- SocialFi merges social media and finance, enabling direct creator monetization beyond ads and platform revenue splits.

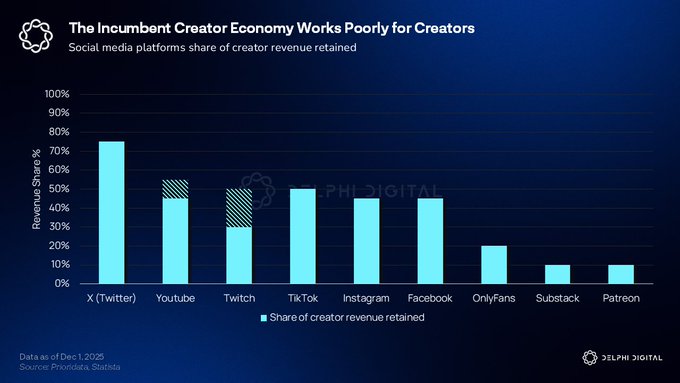

- Revenue data shows major platforms retain 45–75% of value, limiting creator earnings.

- Tokenized audiences and social trading models signal structural shifts in creator-platform economics.

SocialFi is emerging as a defining theme in the evolution of the creator economy as financial activity and social media platforms increasingly intersect. According to Delphi Digital’s latest 2026 Application Outlook report, this convergence is expected to accelerate in 2025, reshaping how creators monetize audiences and how financial behavior is embedded into online communities. The report outlines how crypto-based infrastructure could alter long-standing platform dynamics by enabling more direct economic relationships between creators and users.

Delphi Digital identified two parallel developments driving this transition. Trading activity is becoming more social, while social media platforms are incorporating more explicit financial features. The firm said these trends are converging into what it describes as SocialFi, where social interaction and financial participation are tightly linked. Within this framework, creators are no longer limited to advertising or platform-controlled revenue programs.

SocialFi and Creator Monetization Models

Delphi’s report highlights the creator economy’s scale, estimating it at approximately $320 billion. Despite this growth, the firm argued that existing business models remain constrained by platform incentives that prioritize advertising revenue and platform margins. According to the analysis, crypto-based tools allow creators to tokenize their audiences, converting subscribers into tokenholders and enabling monetization structures that do not rely on traditional ad intermediaries.

Two trends are converging in 2025.

Trading is becoming social, and social media is becoming financial.

The creator economy is $320B and growing, but the underlying business models are broken.

A similar cycle plays out with new mediums. A new platform emerges that creators… https://t.co/jyXIhQBovU pic.twitter.com/t8O8tiRODm

— Delphi Digital (@Delphi_Digital) December 16, 2025

This structure allows creators to establish direct, programmable relationships with their audiences. Rather than depending on opaque algorithms or fixed revenue splits, monetization can be embedded into the relationship itself. Delphi noted that this approach changes how value flows between creators and users, particularly compared with legacy Web2 platforms.

Platform Revenue Splits Highlight Structural Tensions

A chart referenced alongside the report illustrates how major platforms distribute creator-generated revenue. X retains the largest share, at roughly 75%, leaving creators with a comparatively smaller portion. YouTube and Twitch each retain around 45–50%, reflecting their ad-driven and subscription-based models.

Source: X

TikTok, Instagram, and Facebook also cluster in the 45–50% range. While these platforms provide reach and discovery, the data suggests that creators capture less than half of the value they generate. This revenue structure has contributed to growing scrutiny of platform alignment with creator incentives.

In contrast, creator-focused platforms retain less. OnlyFans appears to keep about 20%, while Substack and Patreon retain roughly 10% each. These models prioritize direct subscriptions over advertising, resulting in higher take-home revenue for creators.

Social Trading and Financialized Media

The report also situates SocialFi within broader trends linking online culture and finance. Social trading gained prominence in 2021, and more recent developments include copy-trading products and social trading applications. At the same time, many large social platforms continue to rely on advertising, subsidies, or support from their parent companies, with varying degrees of sustainability.

Delphi Digital’s analysis suggests that these structural pressures are creating space for crypto-based alternatives. As social media becomes more financialized, SocialFi frameworks are increasingly positioned as mechanisms for direct monetization and economic alignment, based on the data and observations outlined in the report.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.