What I Learned After One Year of Trading Cryptocurrencies

Like many others, I was attracted to cryptocurrencies in hopes of making money and retiring early. Instead, my stress increased and I gained some valuable lessons in human behavior.

I jumped into the crypto rabbit hole one year ago and have since invested a lot of time into reading dense white papers, learning technical analysis (TA) and grasping the basics of market psychology. In the process I made all of the classic mistakes — I blindly followed certain traders, fell for scams, lost money, and didn’t sell when I was profiting, greedily hoping the price would rise infinitely to the moon.

Ultimately these mishaps pushed me towards painful self-reflection and led me to join a community where I could get feedback and learn from people more experienced than myself. After several setbacks, one year later I’m still in the game and making steady progress.

What fascinates me about cryptocurrencies is that they have opened up investment and speculation to virtually the whole world. As long as you have decent internet, you can connect to thousands of projects, participate in a vibrant community, and make money.

You can also get scammed, lose all of your money, and develop an unhealthy addiction to checking price action. Given that gaming addiction was recently listed an official psychiatric (addictive) disorder, I wonder whether all of us playing around with our crypto tokens might be one day diagnosed with similar issues. I hope not.

There are many people I know that have been trading since 2013, so my year of trading may seem short in comparison. However, I’ve face-planted many times along the way, and my hope is that at least some of my lessons learned will be valuable for other traders.

I. How to Manage your Dr. Jekyll and Mr. Hyde

“With every day, and from both sides of my intelligence, the moral and the intellectual, I thus drew steadily nearer to the truth, by whose partial discovery I have been doomed to such a dreadful shipwreck: that man is not truly one, but truly two.”

― Robert Louis Stevenson, Dr. Jekyll and Mr. Hyde

There are lots of natural insecurities, impulses, and tendencies that manifest in a high-stakes environment. It’s what happens when we let envy, greed and anger drive our decision-making. We can call these our animal instincts — this is our wild and irrational Mr. Hyde.

We also have another more analytical and rational side that allows us to deliberate by reason. This mode of thought gives us the power to plan for the future, control our impulses, and even to think numerically. This is the good guy — our much-coveted Dr. Jekyll.

The bad news is that, as we discover in the famous 19th-century novel, Dr. Jekyll and Mr. Hyde are the same people. We all have a bit of both personality in us, and unless we make a conscious effort to reason with our Jekyll, we’re prone to default into a Mr. Hyde.

The good news is that while we’re all slaves to this duality of thinking/being, we can train ourselves to be more rational — even though it may not feel natural at first.

The first step is simply recognizing some of the most common and strongest tendencies that we identify with. Indeed, since Mr. Hyde is arguably a more default or natural state of being, we have to vigilantly observe our natural behavior when, in this case, trading cryptocurrencies.

All of the mistakes I have made trading crypto — perhaps in life — have come down to letting my emotions get the best of me. Here are some the traps that I’ve personally fallen into:

- “If I don’t have absolute control over the situation, then nothing will be ok.” = Controlling behavior will result in constant over-checking of daily price swings.

- “Even a small loss equals a massive failure.” = A strong aversion to loss will result in smaller trades.

- “It’s either go big or go home.” =A strong tendency for risky behavior result in big losses/total wipe-out.

- “I can skim over the details and things will work out.” = Winging it leads to not planning your entry and exits on trades.

- Lots of fingernail biting = even more, fingernail biting.

How do we overcome some of these natural human tendencies, bad habits and develop our Dr. Jekyll?

Step 1: Spend Time Developing Mental Models

Unless we have trained our minds to think in a certain way, we will automatically default into whatever habit-pattern is convenient or available. Psychologists call this the ‘availability heuristic.’

Take time to understand the various mental models that exist. Each model is like a different pair of glasses — if you only have a blue pair of shades, your entire world will be tinted in blue. When you try and have a conversation with someone wearing a red pair of glasses, there’s going to be a fundamental lack of understanding.

