Japan-based Bitcoin treasury firm Metaplanet faces heavy selling pressure as global financial giants increase their short positions. UBS has joined Morgan Stanley and other institutions in betting against the company, triggering a steep drop in its stock price below 600 JPY on Monday.

Rising Short Interest from Global Firms

UBS AG has opened a fresh short position of 7.31 million shares in Metaplanet. This adds to a growing list of financial institutions that see further downside in the stock.

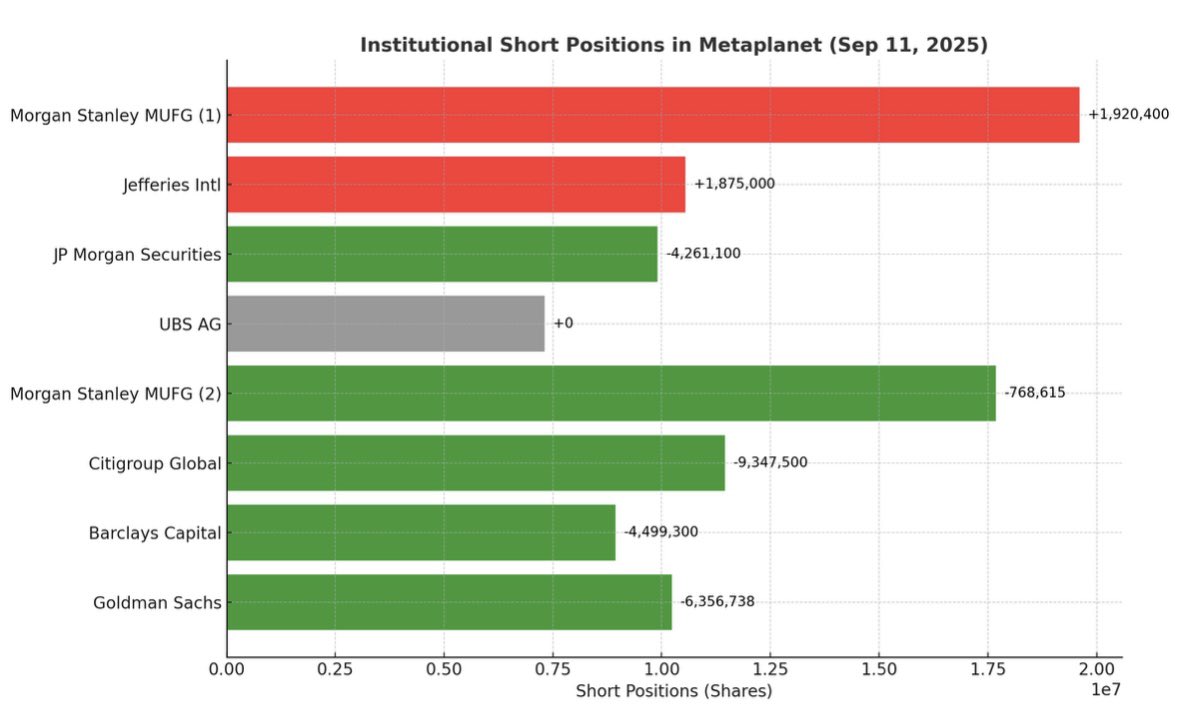

Morgan Stanley MUFG remains the largest short holder with 20 million shares. The firm expanded its exposure last week by adding another 1.92 million shares. Data also shows a separate Morgan Stanley trading desk holding 17.68 million short shares, though with a slight reduction of 768,000.

Institutional Short Positions in Metaplanet

Jefferies International holds the second-largest short position, currently standing at 10.54 million shares. It recently increased its position by 1.88 million shares.

Other large institutions have also entered the trade. JPMorgan Securities, Citigroup Global Markets, Barclays Capital Securities, and Goldman Sachs all maintain short positions. However, Goldman Sachs, JPMorgan, Citi, and Barclays have begun to scale back their exposure, signaling a cautious shift.

The accumulation of short interest suggests that large investors expect Metaplanet’s shares to fall further. Concerns about equity dilution from the company’s ongoing fundraising efforts appear to be driving much of the bearish outlook.

Share Price Under Heavy Pressure

Metaplanet’s stock dropped 8.37% on Monday, closing at 591 JPY. It marked the first time since May that the stock closed below the 600 JPY level. The day’s trading range showed volatility, with a low of 546 JPY and a high of 612 JPY.

According to Yahoo Finance, the company’s shares have fallen 39% over the past month. Its year-to-date return is now 69%, sharply down from earlier highs. In the United States, Metaplanet’s over-the-counter stock under the ticker MTPLF has mirrored the decline. MTPLF slipped 8.90% last week and is down nearly 28% for the month. Its year-to-date gain now stands at 91%, down from more than 510% earlier this year.

The timing is critical for Metaplanet, which is currently in a silent period until September 17. During this time, the firm is not making public statements or engaging with shareholders. Once the period ends, management plans to address questions and outline next steps.

Metaplanet is pushing ahead with its Bitcoin-focused strategy despite market skepticism. The firm intends to raise $1.4 million through equity sales to increase its Bitcoin holdings. Its target is to accumulate 30,000 BTC by the end of 2025. However, raising funds by selling new equity risks diluting existing shareholders, further fueling bearish bets.

Despite Bitcoin’s price rising above $116,000, Metaplanet’s stock has failed to capture upside momentum. Investors remain cautious about its aggressive Bitcoin treasury plan while institutional short sellers continue to weigh down sentiment.

Metaplanet stands out as one of the few Japanese firms embracing Bitcoin as a core asset. Yet with UBS, Morgan Stanley, and other major institutions deepening their short positions, the company faces mounting pressure both in Tokyo and abroad.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.