In a strategic move that signals Ripple’s aggressive expansion into the rapidly growing stablecoin infrastructure market, the blockchain payments giant has announced the $200 million acquisition of Rail, a Toronto-based platform specializing in real-time stablecoin payment solutions. This acquisition, expected to close in Q4 2025 pending regulatory approval, represents Ripple’s largest investment in payment infrastructure and positions the company to capitalize on the explosive growth in institutional stablecoin adoption.

Understanding Rail’s Strategic Value

Rail has established itself as a critical player in the B2B stablecoin payment space, handling an estimated 10% share of the $36 billion global B2B payments market in 2025. The platform’s core innovation lies in enabling real-time international payments without requiring clients to directly interact with cryptocurrencies, significantly reducing operational complexity for traditional financial institutions.

Rail’s Key Capabilities:

-

Virtual Account Technology: Simplified banking integration that abstracts blockchain complexity

-

Automated Back-Office Systems: Streamlined reconciliation and compliance reporting

-

Cross-Border Settlement: Real-time stablecoin transfers across multiple jurisdictions

-

Regulatory Compliance: Built-in AML/KYC frameworks designed for institutional requirements

This infrastructure directly complements Ripple’s existing XRP Ledger and RLUSD stablecoin ecosystems, creating a comprehensive suite of institutional payment solutions.

Strategic Rationale and Market Timing

The acquisition comes at a pivotal moment in the stablecoin market’s evolution. Following Ripple’s 2024 legal settlement with the SEC, the company has pursued an aggressive expansion strategy that includes the December 2024 launch of its RLUSD stablecoin and a previous $1.25 billion acquisition of Hidden Road earlier in 2025.

Market Dynamics Driving the Deal:

-

Regulatory Clarity: Recent stablecoin regulations have provided clearer frameworks for institutional adoption

-

Enterprise Demand: Banks and fintechs increasingly seek blockchain-based payment solutions that don’t require direct crypto handling

-

Speed and Cost Advantages: Stablecoin payments offer 24/7 settlement capabilities with significantly lower costs than traditional correspondent banking

Rail’s technology addresses the primary barrier to enterprise stablecoin adoption: the operational complexity of directly managing digital assets. By providing a familiar banking interface backed by blockchain infrastructure, Rail enables traditional institutions to access the benefits of digital asset payments without requiring extensive technical integration.

Integration Strategy and Synergies

Ripple plans to integrate Rail’s automated systems and virtual account technology into its broader payment infrastructure, creating what CEO Brad Garlinghouse describes as a “unified 24/7 stablecoin settlement platform.” This integration will:

- Enhance RLUSD Utility: Rail’s B2B platform provides immediate distribution channels for Ripple’s stablecoin across existing enterprise relationships.

- Expand XRP Ecosystem: The combined platform can leverage XRP’s liquidity and settlement capabilities for complex multi-currency transactions.

- Accelerate Enterprise Adoption: Rail’s proven track record with banks and fintechs provides Ripple with established institutional relationships and tested integration protocols.

- Geographic Expansion: Rail’s Toronto base and international payment focus complement Ripple’s global expansion strategy, particularly in markets where traditional correspondent banking faces regulatory or cost challenges.

Financial Impact and Market Position

The $200 million valuation reflects Rail’s significant revenue generation and growth potential within the expanding stablecoin market. Industry analysts estimate that the global stablecoin payment market could reach $1 trillion in annual volume by 2027, driven primarily by B2B cross-border transactions.

Competitive Positioning:

The acquisition positions Ripple to compete directly with established payment processors while offering superior speed, cost efficiency, and global reach. Key competitive advantages include:

-

24/7 Operation: Unlike traditional banking infrastructure, blockchain-based payments operate continuously

-

Lower Costs: Elimination of correspondent banking fees and faster settlement reduces overall transaction costs

-

Global Reach: Single platform access to multiple currencies and jurisdictions

-

Programmable Money: Smart contract capabilities enable complex payment automation

Technology Integration and Future Development

Rail’s API-driven architecture will be integrated with Ripple’s existing technical infrastructure, including:

- RippleNet Integration: Connecting Rail’s virtual accounts with Ripple’s global payment network for enhanced liquidity and routing optimization.

- XRPL Integration: Leveraging XRP Ledger’s built-in decentralized exchange functionality for multi-currency transactions and liquidity provision.

- Compliance Automation: Combining Rail’s regulatory reporting capabilities with Ripple’s established compliance frameworks to create comprehensive institutional-grade solutions.

The acquisition has been viewed positively by industry analysts, who see it as validation of the stablecoin infrastructure market’s maturity and growth potential. The deal follows similar strategic investments by other major blockchain companies seeking to bridge traditional finance and digital asset capabilities.

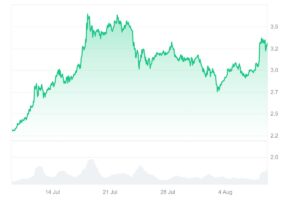

XRP price performance has reflected positive investor sentiment, with the token gaining 37% over 30 days as markets anticipate increased utility from expanded payment infrastructure.

Source: CoinMarketCap

Regulatory Considerations and Timeline

The transaction remains subject to regulatory approval in multiple jurisdictions, reflecting the increasingly complex regulatory environment surrounding stablecoin and cross-border payment services. Ripple’s experience navigating regulatory requirements, particularly following its SEC settlement, positions the company well to manage the approval process effectively.

Ripple’s acquisition of Rail represents more than a strategic purchase but a statement of intent to dominate the emerging stablecoin infrastructure market. By combining Rail’s proven B2B platform with Ripple’s established blockchain infrastructure and regulatory expertise, the merged entity is positioned to capture significant market share as traditional finance continues its migration toward digital asset-based payment solutions. The deal underscores a broader trend where blockchain companies are moving beyond pure technology development to acquire established operational capabilities, accelerating mainstream adoption through proven enterprise relationships and tested integration frameworks.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.