The greater your collection of glasses, the greater variety of shades you will be able to interpret the world, and the more angles you’ll be able to tackle a problem.

The book by Mark Douglas, Trading in the Zone (thanks Chris Dunn for the recommendation!) helped me reframe my thinking in terms of probabilities (life is a lot like poker) when I was first starting out, and I have since revisited it several times.

While the book is a bit dated and deals mostly with stock trading, the concepts have more to do with managing oneself and thus equally apply to cryptocurrencies. The book helped me identify many of my own mental biases and is full of powerful lessons:

“A probabilistic mind-set pertaining to trading consists of five fundamental truths: 1. Anything can happen. 2. You don’t need to know what is going to happen next in order to make money. 3. There is a random distribution between wins and losses for any given set of variables that define an edge. 4. An edge is nothing more than an indication of a higher probability of one thing happening over another. 5. Every moment in the market is unique.” — Mark Douglas

Step 2: Patience is a Virtue

Give yourself ample time to reflect and strategize before making a trade. In anticipation of doing or having something pleasurable — like making a kickass trade — the neurochemical dopamine is released. During this process, the areas of your brain that are responsible for complex planning and prediction (namely the pre-frontal cortex) are hijacked.

The fact that you wait means you are giving your brain a chance to return to a baseline point where you’re able to engage in complex and abstract thought processes.

While hasty decisions lead to poor trades, waiting a bit longer gives our Dr. Jekyll time to do his work.

Nowadays I always give myself at least a day before entering a trade — this gives me leeway to actually create a plan, rather than jumping in unprepared.

While some might think a day is too long to wait, the number of times where I regretted making a trade was much higher than the times I regretted not making a trade. Besides, if a coin is breaking out it usually makes a 1-2-3-4 breakout pattern, so you can usually get in on the next dip anyways.

Step 3: Body, then Mind

Taking care of your body will help you make better decisions in life, so this is a given for trading too.

Dialectical Behavior Therapy teaches the importance of doing incredibly simple things to avoid acting during a state of emotional over-arousal — this might involve deep breathing, taking a walk in nature, engaging your senses (hot shower, ice on hand, smelling a flower) and so forth.

After 30 minutes of sitting 90% of your metabolism slows down. Simply standing up and walking for 5 minutes restarts it. It’s so simple that it’s absolutely dumb not to get off your butt every few minutes.

Personally, I meditate, exercise and have a daily sauna session that essentially washes away my stress so I can make better decisions. It doesn’t matter what exercise you do, just do something.

This is pretty basic stuff, I know, but it’s easy to lose track of things when you’re caught up in the grind and selling off your body heat to bitcoin miners (foreshadowing of a Matrix apocalypse?)

In summary:

- Spend time developing mental models.

- Give yourself some breathing room before making a trade (a day or more).

- Take care of your body and your mind will be sharper, leading to less emotional trading.

II. The Four Steps of a Trade Setup

“I will prepare and some day my chance will come.”

― Abraham Lincoln

Now that we’ve covered the basics of handling emotions and good decision making, let’s take a look at one way to conduct an analysis before executing a trade, whether that’s a shorter or longer-term investment.

- Fundamental Analysis

- Technical Analysis

- Market Sentiment Analysis

- Self-Analysis

When we are highly optimistic and impulsive by nature (like myself), we might do our research on a project like Cardano (ADA) and conclude that it is undervalued.

When we see the price rising, without creating a plan we jump into to buy, ignoring other important factors like its correlation to bitcoin, the current market sentiment, its market capitalization, and our recent successful trade that has left us feeling lucky— all factors that could be relevant for our trading strategy.

Sometimes we’ll get lucky, other times we won’t.

We will all have strengths and weaknesses. Some may gravitate towards the bigger picture, like market/fundamental analysis, while others will be more drawn to the TA.

You might even feel like you have an ‘edge’ over others because of a particular strength you have. Good. But simply picking and choosing only one of the above strategies you like or are skilled at leaves you susceptible to large blind spots.

