Dogecoin (DOGE), the popular meme cryptocurrency known for its playful community and massive online following, faced new tension after a large transaction caught traders’ attention. On October 14, 2025, a wallet transferred 132 million DOGE tokens, worth about $27 million, to the trading platform Robinhood. This move immediately sparked concern across the crypto market. When “whales” move coins to exchanges, it can be a sign they’re preparing to sell. In the past, such actions have sometimes led to price drops. Traders and social media users began speculating whether this transfer marked the start of a major sell-off or if it was simply a repositioning move before the next price surge.

At the time of the transfer, Dogecoin’s price was already struggling to stay above key support levels. The token had been trading in an ascending channel, but it faced repeated resistance around $0.22, a level that traders watched closely as a potential breakout point. DOGE’s price stayed near the $0.18 – $0.20 range, an area where buyers (bulls) were trying to prevent further decline. While the $27 million inflow didn’t cause an immediate crash, it created uncertainty in an already fragile market. Trading activity rose quickly, volume increased by 15% to about $1.2 billion in a single day.

Here’s a quick overview of key data that analysts are watching:

| Metric | Value | Meaning |

|---|---|---|

| Whale Inflow | 132 million DOGE ($27M) | Could signal upcoming sell pressure |

| Price Range | $0.18 – $0.22 | Key support and resistance zone |

| Trading Volume | +15% to $1.2B | Rising market activity amid uncertainty |

| RSI | 39.99 | Weak buying momentum; mild downside pressure |

| NVT Ratio | 287 | Suggests overvaluation vs. on-chain activity |

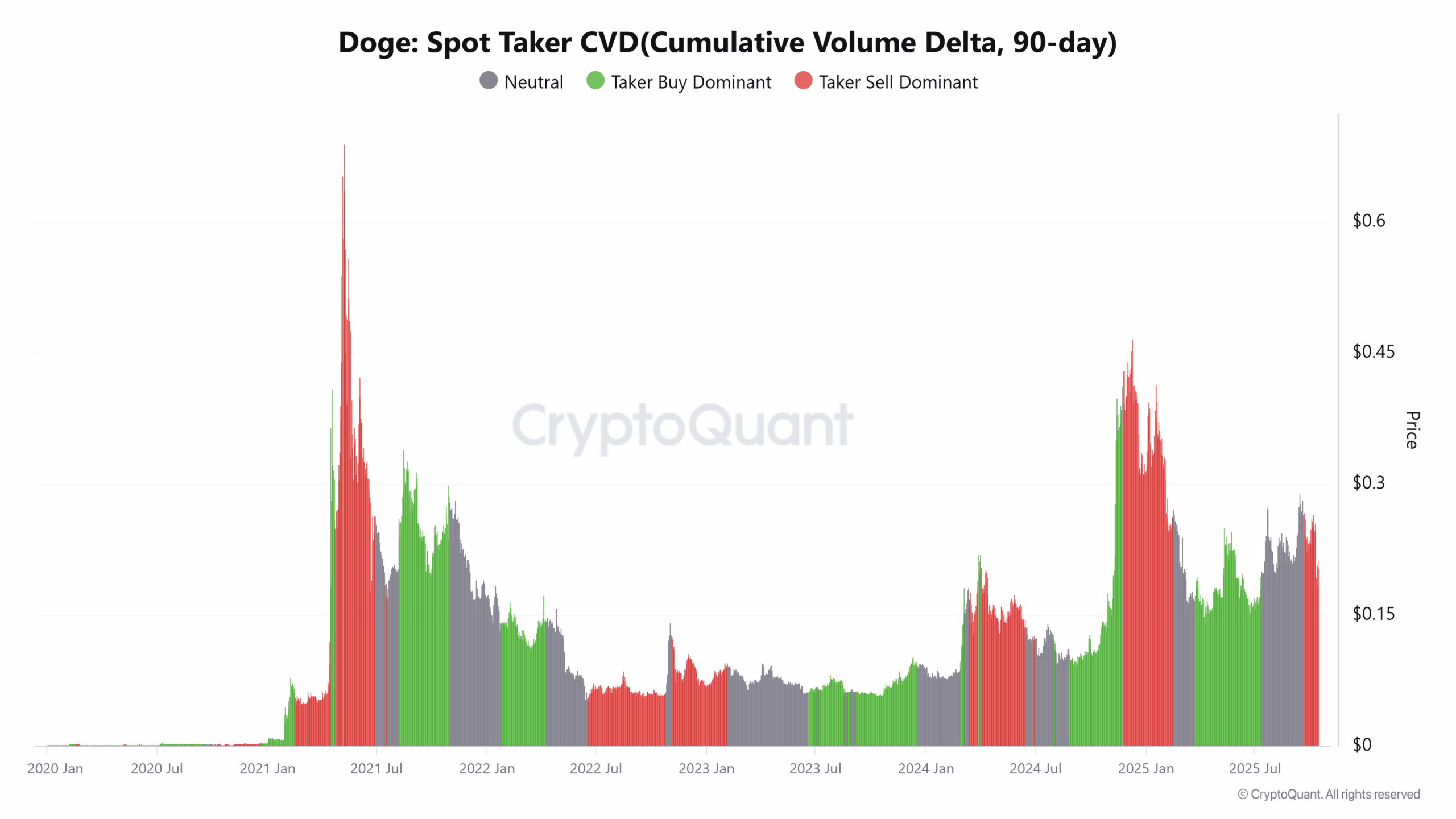

| Spot Taker CVD | Sell-side dominant | Indicates traders closing long positions |

