Bitcoin’s rise above $110,000 has put every corporate transaction under a microscope, and SpaceX’s recent activity has become one of the most discussed events of the month. Over the past several days, the aerospace company shifted more than 5,645 BTC across multiple blockchain addresses. These transfers include a new 281 BTC transaction detected on October 29, following several earlier movements involving 346 BTC, 1,215 BTC, 1,197 BTC, 1,298 BTC, and an older transfer of 1,187 BTC in July.

Each move was spotted by on-chain researchers, including analysts from Timechainindex.com and Arkham Intelligence. Their findings circulated quickly because SpaceX rarely touches its Bitcoin wallet. When a major holder becomes active after months of silence, it often raises questions about potential sales, new custody arrangements or internal restructuring.

🚨ELON’S BITCOIN MOVES AGAIN!

— Coin Bureau (@coinbureau) October 30, 2025

SpaceX just transferred $31 MILLION in $BTC, part of a broader $472M custody shuffle through Coinbase Prime — the go-to platform for institutions securing their crypto. pic.twitter.com/zmNxWyvG0W

At this stage, none of the moved coins have reached an exchange, and there is no confirmed sign of liquidation. The receiving addresses appear to be linked to Coinbase Prime, which is often used by companies for secure custody. This pattern has led many observers to believe that SpaceX may be reorganizing its Bitcoin holdings rather than preparing to sell them.

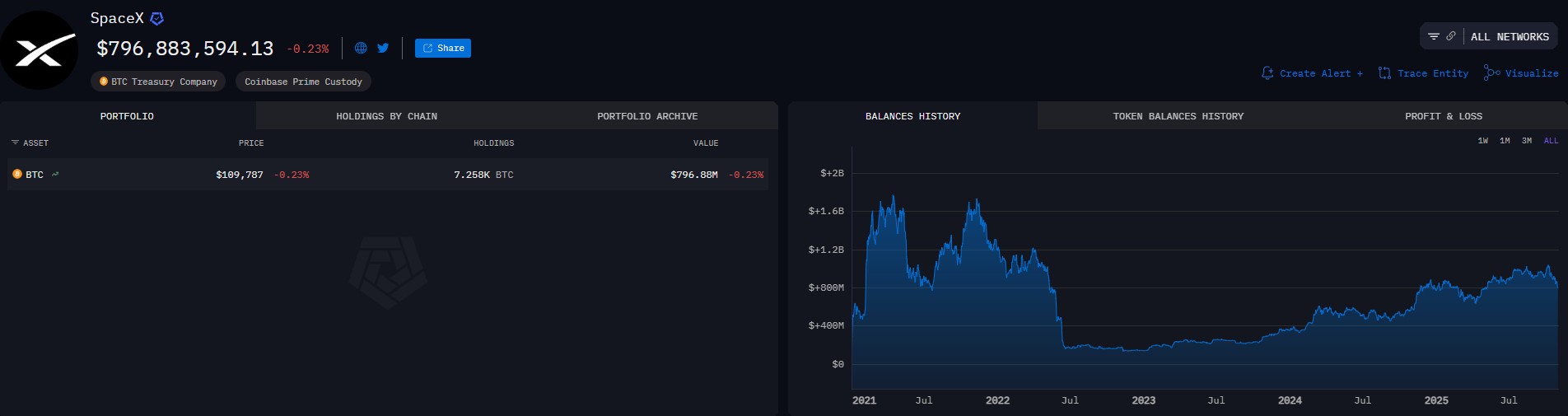

Arkham’s data places SpaceX’s holdings at roughly 7,258 BTC. At current prices, this equals about $785 million, placing SpaceX among the largest private corporate holders of Bitcoin. Its strategy has evolved over several years, but the company continues to treat Bitcoin as a long-term asset rather than a short-term trading tool.

The chart below offers a basic snapshot of how SpaceX compares with other major corporate holders.

|

Company |

Approx. BTC Holdings | Estimated Value (Oct 2025) | Corporate Type | Notes |

|---|---|---|---|---|

| MicroStrategy | 640,808 | ~$70B | Public | Largest BTC holder worldwide |

| Tesla | 11,509 | ~$1.27B | Public | No recent changes |

| MARA Holdings | ~28,000 | ~$3.1B | Public | Mining-driven treasury |

| Block (Square) | ~8,300 | ~$915M | Public | BTC-focused payment ecosystem |

| SpaceX | ~7,258 | ~$785M | Private | Recent internal reorganizations |

These movements are significant because SpaceX rarely adjusts its Bitcoin wallets. The company typically holds coins for long periods, making any shift a potential signal of change in strategy or custody. Several on-chain clues suggest that these transfers may be part of a consolidation process. Large companies often reorganize wallets to improve security, update internal systems, or move assets into institutional-grade cold storage. This is especially common when market values rise and digital assets require stronger protection. This interpretation is strengthened by the fact that none of the coins have been sent to exchanges. When companies plan to sell, funds usually appear on major trading platforms within hours. The absence of such activity points toward housekeeping rather than liquidation.

Despite the size of the transfers, Bitcoin’s price barely reacted. The market saw less than a one-percent dip after the news, showing how much more stable BTC has become compared to previous cycles. A few years ago, similar moves by a major tech company might have triggered large swings. Today, the market absorbs these events more calmly because liquidity is deeper and institutional participation is higher. Many analysts also believe that large corporate movements are increasingly viewed as neutral rather than threatening. Internal reorganizations have become common as companies adopt more professional custody systems, diversify their wallet structures and integrate digital assets into daily operations.

SpaceX’s Bitcoin transfers may look dramatic, but on-chain evidence suggests a routine reorganization rather than a sale. The company still controls more than 7,200 BTC, and none of the recent transactions indicate that these holdings are being liquidated. Instead, the movements highlight how major firms manage digital assets during periods of growth and rising valuations. As Bitcoin becomes more common in corporate treasuries, such internal adjustments may become part of normal financial operations.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.