The point: We can still maintain our edge but we can’t ignore the other factors!

#1 Fundamental Analysis

Fundamental analysis is research on the viability of the project, engagement of their community (on Slack/telegram/discord/etc) adherence to development schedule (perhaps on Github), white-paper, and their team. Like an angel investment, you are trying to measure the intrinsic value of something that has a statistically high chance of going bust. Here’s a good guide on this.

I spend at most 2–3 hours on fundamental analysis. I’ll also ask people I trust that what their thoughts are on X project, and add that into my mix of considerations, keeping in mind that everyone has their own view.

Where it falls short: Let’s take the BABB project for example, which is a centralized blockchain-based ‘bank account’ based out of London. Cool concept, though if you are to compare the team to an “all-star” one like Beetoken, one might decide to not invest in BABB purely on this basis — or at least mark them down a couple of points in your mind.

Yet when BABB had their ICO, the token started trading at around triple the ICO price. Some might think that’s not very much. It’s funny because the crypto markets are the only markets in the world where you can feel salty and bitter because you only doubled or tripled your money, but didn’t 10x it. Kind of crazy isn’t it?

My point is that while fundamental analysis is certainly important, we can still get a winning coin and make a profit even if the project doesn’t rate 5 out of 5 stars.

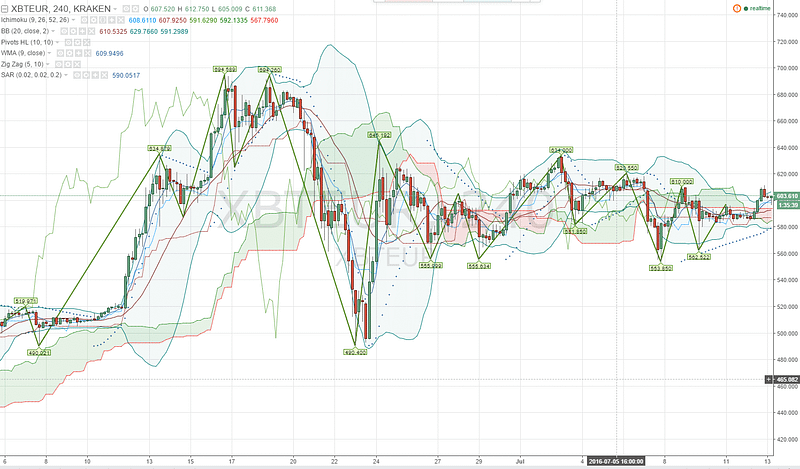

#2 Technical Analysis — Beware of Analysis Paralysis

Whether you are trading cryptocurrencies frequently or investing in blockchain projects for the long term, once you get the fundamentals of buying/selling, it’s really not that complicated.

I remember reading a 90-page PDF about the history, theory and practical applications using Fibonacci numbers. It was fascinating to get some background and it’s an important tool to have in the toolshed.

But I was able to learn the practical application for the tool in 20 minutes from a YouTube video and then watching other traders.

Day traders spend an inordinate amount of time looking at charts, checking their phones and trying to make small gains here and there. It can lead to over-complicating things, and not to mention an unhealthy lifestyle. There’s been at least one story of a bitcoin investor who committed suicide.

Of course, having a basic grasp of technical analysis is still important (H&S, flags, wedges etc). You can analyze the crap out of a chart, draw a million lines on it and make it say whatever you want it to say. You can run Fibonacci extensions a dozen ways, stare at logarithmic scales and convince yourself that a certain coin is going to the moon sometime in the not-to-distant future.

Like using KPI’s in the business world, technical analysis is largely comprised of indicators, not ultimate truths. Forecasting is as much of a science as it is an art. Especially in retrospect, when a coin does well, you can use this to justify your superb technical skills.

The best traders I have spoken to might only execute a couple of trades per month and are extremely selective about setting up trades. Rather than trying to catch each tiny ripple (no pun intended), they focus on catching the big waves.

