In simple terms, yield farming means putting cryptocurrency to work in order to earn more crypto. Instead of leaving coins idle in a wallet, they can be deposited into decentralized finance (DeFi) platforms where they earn rewards. These rewards may come as interest payments, fees from trading activity, or special tokens given out by the platform. Normally, this process requires moving funds between different platforms like Uniswap, Aave, or Compound to chase the best returns. However, doing this by hand can take time, involve high transaction fees, and increase the chances of mistakes. That’s where Yearn.Fi enters the picture.

What Is Yearn.Fi?

Yearn.Fi is a DeFi aggregator launched in 2020. It was designed to make yield farming easier for everyday crypto users. Instead of constantly shifting assets between platforms, Yearn automates the process. This means the system itself searches for the best opportunities and moves funds accordingly. The main feature of Yearn is its “yVaults.” These are smart contracts that hold user deposits and follow pre-programmed strategies. For example, one vault may lend assets on Compound, while another may use Curve or Balancer. The goal is always the same: earn the highest possible annual percentage yield (APY) while minimizing unnecessary costs.

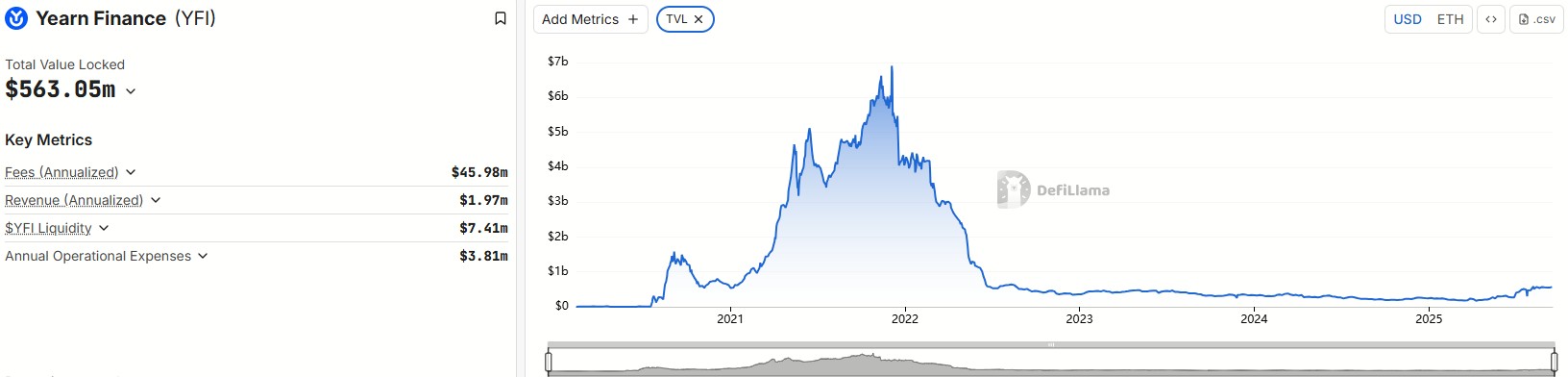

As of September 2025, Yearn.Fi manages more than $450 million in locked funds, according to DeFiLlama. Many stablecoin vaults earn between 5% and 15% APY, making them attractive to investors looking for steady growth.

Getting started with Yearn is relatively simple. A user connects a crypto wallet such as MetaMask to the Yearn website, chooses a vault, and deposits funds. From there, the vault automatically carries out strategies, collects rewards, and reinvests them. The only fees are a small cut of the profits, often around 2%, which helps maintain the platform. The benefit for users is clear, less time managing funds, fewer gas fees wasted on transactions, and strategies handled by automated smart contracts.

In DeFi, transaction costs and timing can make a big difference. Switching from one protocol to another manually may mean spending more on fees than is earned in rewards. By using automation, Yearn keeps these costs low and ensures opportunities are captured quickly. Recent upgrades to the platform, such as ERC-4626 compliant V3 vaults, have made it even easier to move assets with fewer steps. Layer-2 integrations, such as those with Base, have also lowered costs to almost nothing sometimes under $0.01 per transaction.

While Yearn.Fi simplifies DeFi, it does not remove all risks. Smart contract vulnerabilities are always a possibility, as shown in past incidents across the wider DeFi space. To address this, Yearn has undergone multiple audits and maintains a $10 million insurance fund to help reduce potential losses from exploits. Other risks include market downturns, impermanent loss in liquidity pools, and occasional withdrawal delays that may last up to 48 hours. For this reason, beginners are encouraged to start small, diversify across different vaults, and learn how each one works before committing larger amounts.

The Role of YFI Governance

Yearn has its own governance token, YFI, with a fixed supply of 36,666 tokens. Holders of YFI vote on upgrades and changes to the system, keeping development community-driven. This token has seen strong performance in 2025, trading at over $5,300 in September, reflecting renewed interest in automated platforms. Governance decisions have shaped many improvements, such as reducing fees, launching new vault strategies, and introducing AI-powered previews. This shows how active participation from the community helps Yearn remain competitive in the fast-changing DeFi sector.

For those exploring Yearn.Fi for the first time, conservative strategies are often the best entry point. Stablecoin vaults, such as those for USDC or DAI, typically provide steady returns without the wild price swings seen in riskier tokens. Over time, more adventurous users can try vaults tied to assets like ETH or BTC derivatives, which may offer higher yields but also carry greater risks. Tools like Zapper.fi can be useful for tracking investments and understanding exposure across multiple vaults.

Final Thoughts

Yield farming on Yearn.Fi is not a quick way to get rich, but it is a practical system for compounding cryptocurrency holdings over time. With automation handling the heavy lifting, users can participate in DeFi without needing to constantly monitor the market. As blockchain technology matures and transaction costs continue to fall, Yearn.Fi is likely to attract even more participants worldwide. For beginners looking to explore DeFi safely, it offers an accessible, efficient, and well-structured path to earning passive income.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.