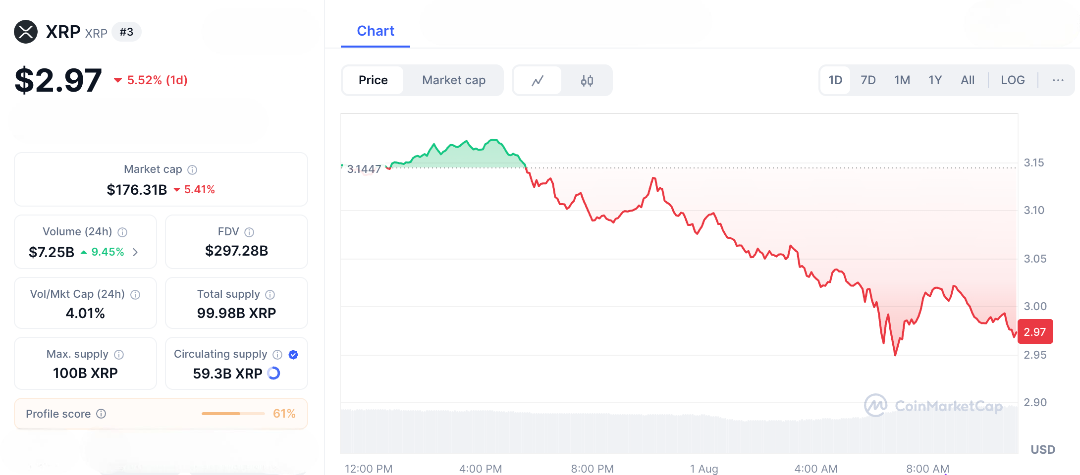

In the ever-turbulent world of crypto, where global events can toss prices around like ships in a storm, XRP is feeling the pressure again. As of August 1, 2025, It is down about 4.5%, trading near $2.85. The drop follows the Federal Reserve’s hawkish tone on interest rates and a wave of liquidations sweeping through the crypto market leaving investors uneasy and glued to their screens. As someone who’s lived through the adrenaline of bull runs and the panic of price crashes, I’ve seen it survive more than a few storms. It may come out of this one with a few bruises but possibly stronger.

This dip isn’t just a blip it’s a moment where global economic uncertainty collides with the long-term promise of blockchain. In group chats and trading forums, people are asking: is this just a healthy shakeout before the next rally, or the start of a deeper fall? If you’ve ever stared at a red chart, heart racing, unsure whether to sell or hold you’re not alone. Share this with your fellow hodlers, because XRP’s story today is one that might just echo far beyond the charts.

XRP Takes a Hit as Fed Stays Hawkish and Market Volatility Spikes

The Federal Reserve’s latest policy meeting didn’t bring surprises but it sure brought pressure. Interest rates were held steady at 4.25% to 4.5%, but Chairman Powell’s cautious tone and warnings about persistent inflation signalled no rate cuts anytime soon. That was enough to spook investors. Fears of tighter liquidity pushed people out of risky assets like XRP, sending them running toward safer bets. In just the past 24 hours, the crypto market saw over $629 million in liquidations, and it was a major part of that wave. As leveraged positions got wiped out, whales offloaded large amounts, adding even more weight to the sell-off.

To make matters worse, new U.S. tariffs on imports which kicked in today are fuelling fresh concerns about a trade war. That’s especially bad news for assets like XRP, which are closely tied to cross-border finance. Ripple’s token is built for fast international payments, and it tends to do well in calm, stable environments. But today’s market chaos has shown just how sensitive it can be to macroeconomic stress. After reaching recent highs near $3.05, it’s now slipped to around $2.97.

XRP’s Resilience Tells a Bigger Story

Yes, It is down today but there’s more to the story than just red charts. Despite the price dip, XRP’s real-world utility remains solid. It’s still moving billions through remittance corridors with near-instant, low-cost transactions. Partnerships with banks across Asia and Europe are growing, giving it a clear edge over slower legacy systems like SWIFT.

On-chain data shows that transaction volumes are holding steady, even as prices slip. Technically, what we’re seeing looks like a classic liquidation cascade the RSI has dropped to 28, which is considered oversold territory. If it can hold support around $2.70, there’s a good chance we could see a bounce. Analysts are already hinting at a “brutal flush” that wipes out weak hands and sets the stage for stronger gains especially if the Fed softens its tone or overall crypto sentiment improves.

And here’s a reminder from the past: It has seen huge rallies after similar macro-driven dips remember that 150% spike after the last inflation scare? So the question now isn’t just why XRP dropped, but what if things turn? If liquidations slow down and tariff concerns fade, It could climb back toward $3.20 rewarding those bold enough to buy when others panic.

XRP at a Crossroads: Crash, Comeback, or Caution?

This latest drop in XRP isn’t happening in a vacuum it’s a snapshot of the growing pains that come with crypto’s move into the mainstream, where global policy shifts can swing digital markets. With a market cap of $176 billion, It sits at the heart of this tension between bold innovation and heavy regulation. It’s already weathered major legal battles with the SEC, and now it’s navigating a storm of Fed rate signals and mass liquidations.

Crypto communities are hyping memes of XRP rising like a phoenix are flying around, and traders are posting charts that show potential recovery paths. It’s the kind of moment that can turn casual holders into die-hard fans. Just imagine the bragging rights: “I grabbed XRP at $2.97 during that flash crash and rode the rebound when the market turned.” But it’s not all hype. There’s still risk. If liquidations keep piling up or trade tensions worsen with more tariffs, It could slide further, testing key support around $2.50 a level that might shake the confidence of even long-term believers. So while the dip has created opportunity, caution is still key. This is one of those moments where the bold get in early but the smart stay alert.

Warning or Opportunity?

As the dust settles from today’s drop, It reminds us that crypto is a journey of highs and lows, where even a hint from the Fed can send shockwaves through the charts. Whether this dip is a golden buying opportunity or a signal to tread carefully, it’s a moment worth watching and sharing. Because in the ever-evolving crypto story, fortune favours the informed. Today’s XRP slide might feel like a setback, but it could also be the setup for tomorrow’s comeback.

FAQs

- Why is XRP down today?

XRP is down due to the Fed’s hawkish rate signals and over $629 million in crypto liquidations, amplifying selling pressure. - What is the current XRP price?

As of August 1, 2025, XRP trades around $2.85, reflecting a 4.5% daily decline amid market turmoil. - How do Fed signals affect XRP?

The Fed’s decision to hold rates at 4.25%-4.5% signals tighter liquidity, prompting investors to reduce risk in assets like XRP. - What role do liquidations play in XRP’s drop?

Massive liquidations unwound leveraged positions, with XRP hit hard as whales sold, exacerbating the price decline. - Could XRP recover quickly?

If liquidations subside and supports at $2.70 hold, XRP could rebound to $3.20, rewarding those who buy the fear.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.