Ripple’s stablecoin, RLUSD, recently crossed the $1 billion mark in circulating supply on the Ethereum blockchain. For a stablecoin introduced within the last year, reaching this level so quickly shows that the market is actively searching for more transparent and regulated digital currencies. It also demonstrates that both everyday users and institutions want stablecoins that feel safer and more reliable during times of economic uncertainty.

While the $1 billion figure is impressive, the real story lies in what this rise represents. It signals growing trust in regulated stablecoins, increasing demand for on-chain dollars, and a shift in how liquidity flows across the Ethereum network and the broader crypto ecosystem.

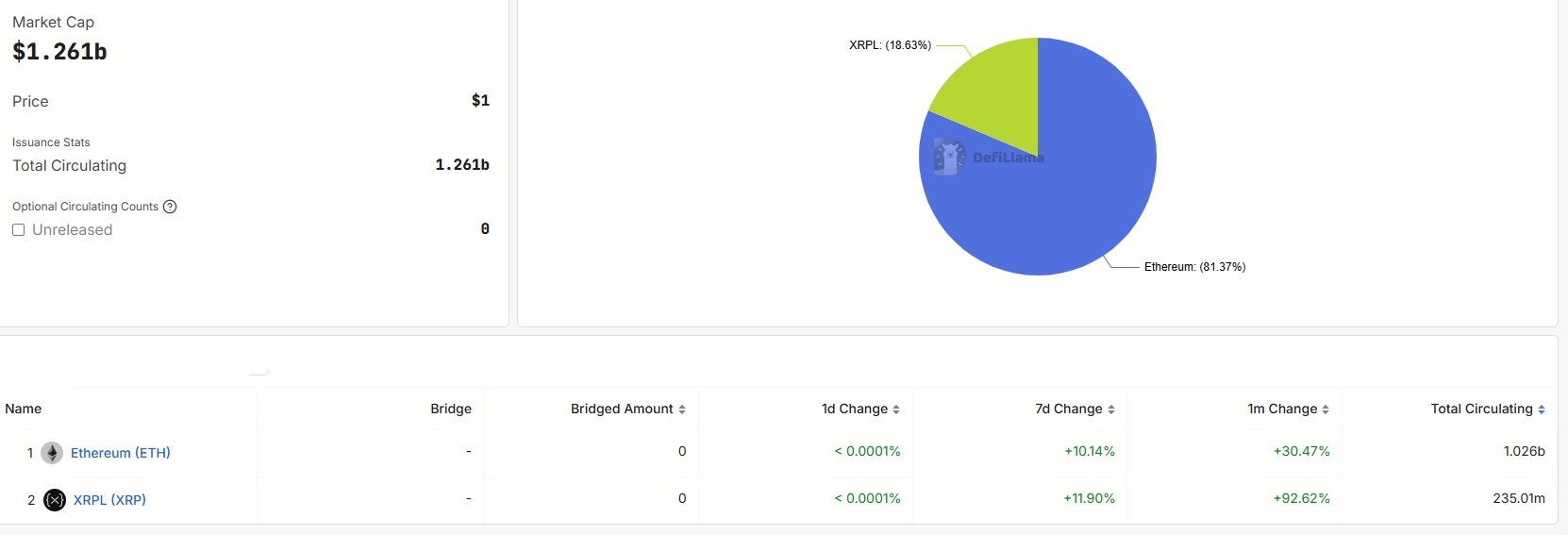

RLUSD was first created on the XRP Ledger (XRPL), and today it makes up around 77% of all stablecoin value on that network. However, most of its recent growth is happening on Ethereum. Ethereum has become the main driver of RLUSD’s expansion because it has a much larger DeFi ecosystem, active lending markets, and growing institutional use of tokenized real-world assets. These features make Ethereum a natural place for regulated stablecoins to move and settle value.

Recent integrations have also made it easier to move RLUSD between XRPL and Ethereum. This movement allows liquidity providers, payment companies, and cross-chain platforms to use RLUSD for transfers, swaps, and business settlements across both networks. For Ripple, Ethereum’s huge user base and scale give RLUSD far wider reach than the XRPL alone. It places RLUSD directly in competition with other major regulated stablecoins such as USDC and PYUSD, helping it gain visibility and adoption across the broader crypto economy.

The amount of RLUSD running on Ethereum has now become the largest portion of the stablecoin’s total supply. Across all networks, RLUSD’s market value is close to $1.02 billion. Its fast growth on Ethereum the biggest blockchain for stablecoin transactions, shows that demand is coming from far beyond just XRP Ledger (XRPL) users. A major part of this new activity is now coming from institutions and DeFi users who prefer Ethereum because of its deeper liquidity and mature financial ecosystem.

Regulatory support is boosting confidence in RLUSD

One of the main reasons RLUSD is expanding at this pace is its positioning as a regulated and compliance-focused stablecoin. Many older stablecoins have faced scrutiny regarding their reserves or transparency, prompting investors to search for options that offer clearer documentation and stronger oversight. RLUSD benefits from this environment because it is designed to align with regulatory expectations rather than operate outside them.

Another factor driving growth is the rising need for stable digital dollars that can be used directly within the crypto ecosystem. Many investors hold a mix of cryptocurrencies and want a safe place to shield funds from volatility without withdrawing to a bank. RLUSD fits this need by offering a stable value that stays on-chain, making it convenient for trading, lending, and managing risk. This trend is especially strong among international users who may face currency instability or limited access to traditional banking.

RLUSD’s recent surge is closely tied to a major regulatory update. The Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM) has now officially recognized RLUSD as an “Accepted Fiat-Referenced Token.”

🇦🇪 NOW: Ripple's $RLUSD stablecoin has been recognized as Accepted Fiat-Referenced Token by Abu Dhabi's FSRA, enabling its use by authorized entities within the ADGM. pic.twitter.com/ghTsyikbQb

— CryptoDaku (@CryptoDaku_) November 28, 2025

This designation is important because it means licensed banks, brokers, payment companies, and fintechs operating within ADGM can now legally use RLUSD for things like collateral, settlements, and other regulated financial activities. This approval builds on RLUSD’s existing regulatory oversight under a New York trust charter, giving Ripple one of the strongest compliance frameworks in the entire stablecoin industry.

Ripple has also highlighted that RLUSD is fully backed by cash and U.S. Treasury bills, the same type of high-quality reserves used by stablecoins like USDC. This backing reassures institutions that RLUSD is a safer, more transparent option. Because of these regulatory protections and strong reserve structure, RLUSD is becoming a preferred choice for institutions across the Middle East, Europe, and Asia, especially compared to offshore or lightly regulated stablecoins.

RLUSD’s Growth Marks a Shift Toward Safer, Regulated Stablecoins

RLUSD’s fast rise on Ethereum highlights a clear shift in the crypto market. Users and institutions are moving toward stablecoins that offer strong transparency, trusted reserves, and regulatory clarity. As more financial ecosystems open their doors to compliant digital dollars, stablecoins like RLUSD are becoming key tools for global payments, trading, and institutional finance. This trend marks an important step toward a more mature and trustworthy digital economy.

Do you think regulated stablecoins like RLUSD will eventually become the preferred choice for global transactions and if so, what might that mean for the future of traditional banking?

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.