The hardest part about all of this is not analyzing charts, it’s not over-analyzing them, as this can lead to over-trading and regrets. There are so many examples of people who could have done nothing and made significantly larger gains.

In other words, after you learn the basics, keep things simple with the charts.

#3 Market Sentiment — “The Trend is Your Friend”

“You want to be greedy when others are fearful. You want to be fearful when others are greedy. It’s that simple.” — Warren Buffett, founder of Berkshire Hathaway

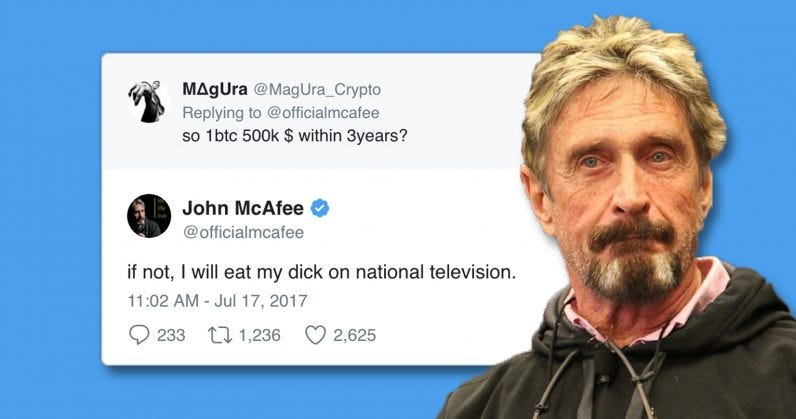

It’s easy to get caught up listening to people who are so die-hard about a cause and willing to go great lengths to prove their loyalty. It’s also tempting to follow the coins they’re shilling on Twitter.

The wave of bitcoin maximalists who support the libertarian dream says “HODL your coins because the price will go up,” as if they have a crystal ball. Over the long run, they may be right. In fact, I’m very bullish on a lot of projects myself, especially when it comes to 5– 10 years time frames.

However, many people enter the market as traders looking to make shorter to mid-term gains. Many are trying to pay the bills, in which case ‘infinite gains’ and ‘hope’ are not good strategies.

“Never ask anyone for their opinion, forecast, or recommendation. Just ask them what they have — or don’t have — in their portfolio.”

― Nassim Nicholas Taleb, Antifragile: Things that Gain from Disorder

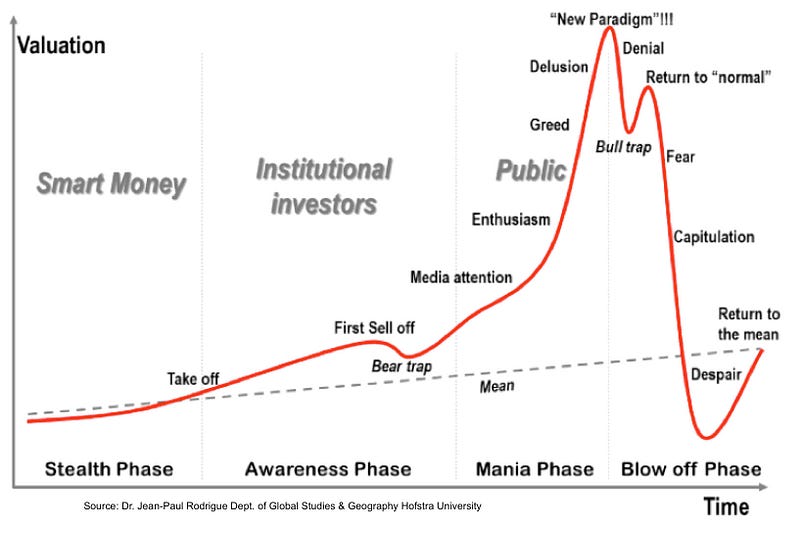

All markets follow cycles. Whether that’s bitcoin, stocks, real estate, commodities — you name it.

