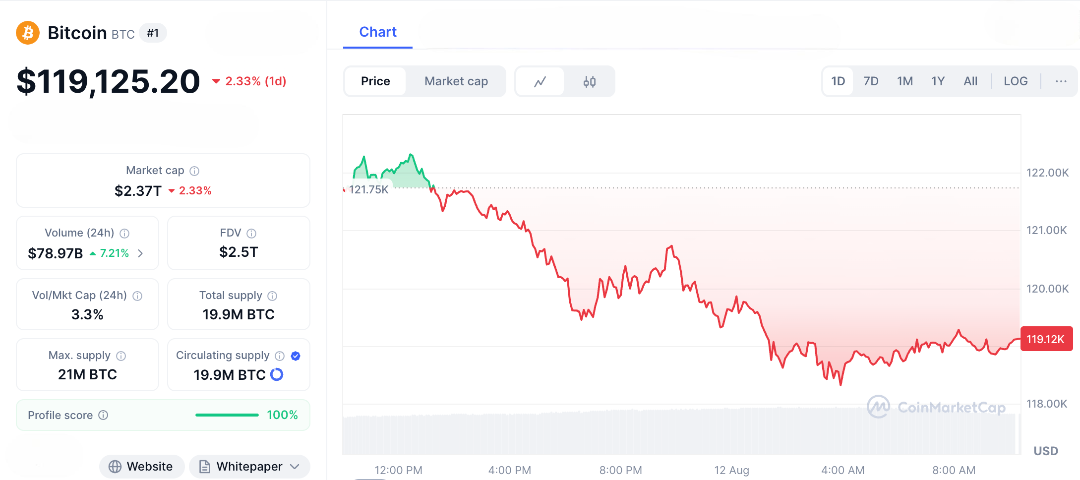

As of August 12, 2025, the crypto market is experiencing a slight downturn. Bitcoin has dipped by about 2.33%, sitting near $119,125 after briefly surpassing $121,000. This drop is reflected in the overall market, reminding us that even with big banks and institutions involved, the crypto world remains unpredictable. What’s causing today’s dip? It’s a mix of factors, including rumors about potential new regulations and sudden waves of trader liquidations.

In Asia, traders have been driving much of the recent surge in crypto prices, fueled by concerns over growing U.S. debt. They have been buying Bitcoin and Ether, pushing prices higher during the overnight hours. However, as the U.S. trading day begins, the situation changes. Wall Street wakes up, and many traders start taking profits, especially since Bitcoin nearly reached its all-time high.

This isn’t a dramatic crash like the one on August 6, when the market lost $83 billion in a single day because of tariff fears and weak economic data. But today’s pullback is still enough to make traders cautious. One of the main reasons for today’s dip is the lingering impact of global economic pressures. Last week’s U.S. jobs report showed signs of a slowing economy only 73,000 new jobs were added, and unemployment rose to 4.2%. That’s got investors worrying that the Federal Reserve might hold off on cutting interest rates, which puts pressure on riskier assets like crypto.

And then there’s the classic plot twist in the crypto story regulation fears. Remember when SEC crackdowns under Gary Gensler sent the whole market into panic mode? Well, even though things have calmed down a bit and spot Bitcoin ETFs are now pulling in billions, the uncertainty hasn’t gone away.

Lately, there have been quiet murmurs from Washington about possible new rules for stablecoins and DeFi platforms. That’s enough to make big investors nervous, and when institutions start playing it safe, it often triggers a chain reaction. Just last week, analysts warned that changing regulations could even disrupt the traditional four-year Bitcoin cycle that’s shaped market trends for years. So, if you’re wondering Why is crypto down today? regulation worries are a big part of it. Even small dips can snowball when cautious “whales” start selling, pulling the rest of the market down with them.

Liquidation cascades can quickly turn a small market dip into a major plunge. In leveraged trading platforms like Binance or Hyperliquid, traders borrow large amounts to increase their bets. However, if prices fall below certain levels, these leveraged positions can be wiped out almost instantly.

Today, there have been over $53 million in Bitcoin short squeezes. On the other hand, if Bitcoin’s price drops below a key support level, long positions could also start getting liquidated. This creates a chain reaction: when one major trader gets a margin call and is forced to sell, it pushes prices lower, causing more margin calls for others.

This scenario has happened before. For example, in July, a big sell-off by a long-term Bitcoin holder caused significant market disruption. In early August, new tariffs from the Trump administration on countries like India and South Africa led to a “risk-off” wave, resulting in $908 million in liquidations in one day. Although today’s market drop is smaller, warning signs like a weakening 200-day moving average indicate that another major downturn could be coming.

Despite all the tension in the markets, there’s still a silver lining resilience. Bitcoin’s market dominance has slipped to about 60%, which suggests some investors are shifting their money into strong-performing altcoins, especially in areas like AI and real-world asset projects. Ethereum has also been flexing its muscles, recently touching price levels not seen since 2021 a reminder of the tech’s long-term potential. So, Why is crypto down today? In part, it could just be the market taking a breather after a massive liquidity surge fuelled by global money supply growth and ETF excitement.

BlackRock’s iShares Bitcoin ETF now holds more than 625,000 BTC, tightening supply while demand stays strong. Some analysts, like those at Standard Chartered, even predict Bitcoin could hit $200,000 by the end of the year if momentum keeps up. But, as always in crypto, volatility is simply the ticket you pay to be part of the ride.

Why Is Crypto Down Today? Understanding Market Fluctuations

From the chaos of the 2022 FTX collapse to today’s ETF-driven highs, one thing remains consistent: human nature. Greed drives market rallies, while fear prompts sell-offs. The smartest investors find opportunities even during chaotic times. If today’s market pullback deepens due to ongoing tariff tensions or cautious signals from the Federal Reserve, it might be the perfect chance to buy before the next surge.

Today’s crypto downturn is due to a mix of global market jitters, regulatory uncertainty, and high-stakes leveraged trading. However, history shows that these turbulent times often pave the way for even bigger upward trends. Stay alert and diversify your investments wisely. In the world of crypto, a dip today could lead to a major rally tomorrow. Whether you’ve perfectly timed a market bottom or missed a big opportunity, it’s clear that the market’s wild ride is far from over.

FAQs

1. What’s a crypto market dip?

A dip is a sudden price drop, often 10-20%, due to profit-taking, news, or economic shifts. It’s common in crypto’s volatile cycles.

2. Why is crypto down today?

Today’s dip is driven by profit-taking, U.S. economic concerns, regulatory uncertainty, and possible liquidation cascades.

3. What are liquidation cascades?

When leveraged trades are closed due to price drops, it triggers more sales, worsening the dip. Recent cascades hit $908M.

4. How do regulations impact crypto?

Regulatory uncertainty, like potential U.S. stablecoin or DeFi rules, can scare investors, causing sell-offs.

5. Should I buy during a dip?

Buying can work if you research and use dollar-cost averaging, but prices may drop further. Only invest what you can lose.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.