In the wild west of crypto, where fortunes flash and fade in seconds, Safemoon has always been one of the most talked-about underdogs. It was launched with sky-high hype, got tangled in controversy, and now it’s trying to rise from the ashes. Picture a phoenix that’s not quite flying yet, but starting to flap its wings. As of July 28, 2025, the token’s momentum from earlier this year is slowing down, with the price dipping to around $0.000008 partly due to a jittery broader market. But behind the scenes, there’s a quiet hype building. Community forums and analyst chats are hinting at a potential turnaround. Why? Because Safemoon is going hard on token burns, rolling out a revamped DAO structure, and weaving itself deeper into the fast-moving Solana ecosystem. As someone who’s watched crypto’s biggest rises and most painful crashes, I can say this: Safemoon’s story reads like a thriller. It’s had its villains, its plot twists, and now maybe just maybe its redemption arc. If you’ve been tuned out, now might be the time to pay attention. This could be one of those comeback stories people tell in group chats, on podcasts, or over midnight Twitter Spaces.

Safemoon’s Second Act: From Scandal to Solana

Let’s rewind to the wild early days of Safemoon a token that promised passive rewards through “reflections,” and quickly shot to stardom. But that stardom didn’t last. What began as a viral crypto darling soon unraveled under serious allegations of fraud. U.S. authorities eventually convicted former Safemoon executives in a multi-million-dollar scheme involving stolen funds meant for liquidity and development. Investors didn’t just lose money they lost trust. Prices crashed, and the project nearly vanished.

But if crypto has taught us anything, it’s that nothing stays dead for long. Cue the relaunch. Under new leadership this time involving the VGX Foundation Safemoon made a bold pivot: leaving behind the Binance Smart Chain and moving to Solana, a network known for its lightning-fast transactions and meme coin hype. The move was strategic, aimed at slashing fees and boosting credibility. And for a moment, it worked. The migration wrapped up in spring, and excitement surged. Prices jumped nearly 92% as holders traded in their old tokens for the new, hopeful this was the clean slate they’d been waiting for. With Solana’s thriving DeFi and memecoin scene, Safemoon’s revival suddenly didn’t feel so far-fetched.

Slipping Momentum or Setup for a Comeback?

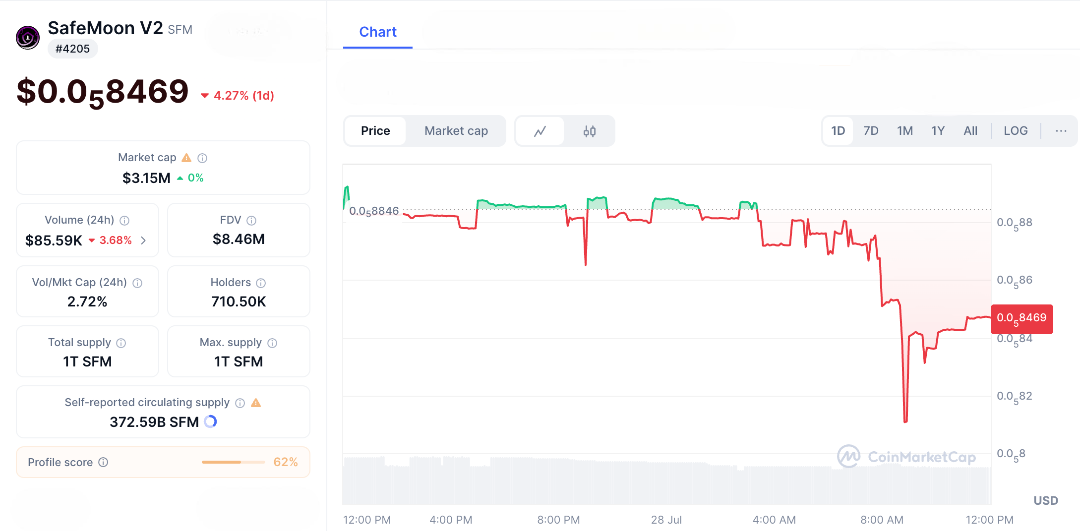

That post-migration pump? It’s faded. After a brief surge when Safemoon relaunched on Solana, the token’s value has taken a step back mirroring broader market uncertainty and the weight of its controversial past. Daily trading volume now sits around $90,000, a far cry from the frenzy of its early days. The market cap remains modest, highlighting the tough road ahead. Across social media, skeptics are quick to call it “dead money,” citing its rocky history and the sheer number of rival tokens flooding the Solana network. But here’s where things get interesting: behind the scenes, massive token burns are lighting up the charts.

