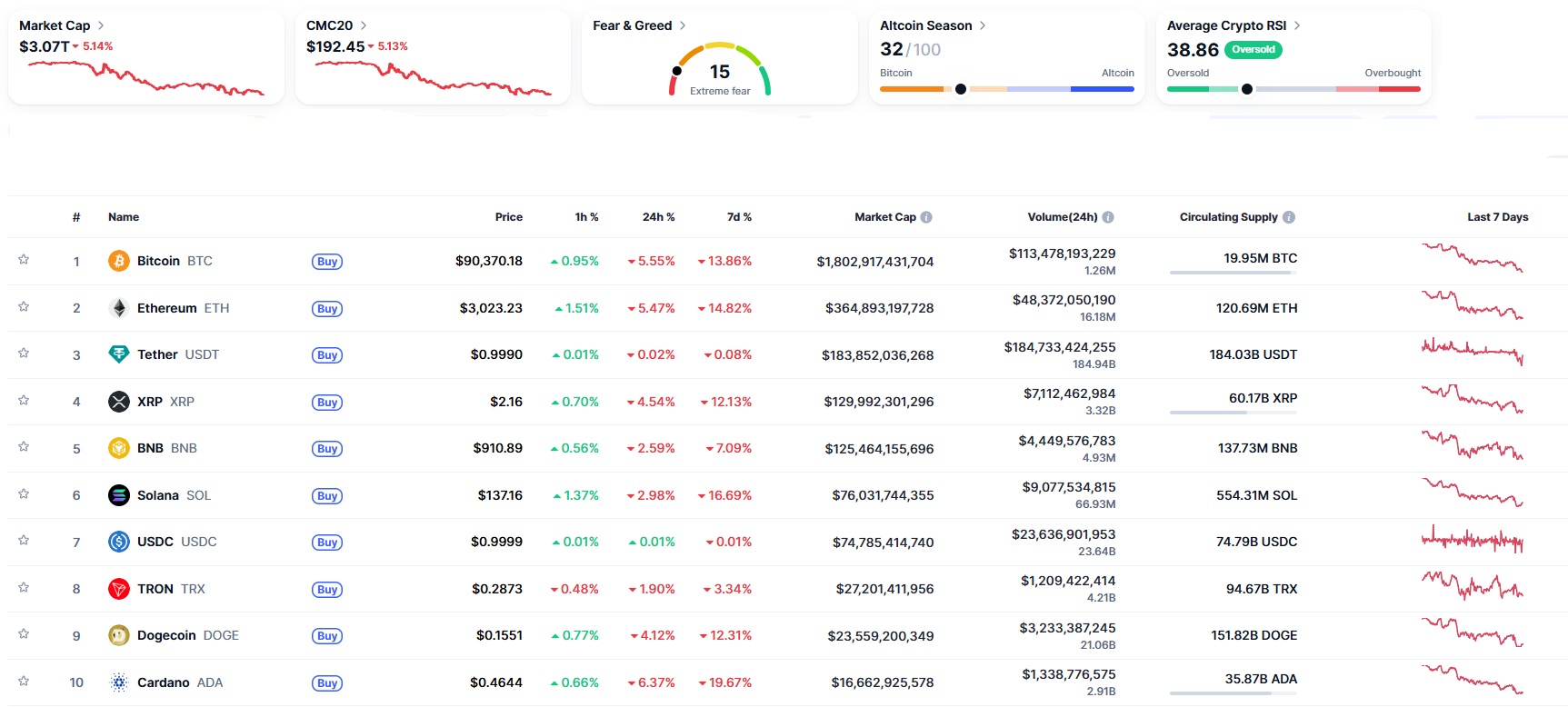

On November 18, 2025, Bitcoin’s price dropped to $89,673.47, the lowest it has been since April 2025. Just a few weeks earlier, in early October, it was trading above $126,000, so this is almost a 30% drop in a very short time. Other major cryptocurrencies also fell. Ethereum dropped about 6%, Solana fell 3.3%, Dogecoin slipped 4%, and XRP was down 5%. Because so many large coins fell at the same time, nearly $600 billion disappeared from the entire crypto market.

This sudden decline has changed investor mood very quickly. What was recently a period of strong confidence has now shifted into “extreme fear.” Many investors did not expect prices to crash so sharply, and the speed of the drop has caused a lot of stress and uncertainty across the market.

This isn’t just a normal price correction. The fall is tied to bigger issues, such as global economic challenges, weaker market liquidity, and a shift in how investors are behaving. Understanding these factors helps make sense of why the market dropped so fast and what could happen next.

Why the Crypto Market Is Down: The Main Reasons

A number of major forces are contributing to the drop, and each one plays a different role in pushing prices down.

Uncertainty About Interest Rates

One of the biggest influences is the global economic outlook. Many investors had expected the U.S. Federal Reserve to begin cutting interest rates soon. However, recent data shows inflation may not be easing as quickly as hoped. As a result, expectations for rapid rate cuts have faded. When interest rates are likely to stay high, investors usually avoid riskier assets like cryptocurrencies. This shift in expectations has created pressure on Bitcoin, especially after it failed to hold above the $100,000 level.

Low Liquidity and Cautious Buyers

Trading activity has slowed down noticeably. Liquidity meaning how easily assets can be bought or sold, has become weaker. When liquidity dries up, even normal selling can cause larger price drops. Both retail and institutional investors are participating less aggressively than before. With fewer buyers in the market, downward moves become sharper and harder to stop.

Part of the fall is being driven by automated liquidations. Many traders use leverage, meaning they borrow money to make larger bets. When the price of Bitcoin starts falling, leveraged positions are automatically closed to prevent further losses. These forced liquidations push the price down even more, creating a chain reaction. Once this spiral begins, the market can fall sharply in a very short time.

Weak ETF Flows and Institutional Retreat

Earlier in the year, spot Bitcoin ETFs helped support prices by attracting institutional capital. Recently, however, those funds have slowed or reversed, with outflows beginning to show up. This matters because institutions have become an important part of the Bitcoin market. When they step back or withdraw money, it sends a signal that confidence is weakening.

Investors around the world are becoming more cautious. With geopolitical uncertainty, unpredictable inflation trends, and mixed economic forecasts, many are avoiding high-risk assets altogether. In moments like this, cryptocurrencies tend to fall more sharply because they are viewed as more volatile.

The recent crash shows that Bitcoin and the broader crypto market are no longer driven only by excitement or new technology. They are now deeply connected to global economic trends, investor behavior, and overall market liquidity. A nearly 30% drop in Bitcoin, along with a $600 billion loss across the entire market, highlights how quickly conditions can change when confidence weakens. While long-term believers may view this downturn as part of a larger cycle, the truth is that the path forward depends heavily on what happens in the world economy. Whether the market stabilizes or continues to fall, this moment reminds everyone that crypto is not isolated from global financial pressures. Understanding these connections will be essential for making smarter, calmer decisions in the weeks ahead.

As the market adjusts to rising uncertainty, do you believe this downturn is a temporary reset or the start of a deeper shift in how the crypto cycle behaves?

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.