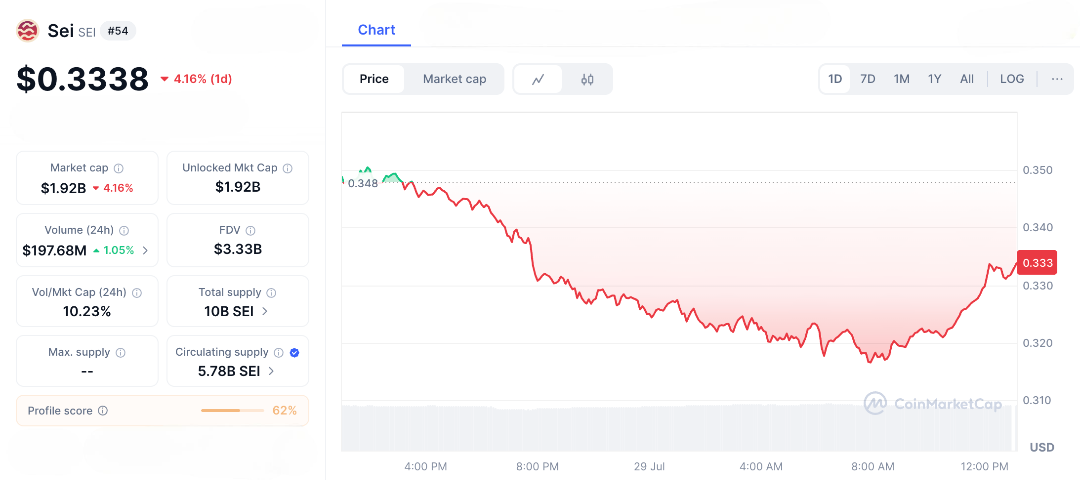

In the fast-moving world of blockchain, where layer-1 networks compete for speed and dominance, SEI from the Sei Network is quickly becoming one to watch. Designed specifically for traders and high-performance apps like DeFi and gaming, SEI offers lightning-fast speeds, sub-second finality, and parallel processing to keep things running smoothly even during heavy activity. On July 29, 2025, SEI is trading around $0.33, up 5.4% in the last 24 hours, but down from recent highs near $0.385 and possibly dropping to $0.30.

While the broader market looks shaky, experienced crypto enthusiasts know that dips like this can precede major moves. The big question is. Is this a great buying opportunity or just another fakeout? For some, it’s a tempting chance that could lead to significant gains if it rebounds. For others, it’s a risky situation. SEI is sparking conversations everywhere from group chats to Twitter threads as traders debate whether this dip is a trap or a launching pad. In crypto, timing your move can make all the difference.

Let’s take a closer look at what’s shaping the story behind SEI. Built on the Cosmos ecosystem, the Sei Network is a layer-1 blockchain specifically designed for speed handling over 10,000 transactions per second with incredibly low fees. This isn’t just theoretical tech; it’s already proving itself in real-world use cases where speed is everything, like trading and gaming. After a massive 105% surge earlier this month, it has cooled off a bit and is now consolidating near key support levels. It’s currently not too far from its all-time low of $$0.007989 , showing how much ground it’s covered and how much volatility still lingers.

As of now, SEI’s market cap is around $1.92 billion, and its 24-hour trading volume tops $197 million a sign of strong liquidity, but also a reminder that traders are actively reacting to market swings. Analysts are currently divided. On the cautious side, some predict a potential drop to $0.24, pointing to overbought RSI indicators and short-term bearish pressure that could lead to a 4% dip. On the flip side, others see signs of strength, highlighting network upgrades and new integrations that could drive momentum toward a breakout at $0.45.

The real excitement around SEI isn’t just price action it’s the strong fundamentals behind the scenes. Recently, Sei integrated native USDC and launched CCTP V2, making cross-chain transfers smoother and boosting its connection to major DeFi platforms. This kind of progress is key for attracting serious institutional players. Add in the arrival of Etherscan support bringing better analytics to one of the fastest EVM-compatible chains and it’s clear Sei is leveling up.

Meanwhile, the Sei community is hyping. Projects like Groovy Market and Yaka Finance are gaining traction, thanks to it’s speed and low fees. The network’s total value locked (TVL) is rising steadily, showing real, organic growth not just hype. On top of that, staking rewards around 7% give holders another reason to stick around during market dips. And let’s not forget: it has bounced back before. Last year, it hit an all-time high of $1.14 during a wave of ecosystem growth. If the broader crypto market turns bullish again maybe thanks to Bitcoin’s stability or continued ETF inflows SEI could follow suit. For those buying the dip, this might just be one of those rare moments that leads to asymmetric returns.

SEI’s Crossroads

Every great crypto journey has its doubts, and SEI is no exception. Its biggest challenge is volatility. The recent dip reflects not just SEI’s own movement but also the overall market’s instability. With rising competition from projects like Sui, SEI’s potential might be limited if adoption slows down. Regulatory issues are also a concern. However, Sei’s team is focusing on compliance, which could help them navigate tighter regulations.

Despite this, it could be the calm before the storm. In the past, tokens like SEI have dipped only to come back stronger. It’s like a coiled spring, building up energy. Buying around $0.30 now is a bet on its future, backed by increasing on-chain activity and positive momentum that could lead to significant price rallies.

Imagine telling your friends you invested in Sei before it skyrocketed. That’s the kind of story that makes for legendary investment tales. So, whether you decide to invest or wait, one thing is certain: SEI’s story is far from over. This dip might just be the start of an exciting new chapter, because in the world of crypto, the boldest moves often lead to the best stories.

FAQs

- What is Sei?

SEI is the native token of the Sei Network, a Cosmos-based layer-1 blockchain designed for high-speed trading, DeFi, and gaming with parallel processing. - Why is Sei dipping toward $0.3?

Market corrections and consolidation after a 105% surge have driven SEI lower from highs near $0.385, with technicals indicating short-term downside. - What updates could trigger a Sei breakout?

Recent integrations like native USDC, CCTP V2 for cross-chain transfers, and Etherscan for analytics are enhancing functionality and attracting users. - What is Sei’s current price?

As of July 29, 2025, SEI trades around $0.32, with a $1.92 billion market cap and over $190 million in 24-hour trading volume. - Should you buy Sei during this dip?

It could offer entry for potential rebounds given strong fundamentals, but risks include volatility and competition from other layer-1 networks.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.