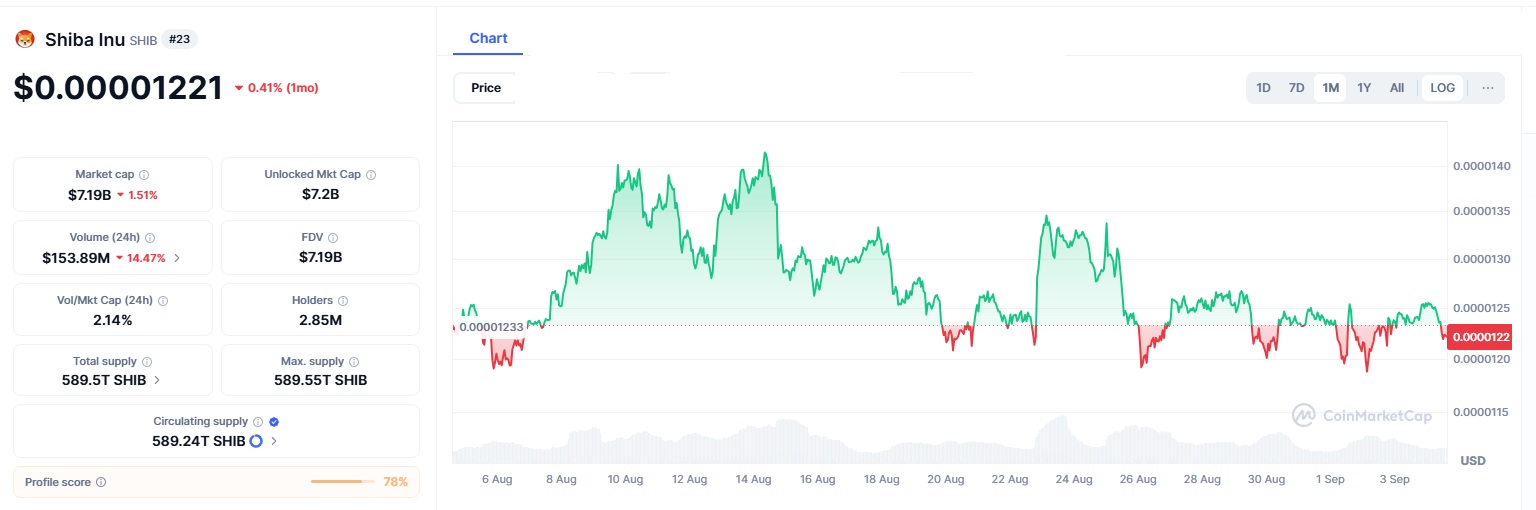

Shiba Inu (SHIB), a well-known meme coin in the crypto world, is currently at a crucial price point. The token is steady around $0.000012, which traders consider an important support level. If this support holds, Shiba Inu could see gains of 10% or more. However, if it doesn’t, the price might drop further, undoing recent progress.

This situation has led to mixed feelings among traders. Some think a recovery is coming, while others worry about a bigger drop. To understand what’s happening, it’s important to look at both the technical indicators and the overall activity in Shiba Inu’s ecosystem.

The Technical Picture

Analysts have noticed that Shiba Inu has formed what is known as a double bottom pattern. This pattern occurs when a token’s price drops to the same low point twice and then stabilizes. It is often considered a bullish signal, meaning the price could reverse upward.

In Shiba Inu’s case, the coin has repeatedly defended the range between $0.00001230 and $0.00001232. Each time it approached this level, buyers stepped in to keep it from falling further. This kind of support suggests that many investors see this price as a good entry point, which could fuel a rally.

If momentum builds, short-term price targets are set between $0.00001320 and $0.00001500, representing gains of 8–23% from current levels. However, not all signals are bullish. The Relative Strength Index (RSI), which measures whether an asset is overbought or oversold, is currently neutral. Meanwhile, the MACD indicator, another popular tool, shows warning signs that the price could lose momentum.

On-Chain Signals and Market Activity

Beyond charts and indicators, blockchain data tells another story. According to analytics, the number of active Shiba Inu addresses has jumped by 75% since August, reaching levels not seen since June. This suggests that more people are interacting with the token, either by trading, transferring, or using it in some way.

Shiba Inu has also seen its exchange supply shrink by 12% since the beginning of 2025, dropping to around 73.08 trillion tokens. This means fewer coins are sitting on exchanges, which can reduce selling pressure and support the price.

At the same time, Shiba Inu’s social presence is climbing. Mentions of the coin on crypto forums and platforms spiked recently, giving it a social dominance of 1.81%, the highest in six months. Social activity often reflects market sentiment and can help fuel short-term rallies, especially for meme coins like SHIB.

September History: A Tough Month for SHIB

Despite the recent positives, history paints a cautious picture. Since its launch, September has typically been a weak month for Shiba Inu. The coin has only posted gains in two Septembers—2021 and 2024, with most other years ending in losses. Some analysts believe this seasonal trend could weigh on SHIB’s performance this year as well.

Forecasts remain divided. Some predictions suggest SHIB could climb toward $0.00001324 before the month ends. Others warn that if the key support zone breaks, the token could fall below $0.00001150, with a worst-case target near $0.000010.

Burns, Utility, and Ecosystem Growth

Shiba Inu (SHIB) is working to maintain its value through several initiatives. The project features a deflationary burn mechanism to reduce the supply of SHIB tokens over time. Reports from August and September 2025 indicate a much smaller burn volume, with only 2.48 million tokens burned.

Shibarium, Shiba Inu’s Layer-2 blockchain, continues to grow and expand its real-world applications. While it has surpassed 1.5 billion in total lifetime transactions. Activity on Shibarium has been volatile, with significant fluctuations in daily transactions. The Shiba Doggy DAO has introduced new governance strategies, including quadratic voting, which aims to give smaller token holders more influence and reduce the dominance of larger investors.

These initiatives reflect Shiba Inu’s efforts to enhance its ecosystem, manage its token supply, and provide more utility. However, investors should be cautious of specific statistics that lack verification. The long-term impact of these measures on SHIB’s value will depend on market conditions and adoption rates.

Whale Activity and Concentration Risks

Large holders, known as whales, continue to play a big role in SHIB’s market moves. Recently, whales transferred around 3.47 trillion tokens, a sign that some may be accumulating. When whales buy in large amounts, it can support prices, but when they sell, it can drag the market down quickly.

A point of concern is that a single wallet controls about 41% of the entire SHIB supply. This heavy concentration poses risks, because if that wallet decides to sell, the market could experience significant volatility.

The Bigger Picture

Shiba Inu’s market value is about $7.19 billion. Experts suggest that the key support level is around $0.000012. If SHIB stays above this level and activity remains strong, the price could increase by 10%. However, if it falls below this level, the price might drop to $0.000010, highlighting the risks of investing in speculative assets.

Shiba Inu is in a delicate position. Its strong community, expanding ecosystem, and ongoing token burns are positive signs. However, past weaknesses in September, technical warning signs, and the concentration of large holders present challenges. The future of SHIB’s price will depend on how both small and large investors react in the coming weeks.

Right now, everyone is watching the $0.000012 support level, which could determine whether Shiba Inu’s price goes up or down next.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.