Ignoring market cycles results in grabbing whatever coin and then watching the price plummet — forcing you to “bag hold” — holding those precious coins with dear life in hopes that they will go up in value. I made this mistake, too.

This hysteria was at its worst (so far, but will undoubtedly repeat) back in December/January. The media entered the picture, we had mass euphoria (bitcoin to 100k!), and everybody was buying bitcoin at 20k before it crashed.

The best traders I know look at the larger market cycles, gauge market sentiment, and do the opposite of whatever CNBC is saying you should.

Don’t mistake a “cyclical trend” as an “infinite direction.”

#4 Self Analysis — I am my own boss

There are two steps to this. 1) Making a plan. 2) Checking-in with yourself every week.

- Make a Plan, Stick with It

At one point I blindly followed a couple of traders that I respected. A coin they had suggested to buy absolutely tanked and it really ticked me off because I had chosen to follow their advice. Of course, I had no right to be upset. It was totally my decision and responsibility — only I was to blame.

It takes a lot more discipline, time and effort to make your own plan. This is also scarier because it means that you are ultimately accountable for both your gains and your losses.

I suggest keeping a trading journal where you can specify your reasons for entering the trade, defining profit targets, and answering difficult questions like “if the price of this goes down by 90%, what action will I take?”

Remember that “success” can mean different things to different people, but we have to define it and manage our own risks. What is your definition of success?

The saying in crypto goes, “I was a millionaire in January and broke in February!”

Another big mistake I made was trying to mold my own goals to the behaviors of the market. The problem is, the market doesn’t give a sh*t about your financial goals. I’ve found it’s better to not set monetary goals in terms of the specific $ amount that you want, rather, in terms of percentages (“take 50% of my profit from the position”).

We have to think in terms of probabilities, not in terms of exact, definite outcomes that are simply impossible to predict — that’s called “predicting the future.” One way is to measure risk-reward ratios, for example.

The larger point is that it makes more sense to focus on building the skills that will make it more probable to get to where you are going rather than getting too focused on a specific timeline and number. Skills, consistency and hard work will result in profits down the line.

#2 Weekly Performance Review

Success consists of going from failure to failure without loss of enthusiasm. — Winston Churchill

When you don’t have a boss looking over your shoulder or giving you a quarterly performance review it can be difficult to measure your progress. You are responsible for your own assessment. This is a blessing and a curse because it allows you for ultimate freedom but also no one to point a finger at but yourself.

The weekly self-check is a good practice to adopt. Ask yourself the following questions:

- Did I stick with my plan in my trading journal? Track your trades in an excel document — include entry/exit targets, reasons for buying, and profit targets. Review them and be honest with yourself, but don’t beat yourself up if you didn’t. There’s always the next trade.

- How do I feel? Have I given time to develop a mental/emotional strength? As discussed in the first section, make sure you’re taking time to stay healthy.

- What did I learn? What did you learn (like making a trade you regret) and how will you correct for it in the future? (For example, I would always check the price of a coin but I simply adopted using price alerts, stop loss and limit orders, which gave me a lot more room to breathe).

Get into a habit of using these 4 tools — even if you do so quickly it could save you a lot of time/money. Ultimately, there are black swan events like new government regulations or founders running off with money that would negate any of your analyses, so keep in mind that regardless of your investment it’s always vital to manage for downside risk — i.e, don’t put all your chips on the table in case you’re wiped out.

III. A Great Community is Worth the Money

The half-life of content is becoming increasingly shorter — that is, the accuracy of facts is decaying faster and faster. It’s becoming harder to keep up with the most relevant content as well as to find high-quality content. Not just that, it’s just simply hard to focus.

One day this problem will be solved, perhaps by flipping the incentives of the online advertisement model. That’s what Brendan Eich, the creator of Javascript, is trying to do with his blockchain startup Brave (BAT).

For now, the solution to nurturing high-quality content has been to create a paywall for users to join.

