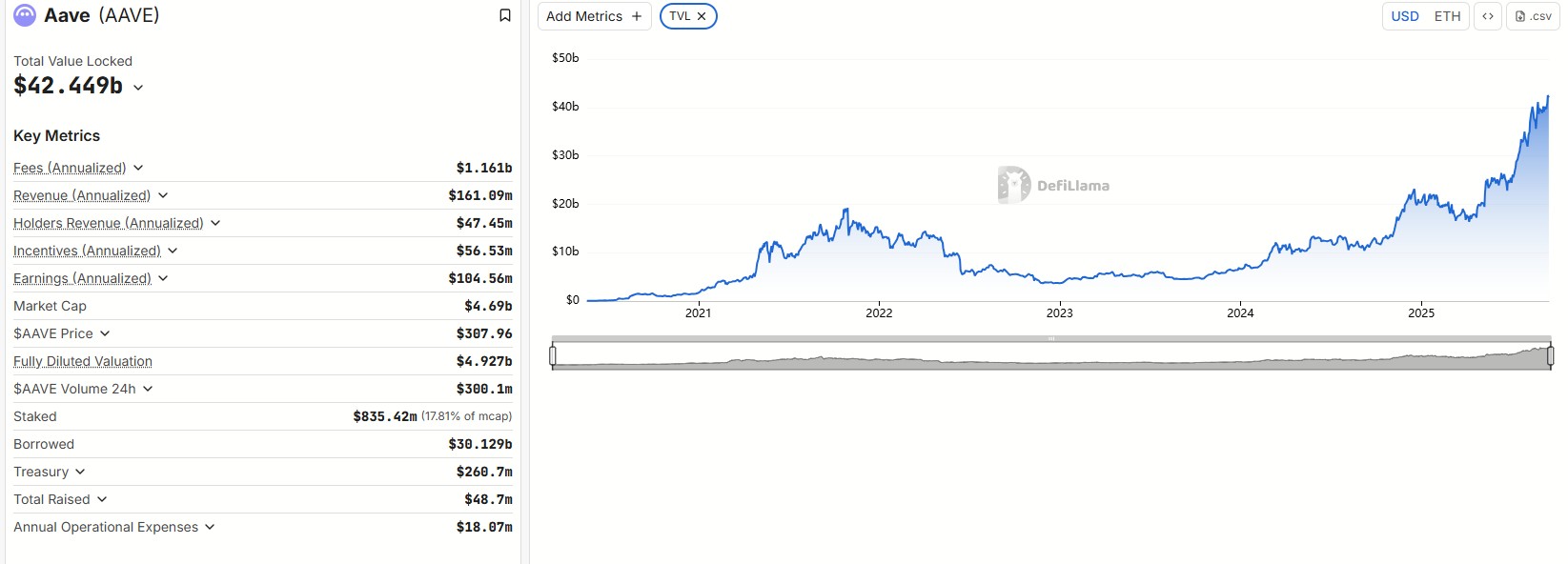

Stablecoins are at the heart of decentralized finance. According to data from DeFiLlama, they make up about one-third of DeFi revenue, and AAVE alone had $42 billion locked by September 2025. Much of this value came from users depositing stablecoins like USDC and USDT to earn yields of up to 5%. Every day, AAVE handles over $1 billion in stablecoin loans, making it one of the most important protocols in the sector.

When the rules for stablecoins change, the entire DeFi system feels the impact. If compliant stablecoins like USDC thrive under the new rules, AAVE could attract more deposits from large institutions looking for safe returns. But if regulators push for tighter checks, platforms like AAVE may face difficult questions about how to stay permissionless while meeting compliance expectations.

The GENIUS Act creates both challenges and openings for AAVE. On one hand, analysts believe it could supercharge AAVE by channeling institutional money into platforms that accept compliant stablecoins. AAVE also has its own native stablecoin, GHO, which is over-collateralized and designed to work seamlessly within the platform. Because the GENIUS Act limits certain forms of interest payments, AAVE may be able to attract regulated issuers by offering yields tied to its ecosystem without breaking the new rules.

On the other hand, some stablecoins will not survive these changes. Algorithmic stablecoins and tokens without full reserves could be delisted, removing liquidity from AAVE’s markets. Already in 2025, AAVE’s Polygon V3 stopped certain stablecoin lending to reduce the risk of tokens losing their dollar peg. Liquidity crunches remain a real concern.

AAVE’s Next Steps

To prepare for this new environment, AAVE is rolling out Version 4 (V4), which was previewed at Stable Summit in June. This upgrade includes risk-isolated pools specifically for regulated stablecoins. The idea is to protect users from depegging risks while allowing cross-chain yields on networks like Ethereum and Base. This shows that AAVE is trying to balance two worlds, the open, permissionless nature of DeFi and the controlled, regulated demands of traditional finance. However, integrating tools like KYC (know your customer checks) without losing its decentralized structure will not be easy.

Stablecoins are moving from being niche tools in crypto to becoming essential parts of global finance. For AAVE, this creates a chance to capture larger, more reliable capital flows. At the same time, it must guard against risks like liquidity shocks, smart contract exploits, and reputational challenges that come with higher scrutiny. Ethereum’s dominance in DeFi, especially in stablecoin activity, positions AAVE strongly. If institutional players adopt stablecoins under the new framework, AAVE could see massive growth. But if compliance costs push smaller issuers out, the market may consolidate around just a few players, raising both opportunity and competition.

The future of AAVE depends on how well it navigates the shifting rules around stablecoins. If it succeeds, it could cement its reputation as the go-to platform for compliant digital lending and borrowing, attracting billions in institutional funds. If it struggles, the same regulations that aim to bring stability could undermine one of the most innovative protocols in DeFi.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.