Developers have already burned over 2.2 trillion tokens across networks. That’s not just a show of good faith it’s a strategic move to reduce supply and boost scarcity. Think of it like a mini version of Bitcoin’s halving designed to increase value over time by limiting availability. These burns may not be grabbing headlines yet, but they’re laying the groundwork. If the market turns, or community hype picks back up, this supply squeeze could help fuel Safemoon’s next rally.

Safemoon’s DAO Upgrade: From Chaos to Community Power

Now here’s where the story gets even more interesting Safemoon’s DAO upgrade is changing the game. The new team has restructured governance into a Decentralised Autonomous Organisation (DAO), giving token holders real voting power on big decisions. From how rewards are distributed to which parts of the ecosystem get expanded, it’s now the community calling the shots.

This is a huge shift from the early days, when a small group of insiders controlled everything and eventually ran it into the ground. Today, proposals like bringing back reflection-style rewards are getting massive support. It’s boosting engagement, trust, and loyalty within the community. It’s no longer a black-box operation. Holders aren’t just along for the ride they’re steering the project. Analysts say this newfound transparency and community-driven model could attract fresh participants especially those drawn to projects where they can actually make a difference. One recent vote even floated the idea of bringing Safemoon into Solana’s booming NFT and memecoin ecosystem, merging real utility with viral potential.

Solana: Safemoon’s Secret Weapon?

Let’s talk about the real wildcard here Solana. With its blazing speed and ability to handle thousands of transactions per second, Solana has become one of the hottest ecosystems in crypto. And for Safemoon, this could be the launchpad it’s been waiting for. Since migrating, Safemoon has plugged into Solana’s liquidity pools and decentralised exchanges, making it easier for everyday investors to trade with lower fees and fewer barriers. And guess what? Whales are buying the dip, quietly accumulating Safemoon in hopes that Solana’s rising tide lifts all boats including this once-written-off token.

If Safemoon plays its cards right think cross-chain bridges, DeFi integrations, or maybe even partnering with Solana-native projects it could tap into the same momentum that turned coins like Bonk and Pump.fun into viral sensations. And we’re already seeing hints of a turnaround. The migration has made the project leaner and smoother, and with Solana’s user base booming, Safemoon’s daily active addresses are on the rise a key sign of organic growth. It’s still early days, but this new chapter on Solana could be the plot twist no one saw coming.

Risks, Resilience & the Road Ahead

No crypto saga is complete without villains, and Safemoon is no exception. Volatility, fierce Solana competition, and lingering regulatory shadows still loom. But the rebound narrative isn’t far-fetched. Some analysts predict a return to $0.00001 or higher, if burns accelerate and the DAO delivers. In my years navigating moonshots and rug pulls, one truth stands out: resilience beats perfection. The Safemoon “Army” hasn’t gone anywhere they’re still posting memes, sharing burn stats, and fuelling belief. If the DAO stays active, burns stay hot, and Solana keeps surging, Safemoon might just write one of crypto’s most unexpected comebacks. As the clock ticks, this token stands at a crossroads: faded hype or brewing storm? Either way, it’s a story worth watching because in crypto, second chances sometimes lead to legend.

FAQs

- What is Safemoon?

Safemoon is a cryptocurrency token that migrated to the Solana blockchain, known for its deflationary mechanics like token burns and holder rewards, aiming to rebuild after past controversies. - Why is Safemoon’s price pump waning?

The initial surge post-Solana migration has faded due to market jitters, ongoing skepticism from historical scandals, and competition within the crypto space. - How could massive burns spark a Safemoon rebound?

By incinerating over 2.2 trillion tokens, burns reduce supply to create scarcity, potentially increasing value if combined with renewed community interest. - What does the DAO upgrade mean for Safemoon?

The DAO upgrade decentralises governance, allowing holders to vote on decisions like rewards and expansions, improving transparency and engagement. - Why is Solana integration important for Safemoon?

Solana’s fast, low-cost network enhances liquidity and adoption, positioning Safemoon for growth in DeFi and memecoin ecosystems amid Solana’s popularity.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.