A VanEck Crypto ETN is an exchange-traded note, a debt security that tracks the performance of a specific cryptocurrency, like Sui or Pyth, without owning the underlying asset. For example, the VanEck Sui ETN, listed on Euronext, mirrors the MarketVector Sui VWAP Close Index, fully collateralized by SUI tokens held by a custodian like Bank Frick in Liechtenstein. This got social media buzzing at the time of launch –

🚀 VanEck Launches SUI ETN Across 15 European Countries! 🌍

VanEck expands its European strategy with a new SUI-based ETN, giving investors access to the rapidly growing blockchain network 🌐. With SUI’s recent price surge 📈, this move comes at a perfect time! 💥 Is SUI on… pic.twitter.com/nbkBxrVfyL

— Crypto B 👑 (Never DM first) 🇧🇷 (@TheCrypto_B) November 21, 2024

Unlike direct crypto ownership, ETNs trade on stock exchanges, offering liquidity and accessibility. VanEck’s ETNs cover assets like Solana, Chainlink, and Pyth, catering to investors seeking exposure without managing wallets or private keys.

ETN vs. ETF – Key Differences

An ETF (exchange-traded fund) is an investment vehicle that holds a basket of assets, like stocks or cryptocurrencies, and issues shares representing ownership in those assets. For instance, VanEck’s Bitcoin ETF (HODL) holds actual Bitcoin, and investors receive periodic dividends. In contrast, a VanEck’s Crypto ETN is an unsecured debt note promises to pay returns based on the performance of an underlying crypto index, like the Pyth Network’s token price, at maturity or upon sale. ETNs don’t hold assets, so returns are a single payout, not dividends.

Benefits of ETNs

- Precise Tracking – ETNs track their index point-for-point, avoiding tracking errors common in ETFs due to management fees or rebalancing.

- Tax Efficiency – ETN payouts are taxed once upon sale, unlike ETFs’ taxable annual dividends. –

- Accessibility – Investors can buy ETNs via traditional brokerage accounts, bypassing crypto exchanges.

Risks of ETNs –

- Credit Risk – Since ETNs are debt instruments, investors rely on VanEck’s creditworthiness. If VanEck defaults, investors could lose their investment.

- No Asset Ownership – Unlike ETFs, ETN holders don’t own the underlying crypto, missing out on potential airdrops or staking rewards.

- Volatility – Crypto ETNs are tied to volatile assets, amplifying risk. Recent Developments

Should You Invest?

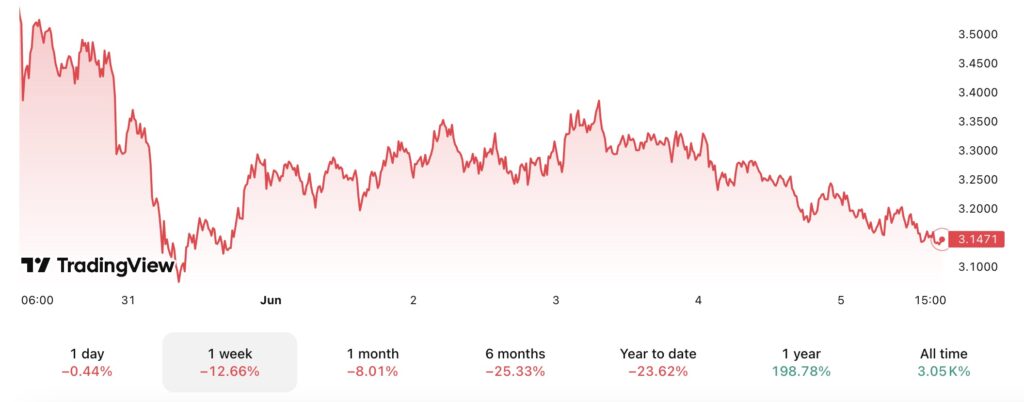

VanEck’s Crypto ETNs offer a compelling way to gain crypto exposure with lower fees and exchange-traded convenience. However, the lack of asset ownership and reliance on VanEck’s solvency are significant risks. Crypto’s volatility, with Sui dropping 10% from its high, adds uncertainty.

Source: TradingView

FAQs –

1. What is a VanEck Crypto ETN?

An Exchange-Traded Note (ETN) is a debt security issued by VanEck that tracks a crypto’s price (e.g., Sui or Pyth) without owning it. It trades on exchanges like Euronext, offering crypto exposure via brokerage accounts.

2. What is the MarketVector Sui VWAP Close Index?

This index tracks Sui’s price using a one-hour Volume-Weighted Average Price (VWAP), calculated as (Sum of Price × Volume) / Total Volume. It ensures a fair, manipulation-resistant benchmark for VanEck’s Sui ETN.

3. What is an ETF?

An Exchange-Traded Fund (ETF) holds assets (e.g., Bitcoin in VanEck’s HODL ETF) and issues shares representing ownership.

4. How do ETNs differ from ETFs?

ETNs are debt notes tracking an index, with credit risk if VanEck defaults; ETFs hold assets, offering ownership but with tracking errors.

5. What does fully collateralized mean?

VanEck’s ETNs are backed 100% by the crypto held by a custodian like Bank Frick, adding security but not eliminating credit risk.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.