Key Takeaways

-

Solana and XRP ETFs are outperforming because they represent reliability during market stress.

-

Solana benefits from real usage, strong performance metrics, and system stability.

-

XRP benefits from regulatory clarity, predictable behavior, and institutional payment use cases.

-

ETF buyers are signaling a shift toward fundamentals-driven crypto allocation.

-

This trend may shape how future multi-chain ETF portfolios are constructed.

A sharp crypto market decline usually sends nearly every major asset downward together. But this time, something different is happening. ETFs tied to Solana (SOL) and XRP are continuing to attract inflows even while the rest of the market struggles. This contrast has caught the attention of analysts, institutions, and retail investors who want to understand why these two assets are defying broader market weakness.

Instead of focusing only on price charts, this analysis looks deeper into investor psychology, network fundamentals, and long-term structural trends. Solana and XRP are proving that during uncertain periods, investors do not retreat from crypto entirely they simply become more selective. Their choices reveal which networks are seen as reliable, resilient, and capable of holding value in difficult market conditions.

XRP’s Stability and Regulatory Clarity Make It Attractive to ETF Investors

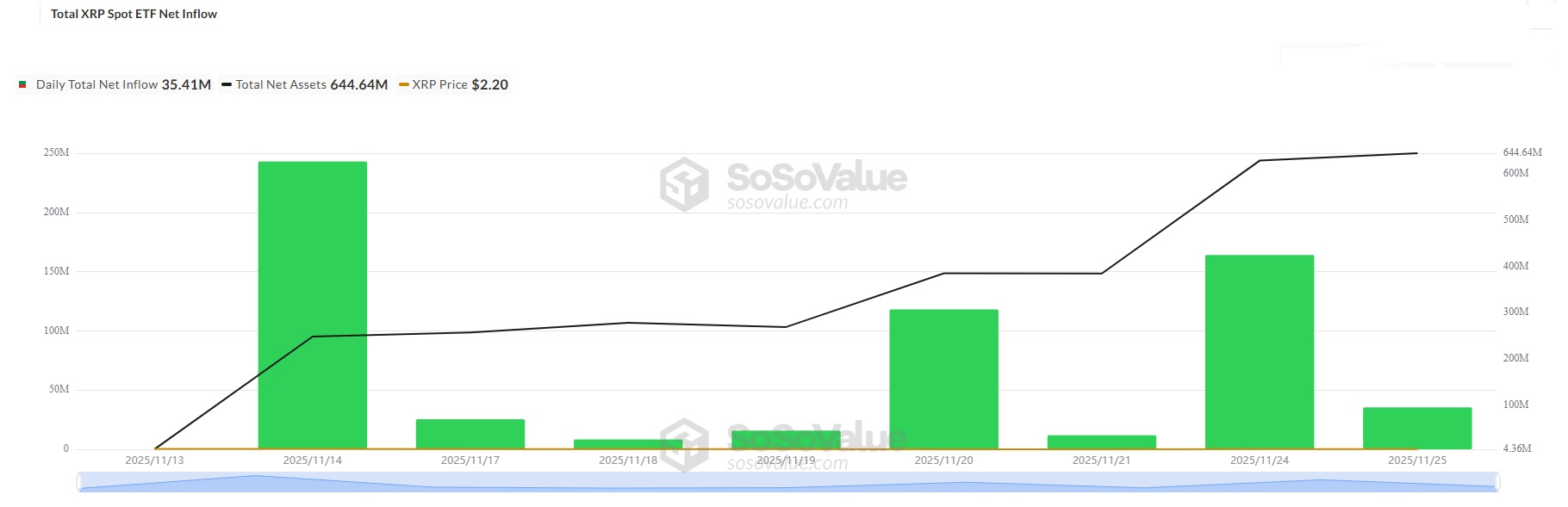

XRP’s new ETF had a very strong start. It brought in about $250 million on its first day, the biggest ETF launch of the year. It continued to attract steady investment for six days in a row. The fund’s total value had grown to $644.64 million, even though XRP itself was priced at only $2.20.

One major reason for XRP’s strong performance is its clear legal status. A previous court ruling said that XRP’s public, or “programmatic,” sales are not considered securities. This gives XRP more regulatory clarity than many other cryptocurrencies. Because of this, ETF issuers and large investors feel more comfortable dealing with it, since they must follow strict rules.

XRP also stands out because it has real-world use cases. Ripple’s payment technology is used by financial institutions that want faster and cheaper international payments. Even when the crypto market slows down, the need for reliable global payment systems remains. This ongoing utility helps XRP stay more stable than tokens that rely only on speculation.

Another benefit of XRP ETFs is how XRP behaves in the market. It often moves differently from other altcoins during market ups and downs. This makes it helpful for diversification. For investors looking to lower risk and manage volatility, XRP offers a level of stability that is rare in the crypto space.

Solana’s Rebound Story Has Become a Source of Confidence

Solana showed a similar trend. Its ETF saw several days where $50–70 million flowed in, along with smaller but steady investments on other days. Because of this, the ETF’s total value has grown to $888.25 million, even though SOL is trading at around $137 in a cautious market.

Solana’s strong ETF performance is linked to its major network comeback. The blockchain was once criticized for shutting down often, but it has now spent more than a year running smoothly without interruptions. It also handles a huge number of transactions. This stability has changed how institutions view Solana, making it a trustworthy platform for fast, high-performance decentralized applications.

Another reason investors stay interested is Solana’s active community. Even when the market is uncertain, Solana continues to see high transaction numbers and strong activity in DeFi, NFTs, and blockchain gaming. This steady usage shows that the network is truly valuable to real users not just traders. Solana ETFs also benefit from the blockchain’s speed and low transaction costs. These advantages make it attractive to developers and organizations that need fast, scalable systems. For long-term ETF investors, Solana’s mix of stability, real user activity, and strong technology creates a compelling story that’s hard to overlook.

When markets decline, the behavior of ETF buyers becomes easier to understand. These investors typically focus on assets that can endure a difficult environment, not just surge during positive cycles. They look for reliability, clarity, and strong underlying technology.

The strong performance of Solana and XRP ETFs shows that even in a shaky market, investors are choosing networks with real strengths, clear regulations, reliable technology, and active user bases. Instead of walking away from crypto, they are becoming more selective, focusing on assets that can survive volatility and deliver long-term value. This shift signals a maturing market where fundamentals matter more than hype.

As investors move toward more reliable and utility-driven assets, do you think this marks the beginning of a long-term change in how people choose which cryptocurrencies to trust?

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.