The cryptocurrency market has been moving sideways in early September 2025, and Solana (SOL) is one of the tokens that traders are watching closely. At the moment, Solana is holding steady around a strong support level of $195, while investors are paying attention to the $215 price mark. If Solana manages to break above this level, analysts believe it could quickly rally toward $250 or even higher.

As of September 2, Solana is trading at around $204, posting a daily gain of 1.34% and boosting its market capitalization to $110.34 billion. Despite uncertainty in the broader crypto market, Solana has shown resilience. Its strength is being driven not only by investor interest but also by network upgrades and steady institutional inflows, both of which are helping it stand out from other cryptocurrencies.

Why $195 and $215 Matter

Solana’s recent price movements suggest a classic chart setup that traders often look for. After dipping to $195 last week, the token bounced back, showing that buyers are strongly defending this support level. For weeks, $195 has acted as a “floor” where price tends to stabilize before moving upward again.

On the upside, resistance has formed in the $213–$215 range. Each time Solana has approached this zone, sellers have stepped in to limit gains. However, if Solana can decisively close above this level, technical patterns suggest it could aim for $238 and $250 as the next targets. These numbers are based on Fibonacci levels often used by traders to forecast future moves.

Network Activity Backs the Price Action

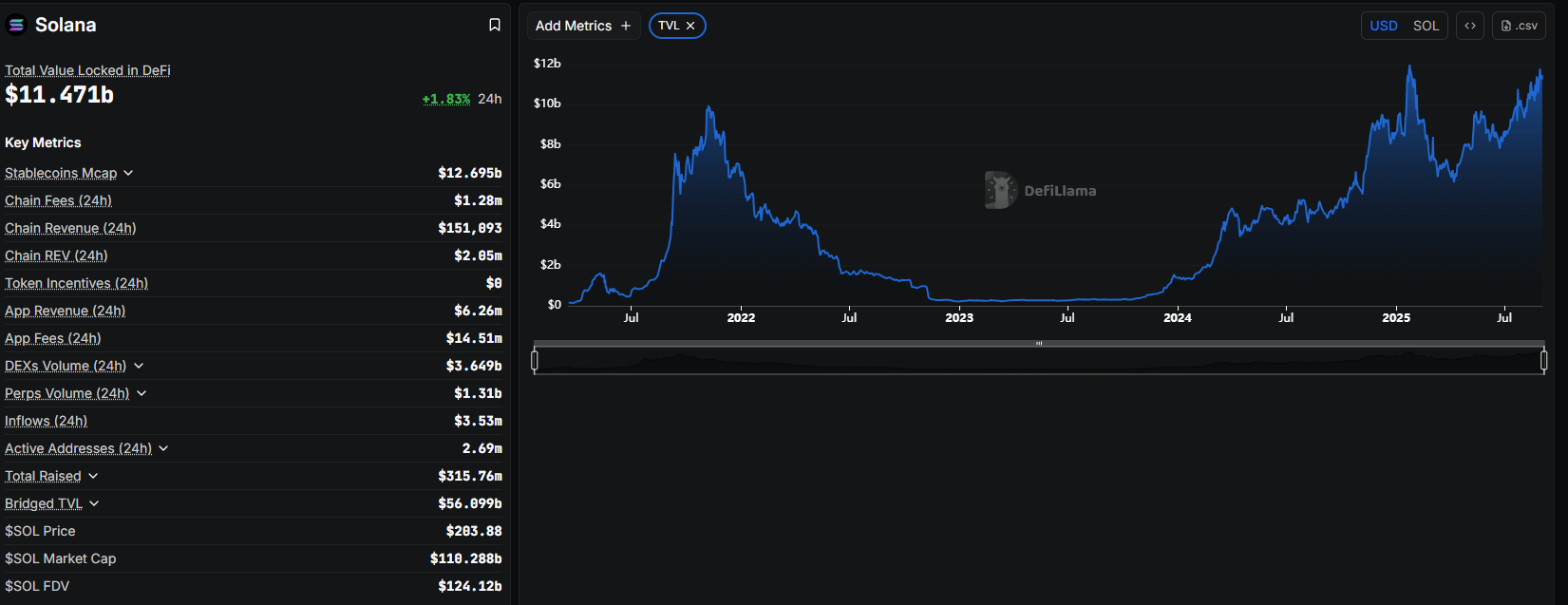

What makes this setup more convincing is the activity happening within the Solana network itself. On-chain data shows that total value locked (TVL), the amount of money deposited into Solana-based DeFi protocols, has reached $11.47 billion. Daily transactions are averaging 45 million, and importantly, gas fees remain consistently low.

This combination indicates that Solana’s ecosystem is not only being used actively but is also handling traffic efficiently without congestion. That is a strong sign of network health, especially as other blockchains sometimes struggle with high fees or slow processing during heavy demand.

Recent upgrades are adding to this strength. For instance, the Alpenglow proposal, which focuses on faster block times and better scalability, is aimed at making Solana more appealing for DeFi applications and NFTs. These improvements increase confidence among both developers and investors.

How Solana Compares with Peers

In 2025, Solana has performed better than many of its peers, gaining 120% year-to-date. This rally has been fueled by strong decentralized exchange (DEX) activity, rising meme coin popularity, and growth across applications like Raydium. Analysts are calling the $205–$215 range pivotal, as a breakout from here could set the stage for a 20–30% near-term upside. Adding to this optimism, Solana’s weekly charts show a “golden cross,” a bullish technical signal that often precedes further gains.

Confidence is also reflected in whale activity. On-chain analytics reported that large holders accumulated 2.5 million SOL (worth about $500 million) in August, even as the token dipped to $182. This suggests that major investors are positioning for a longer-term rally.

What Could Drive the Next Move

Looking forward, several key factors could determine whether Solana continues upward or faces setbacks. If the token breaks above $215, some forecasts see it rallying as high as $280 by October, while more cautious predictions suggest $230 as the first ceiling. On the downside, failure to hold $195 could trigger a drop toward $174 support.

Major events on the roadmap include the rollout of Firedancer, a new independent validator client that aims to push Solana’s transaction speeds below 100 milliseconds. This upgrade could significantly enhance scalability and further strengthen Solana’s reputation as a high-performance blockchain.

At the same time, broader macroeconomic conditions—such as Federal Reserve interest rate decisions and global market volatility, may influence investor sentiment and dictate how much risk appetite flows into crypto assets like Solana.

Timeline of Key Milestones

- January 2025 – Solana started the year at around $100.

- April – The token broke past $200, fueled by ETF excitement.

- July – Firedancer’s testnet went live, boosting long-term confidence.

- August – SOL dipped to $182 but quickly rebounded with whale support.

- September – Focus is now on the crucial $215 breakout level.

- Q4 Projection – If adoption continues and TVL doubles, Solana could target $250 or more.

Technical indicators currently lean bullish. The MACD shows positive divergence, and the RSI at 56 suggests there is still room for growth before the asset becomes overbought.

Overall, Solana’s story is one of steady evolution. Once known mainly for meme coins and fast DEX activity, the blockchain is increasingly proving itself as a serious high-performance network. If it successfully clears resistance at $215, the path toward $250 could unfold quickly, potentially rewarding investors who have shown patience during the recent consolidation phase.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.