The crypto market has shown mixed signals recently, but many traders believe a rebound could be forming. Nearly $29 billion entered the market in just one day, and this shift in capital has helped several Layer 1 blockchains regain strength. SEI, also known as the “red chain,” is among the networks drawing renewed attention. It delivers fast transactions, low fees and a structure designed for large-scale activity, making it attractive for decentralized finance, real-world asset tokenization and developer growth.

Within this environment, SEI’s price movements have become a key focus. The token has held firmly above an important support level, and rising demand has opened the door for a potential climb toward $0.32, $0.38 and possibly even $0.45. As the broader market recovers, SEI’s mix of technical strength and network activity is giving traders reasons to watch closely.

SEI Price Holds Its Ground Above Key Support

SEI stayed above the crucial $0.18 support, a level that has repeatedly shown strong buying interest. This zone helped the token rise toward $0.30 and $0.38 in recent weeks. Such moves show that the market remains confident in SEI’s long-term direction, even when short-term volatility appears. SEI has been trading within a rising price channel. This means the price has been gradually pushing upward between two trendlines that guide its movement. This type of pattern is often considered healthy because it reflects steady accumulation rather than sudden unpredictable spikes.

According to the trend structure, a clean breakout above $0.26 could push the price toward the middle of the channel at around $0.31. If buyers continue to support the move, SEI may attempt to reach the upper boundary of the channel, which currently sits near $0.45. This is the price target analysts widely discuss, as it aligns with both chart patterns and recent market momentum. However, if the $0.18 support fails, the price could slide back to around $0.14, which forms the lower boundary of the trend channel. This area represents the final support before the structure breaks down, so traders often watch it closely during market uncertainty.

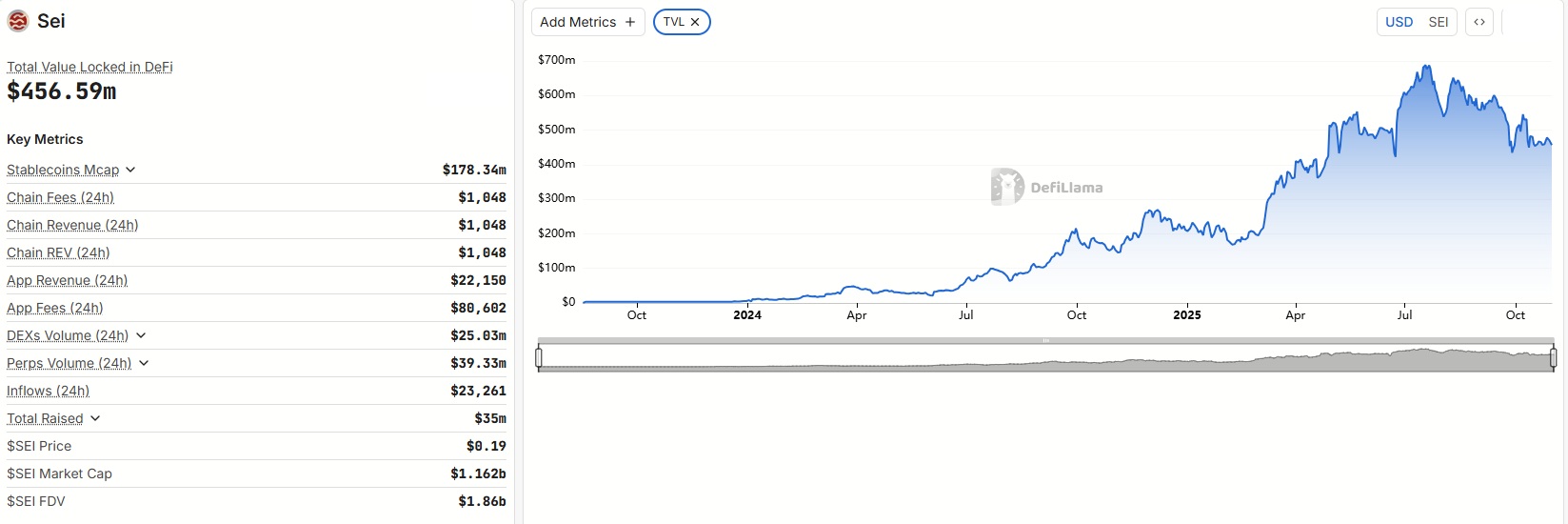

SEI’s recent price strength is supported by strong on-chain fundamentals. Net inflows more than doubled from the previous month, rising from around 250 million SEI to slightly over 600 million SEI. Rising inflows suggest new capital is entering the ecosystem, which often supports price growth in the short and medium term. Perpetual futures activity has also increased significantly. Perps volume surged from almost zero to $28 million in October. This shows higher interest from traders using SEI within the decentralized finance environment.

SEI’s growth extends beyond trading activity. Data shows that SEI now ranks sixth among Layer 1 blockchains by number of active addresses. The network recorded more than 175 million active addresses since the beginning of the year. This elevated position highlights how frequently the network is being used compared with other major chains.

Low fees and fast processing speeds are key reasons for this growth. More users typically mean higher liquidity and more consistent demand, which supports a healthier price trend over time. Here is a simple comparison of SEI’s active address ranking:

| Layer 1 Rank (Active Addresses) | Blockchain |

|---|---|

| 1 | Plasma (XPL) |

| 2 | Polygon (POL) |

| 3 | Ethereum (ETH) |

| 4 | Bitcoin (BTC) |

| 5 | Aptos (APT) |

| 6 | SEI Network (SEI) |

Source:Token Terminal

SEI’s position among these major names shows how rapidly its ecosystem is expanding. Large institutions are increasingly exploring SEI for real-world asset and DeFi use cases. Companies such as BlackRock, Apollo Global, Circle, PayPal, Brevan Howard and Ondo Finance have begun using SEI as part of their coordination systems for digitized finance. This type of participation strengthens confidence in SEI’s long-term potential and signals that its technical capabilities are recognized at a global scale.

Institutional involvement often brings new liquidity and higher usage, which can help support price discovery. When combined with strong retail activity, this creates a balanced market foundation that may assist SEI in holding higher valuations over time.

SEI’s Path Toward $0.45

SEI continues to trade above a key support level, and rising on-chain activity supports a potential move toward higher targets. If the price breaks above $0.26 and holds above $0.28, traders may look for an advance toward $0.31 and eventually $0.45. Growing inflows, increasing futures volume and active institutional participation all strengthen the likelihood of this scenario.

While risks remain, especially if support levels break during a market pullback, SEI’s combination of technical structure and network expansion makes it one of the notable Layer 1 contenders to watch in the coming weeks.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.