Solana, often called the “Ethereum killer” for its speed and efficiency, is once again capturing market attention. As September 2025 ended, the price of SOL began rising steadily, prompting many traders and investors to wonder if this could be the beginning of another major rally.

Solana’s growing momentum is not just about price speculation. Three main factors, network growth, institutional investment, and steady derivatives trading are now working together to strengthen its position. If these trends continue, analysts believe Solana could reach $300 in the coming weeks, marking one of its strongest comebacks since early 2022.

1. Rising Network Activity

One of the biggest drivers of Solana’s current strength is the rise in network usage. The platform’s seven-day transaction fees increased by 22%, reaching $5 million, showing that more people are using Solana-based applications and services. Activity on decentralized exchanges (DEXs) built on Solana also surged. In the past week, DEX trading volume hit $129 billion, surpassing Ethereum’s $114 billion. This is a major milestone, as Ethereum has long been the leader in decentralized finance (DeFi).

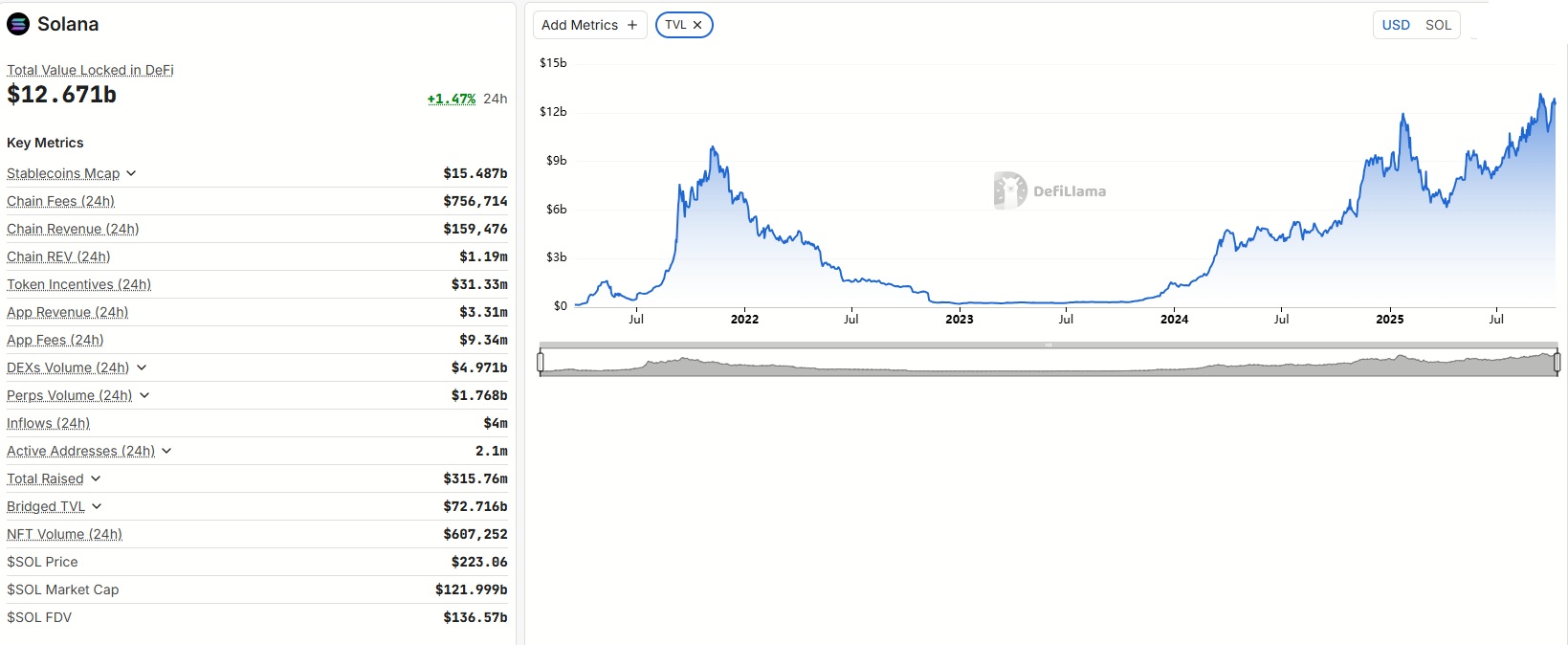

In addition, Solana’s total value locked (TVL) a measure of how much money is deposited in its smart contracts rose 8% to $14.2 billion. This means more liquidity and user participation in the ecosystem. Solana now holds about 8% of the total DeFi market share, making it the second-largest blockchain network by activity. Popular platforms such as Pump, Meteora, and Raydium have seen significant user growth and transaction spikes. The rise in network fees also helps reduce the effect of inflation by increasing rewards for validators who keep the network secure and stable.

2. Strong Institutional Inflows through ETFs

Institutional investors are also showing renewed confidence in Solana. Exchange-traded funds (ETFs) and exchange-traded products (ETPs) focused on Solana recorded $706 million in weekly inflows. This amount is more than triple the inflows for XRP, which saw $219 million in the same period. Analysts expect that the U.S. Securities and Exchange Commission (SEC) could soon approve new spot Solana ETFs, possibly by mid-October. If that happens, it would open the door for even larger institutional investments.

ETF inflows are important because they show growing demand from professional investors who prefer regulated, secure exposure to digital assets. This institutional interest often signals confidence in the blockchain’s future performance and stability.

3. Stable Derivatives Market

The third factor supporting Solana’s rally is the healthy state of its derivatives market an area that often reflects trader sentiment. Solana’s funding rates (which show how leveraged traders are betting on price movements) remain below 6%. This level suggests a balanced market. It means traders are optimistic but not overly aggressive, which reduces the risk of sudden liquidations or extreme volatility. Stable derivatives data often point to sustainable price growth rather than short-term speculation.