Whose advice would you trust more?

- A bunch of random trolls on Reddit

- Content created by a closed community of serious investors/traders that pay $100 monthly to be part of the group

Again, you should ultimately make your own investment decisions and not just follow others. However, being part of a group of likeminded individuals that are paying good money is usually a testament to their seriousness. This allows you to gain access to more thoroughly researched content, crowdsourced technical analysis, as well as an opportunity to talk with successful traders. Shadowing a mentor can be very useful, too, until you are confident enough to trade on your own.

Becoming an accredited investor would allow you to gain access to exclusive crypto projects on Coinlist, but this is out of reach for me and most people considering the minimum net-worth requirements. Being part of a paid community, online or offline, or finding a great mentor is your next best option.

Surround yourself with people smarter than yourself. It is worth the investment and can eventually have a much greater pay-off, both knowledge-wise and financially.

IV. Lastly, Don’t Let the Bad Apples Put you Down

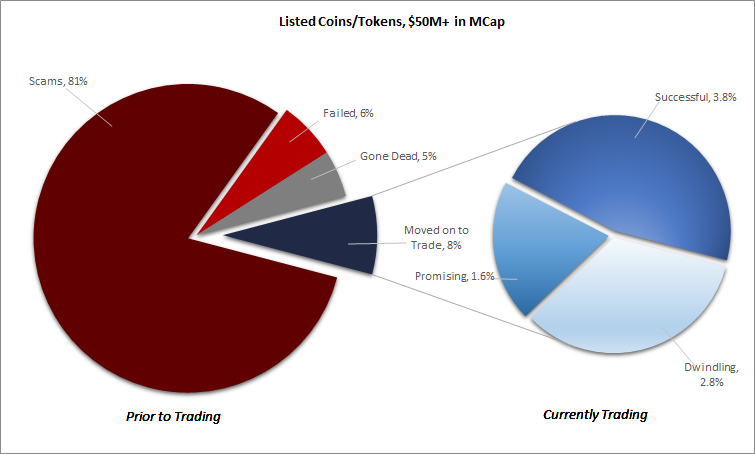

A recent study found that over 80% of ICO’s either haven’t delivered on a product or were flat-out scams.

Caught up in the exuberance of making “big gainz,” I’ve fallen prey to scams myself twice — as if I didn’t learn my lesson the first time.

I remember on one occasion there was a pre-sale for the Quantstamp ICO that claimed to be closing in 24 hours. I did a poor job of due diligence and rushed to buy, sending over one ether (I always only send a small amount first but was still like $400), convinced that time was running out.

Scammers are smart. They had replicated the real website almost exactly but had simply changed the URL to quantslamp, with an L. Considering my impatience and lack of attention to detail, I fell for it.

I’ve spoken to many crypto traders who have gotten duped for much more. Some have been pretty much wiped out. Many gave up, but others took their loss to heart, learned from their mistakes and started small again, often succeeding in rebuilding their portfolios.

What I learned: There will always be bad actors trying to take something from you— your time, money, well-being. Manage your risk wisely but don’t give up after a couple of negative experiences. Perhaps more importantly, don’t give up before even trying.

To summarize…

- Be vigilant of your emotions and impulses — your Mr. Hyde will come out so you want to be prepared.

- Learn about mental models, trading psychology, and spend more time on mental/emotional health.

- Keep a trading journal and be patient. It only takes one or two big trades to make significant gains in this market.

- Use these 4 steps to assess a trade or investment — fundamental, technical, market and self-analysis.

- Manage your risk and don’t get wiped out. Take profits off the table and never regret a trade.

Online Tools & Resources

- Coinigy — for charts and TA

- Coinwink — for trade alerts

- Coinmarketcal— news events, tech releases, ico’s, meet-ups

- Coinrank — analysis of crypto projects through data science

- Protonmail — encrypted email

- Jameson Lopp — everything you need to know about bitcoin

Add a comment

You must be logged in to post a comment.