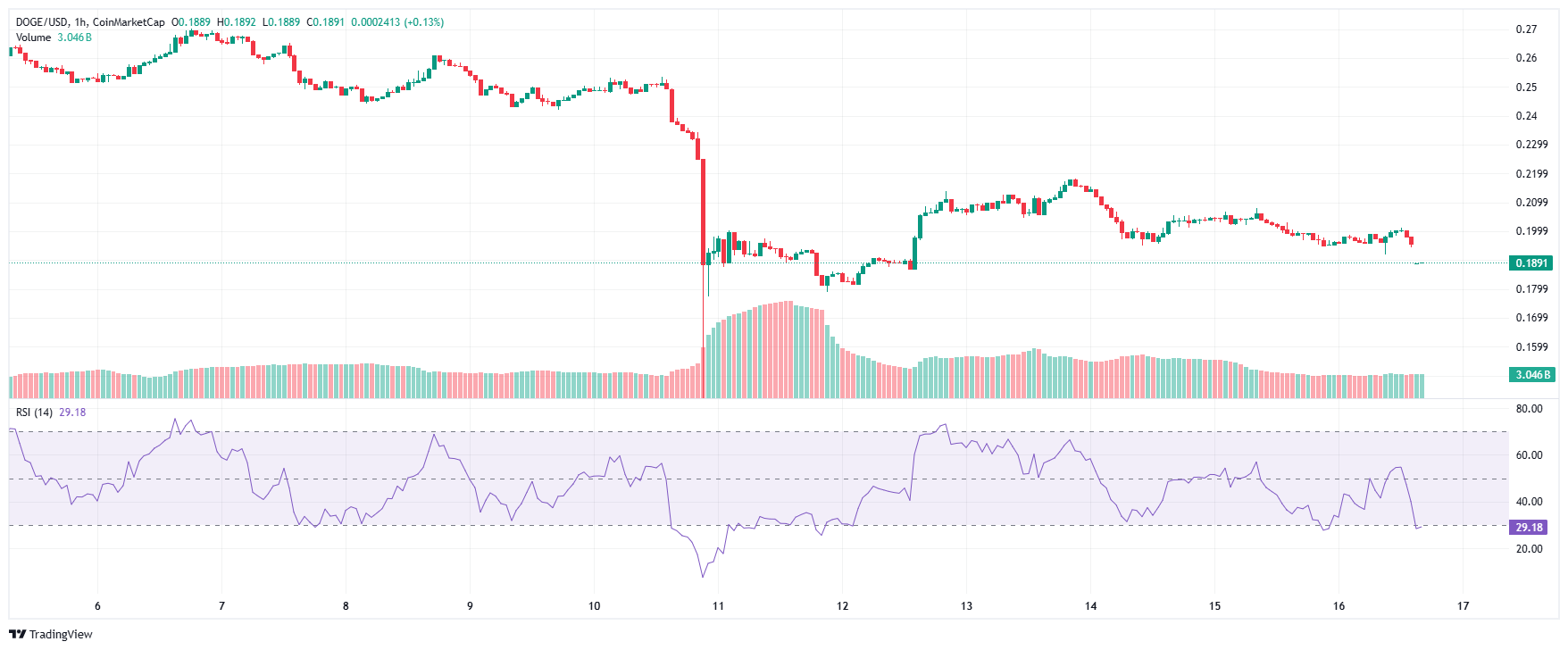

Technical indicators are showing a cautious outlook.

- RSI (Relative Strength Index) at 29.18 means DOGE is being oversold, suggesting weak buying interest.

- The NVT Ratio (Network Value to Transactions) stands at 287. This indicates that DOGE’s market value is high compared to how much it’s being used on-chain a pattern that often happens before a price correction.

- Spot Taker CVD data from CryptoQuant reveals that sell orders have been stronger than buy orders over the past 90 days, showing that many traders are closing leveraged long positions and taking profits.

For traders, the situation remains uncertain but not hopeless. Analysts say that if Dogecoin can hold above the $0.18 support level, there could be a short-term relief rally pushing prices back to $0.22. However, continued whale inflows to exchanges could increase selling pressure and keep prices volatile. If the selling continues and DOGE falls below $0.18, the next possible support lies near $0.15. On the other hand, a strong bounce above $0.22 could help the token aim for $0.25 or even $0.30 in the following weeks.

Should Dogecoin traders panic after DOGE’s 132 mln whale inflow?https://t.co/Ej99kX2Vj0

— John Morgan (@johnmorganFL) October 16, 2025

Online discussions have been filled with mixed opinions. Some traders believe the whale transfer is simply a setup for a larger accumulation phase meaning the whale could be preparing to buy more after shaking out weaker holders. Others fear that this might mark the start of another price dip. Social media reactions range from hopeful to anxious. Meme traders are posting optimistic takes like, “No panic DOGE to $0.25 soon!” while cautious investors warn, “If this inflow leads to selling, $0.15 is coming fast.” The community remains divided, but the shared excitement and tension show just how deeply Dogecoin’s story continues to engage the crypto world.

Bigger Picture for Dogecoin and the Meme Market

This $27 million transfer is more than a single trade it’s a test of Dogecoin’s resilience in 2025. The token’s performance often influences other meme coins like Shiba Inu (SHIB), meaning a sharp drop in DOGE could trigger broader sell-offs across the meme coin sector. Institutional investors are also paying attention. Whale movements highlight how dependent DOGE remains on community hype and large holder actions. A strong rebound could restore confidence and attract new traders, while another drop might push cautious investors toward more stable assets like Bitcoin.

Dogecoin’s market today sits at a crossroads. If the $0.18 support holds, traders may see a recovery rally toward $0.22 or even higher levels. But if whales continue sending coins to exchanges, further declines could follow. The next few days will reveal whether this whale move becomes a short-term scare or the start of a larger trend. For now, the key question remains: Will Dogecoin show strength and swim through the turbulence, or will the whale’s wave pull it deeper underwater?

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.