At the moment, Solana is trading around $225, having moved between $218 and $229 over the past few days. The coin has gained about 3% in the last week, supported by expectations of a possible interest rate cut by the U.S. Federal Reserve, which tends to increase investor appetite for risk assets like cryptocurrencies.

Solana’s Market Snapshot

| Metric

|

Current Value (as of Oct 2025)

|

Trend / Impact

|

|---|---|---|

| Price | $221.45 | Up 3% weekly |

| Market Cap | $120+ billion | Rising steadily |

| DEX Volume | $129 billion | Higher than Ethereum’s $114B |

| Total Value Locked (TVL) | $14.2 billion | Up 8% in one week |

| ETF/ETP Inflows | $706 million weekly | Strong institutional demand |

| Network Fees | $5 million weekly | Up 22%, signals growing usage |

| Funding Rates | < 6% | Balanced sentiment, low risk of overheat |

| Key Resistance | $229 | Breakout could lead toward $300 |

| Key Support | $218 | Drop below may lead to $200 zone |

Market analysts see these numbers as strong signs of growth. They point out that Solana’s ability to generate higher fees, attract more liquidity, and gain institutional support all indicate a more mature and stable network. However, experts also caution that Solana must maintain its recent stability. In previous years, the network faced several outages that temporarily halted transactions. If such technical issues reappear, investor confidence could quickly weaken. Additionally, the market’s reaction to global economic conditions particularly decisions by central banks and inflation trends will continue to influence crypto performance.

The Road to $300

For Solana to reach $300, it must first break through the resistance level around $229 and maintain strong trading volume. If the upward momentum continues, analysts expect short-term targets near $270, followed by a possible run toward $300 by early 2026. The combination of higher network activity, institutional buying, and a stable derivatives market gives Solana a strong foundation. If these factors remain in place, its market value could expand significantly. On the other hand, if trading slows or investor enthusiasm fades, Solana might drop back toward $200 before finding new strength. Still, compared to other blockchains, Solana’s growth story stands out. Its fast transaction speeds, growing ecosystem, and now increasing institutional interest make it one of the most closely watched altcoins heading into the final quarter of 2025.

Solana’s recent performance represents more than just another price rally. It’s a reflection of how a blockchain once known for network issues has evolved into a high-performance ecosystem attracting both individual and institutional investors. Whether it can sustain this momentum and cross the $300 mark will depend on how well it balances speed, security, and real-world utility in the months ahead.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.