In the world of slow bank wires and expensive cross-border transfers, Ripple’s new patent is turning heads. For over 40 years, SWIFT has ruled the global payments game, but Ripple is aiming to change that fast. Picture this: sending money across the globe in seconds, with way fewer fees and no middlemen slowing things down. That’s exactly what this Ripple patent is trying to make real, using XRP as the bridge between currencies. As of today, July 30, 2025, XRP is sitting at $0.52, down just 1% amid some market cooling. But behind the scenes, excitement is building. Could this patent finally give XRP the boost it’s been waiting for? If Ripple pulls this off, we could be looking at the beginning of a whole new era where money moves as fast as messages, and banks play catch-up. It’s not just crypto hype anymore it’s real-world disruption, and people are starting to pay attention.

What’s the Hype About Ripple’s New Patent?

Let’s break it down: Ripple’s latest patent, recently approved in the U.S., is a big deal for anyone who’s ever been frustrated with slow, expensive international money transfers. Instead of waiting days for your bank to move money through the old-school SWIFT system, Ripple’s new idea creates mini-networks that can agree on transactions instantly. Think of it like forming a quick group chat to settle payments fast no long queues, no delays. This system uses XRP as the middleman to swap currencies on the spot, so banks don’t have to keep piles of cash in different countries just to move money. That’s a game-changer.

And get this Ripple says this tech could cut costs by over 60% for things like remittances and big company payments. Imagine upgrading from a pony express to a hyper-loop that’s how massive the shift could be. With over 50 patents now in its toolkit, Ripple isn’t just talking the talk it’s building the future of finance, one clever solution at a time.

Why Ripple’s Timing Might Be Perfect

The timing of Ripple’s patent couldn’t be better. Global remittances now top $800 billion a year, and in many developing countries, those money transfers are still painfully slow and costly. Ripple’s new patent puts XRP in the spotlight as the go-to solution for faster, cheaper cross-border payments. Ripple’s On-Demand Liquidity (ODL) service is already doing the job in places like Mexico and the Philippines, using XRP to move money across borders without delays or huge fees. This new patent makes Ripple’s position even stronger, giving it a competitive edge.

There’s also some serious hype in the market XRP futures open interest is now around $8.8 billion, showing that traders are optimistic, especially with Ripple gaining ground in its legal battle with the SEC. Some analysts think XRP could bounce to $0.70 soon, and if adoption heats up, a move toward $2 in a future bull run isn’t off the table. Of course, it’s not all smooth sailing. SWIFT still works with over 11,000 institutions, and change won’t happen overnight. But with Ripple teaming up with banks across Asia and Europe, where transfer times have already dropped from days to minutes, things are definitely moving in the right direction.

Why Ripple’s Story Is So Shareable

What makes this Ripple story so viral? It’s not just tech it’s real people. Think about a migrant worker sending money back home without watching a big cut disappear in fees, or a small business finally getting paid without waiting days. That’s where XRP and the new Ripple Patent hit home. After years of watching crypto come and go, one thing stands out: tokens with real use cases like XRP stick around when they solve urgent, everyday problems. This patent isn’t some flashy AI stunt or meme-fuelled hype. It’s infrastructure for a borderless economy, with the potential to ease the trillions moved daily through old-school systems like SWIFT.

Crypto forums are hyping, with memes calling XRP the “SWIFT killer” and traders eyeing breakout charts. And if central banks keep warming up to blockchain like we’ve seen in recent pilot programs XRP’s next bounce could be massive. For long-time holders who weathered lawsuits and FUD, that kind of payoff could be sweet justice.

The Other Side of the Ripple

Of course, it’s not all smooth sailing. XRP is still stuck under $0.60, and like the rest of the crypto market, it’s at the mercy of big swings or any new twists in Ripple’s ongoing legal saga with the SEC. And let’s not forget the competition. Stablecoins and layer-2 networks are moving fast and nibbling at XRP’s use case. But here’s the kicker: that Ripple Patent gives XRP something they don’t trustless, instant payments that don’t rely on old-school banking rails. It’s the kind of breakthrough SWIFT never pulled off. If this tech goes mainstream, we could be watching the end of a 40-year financial monopoly.

FAQs

- What is the Ripple Patent?

The Ripple Patent involves temporary consensus subnetworks for instant, trust-based cross-border payments, allowing faster transactions without full network confirmation. - How could the Ripple Patent impact SWIFT?

It aims to challenge SWIFT’s 40-year monopoly by enabling quicker, cheaper settlements using XRP, potentially reducing delays and costs in global finance. - What role does XRP play in the Ripple Patent?

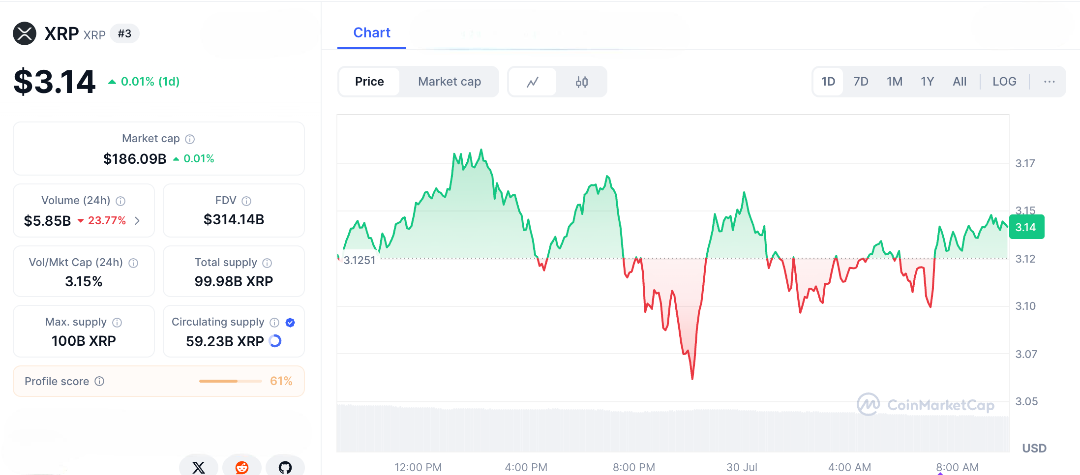

XRP serves as the liquidity bridge in Ripple’s system, facilitating on-demand currency conversions for real-time payments enhanced by the patent’s technology. - What is XRP’s current price?

As of July 30, 2025, XRP trades around $0.52, with futures interest at $8.8 billion reflecting potential for gains. - Could the Ripple Patent drive an XRP bounce?

Analysts predict possible rises to $0.70 or higher if the patent boosts adoption, though competition and regulations could influence outcomes.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.