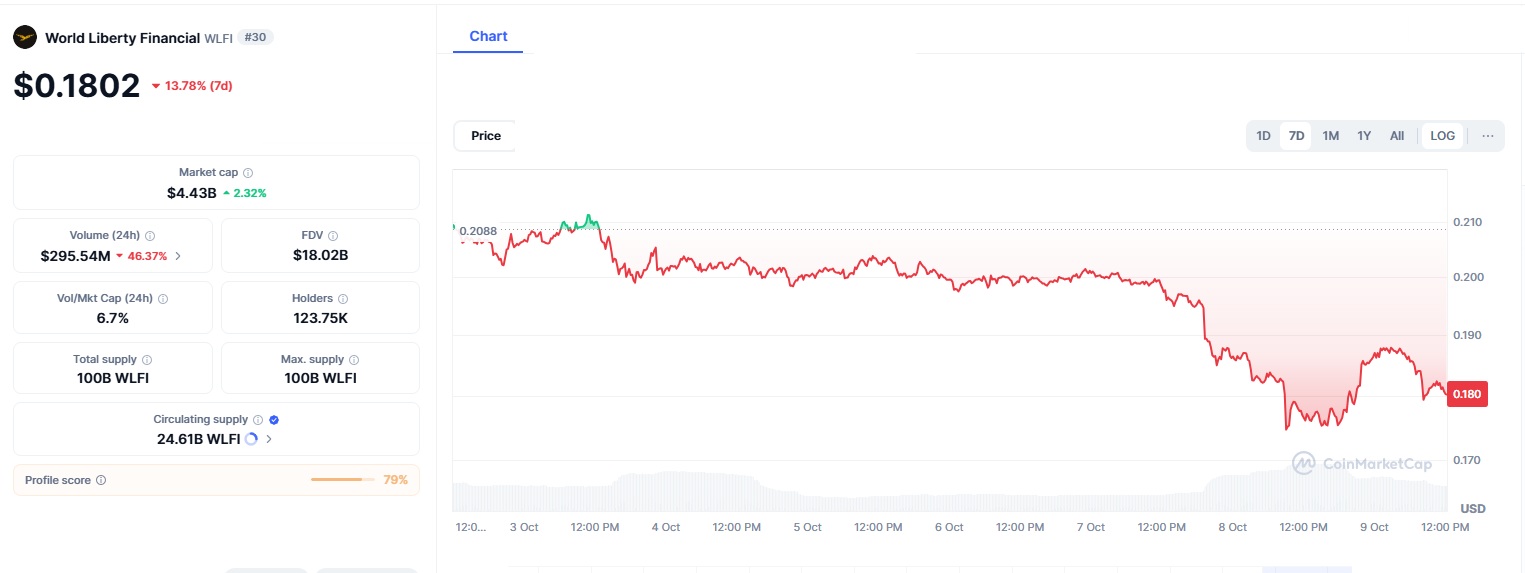

The cryptocurrency market saw another dramatic moment in early October 2025 when WLFI, the token associated with World Liberty Financial and backed by the Trump family, fell 10% in just one day. Within hours, nearly $82 million flowed out of its market positions, triggering widespread discussion across crypto communities. For many investors, this wasn’t just another price swing it was a test of whether WLFI could handle the pressure of large outflows or if the hype surrounding it would fade into a long decline.

The fall came as the token’s total value locked (TVL) a key measure of how much money is held within its ecosystem dropped from over $700 million to $630 million, according to CoinGlass data. This reflected growing caution among traders, though the sudden spike in trading volume to $550 million showed that others saw the dip as a buying opportunity.

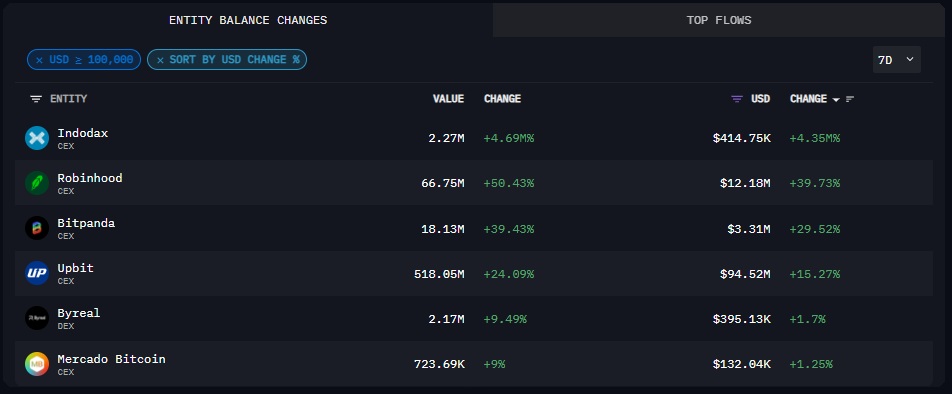

Despite the negative headlines, WLFI still has strong backers. Major investors, including entities linked to Robinhood, Bitget, Bitpanda, and Indodax, reportedly purchased more than $30 million worth of WLFI in the past week, according to Arkham Intelligence. These strategic buys suggest that big players might still see potential in the token’s long-term future, even amid short-term turbulence.

Meanwhile, smaller exchanges such as Binance, MEXC, and Coinbase reduced their WLFI holdings slightly each selling less than 1% of reserves. Analysts interpreted this as normal profit-taking rather than signs of panic. Market sentiment, however, showed some weakness, the number of users tracking WLFI on CoinMarketCap dropped from 79% positive to 75%, reflecting caution rather than confidence.

Understanding WLFI’s Market Position

To help simplify what’s happening with WLFI, the following table outlines the key metrics that explain the current situation:

| Metric

|

Recent Data (October 2025)

|

Implication

|

|---|---|---|

| Price Drop | 10% in 24 hours | Indicates growing short-term selling pressure |

| Liquidity Outflow | $82 million | Investors moving funds away from WLFI’s market |

| Total Value Locked (TVL) | $630 million | Reflects the overall confidence and capital held in the ecosystem |

| Trading Volume | $550 million (up 100%) | Suggests active trading and potential for volatility |

| Whale Purchases | $30 million accumulated | Large investors buying the dip for long-term potential |

| Funding Rate | 0.0033% (positive) | Shows ongoing capital inflow from leveraged traders |

| Community Sentiment | Dropped from 79% to 75% positive | Reflects cautious investor mood |

WLFI’s 10% fall is significant because the token has been seen as the face of political-themed cryptocurrencies, tied to the influence of Donald Trump and the broader idea of “financial freedom.” The dip, combined with major outflows, tested whether the project’s community and investors could remain confident under pressure. One major concern among analysts is that WLFI’s recent launch of the USD1 stablecoin on the Aptos blockchain did not prevent the price decline. This raised questions about whether new product announcements are enough to sustain momentum when broader market conditions turn volatile.

At the same time, technical indicators hint at a possible rebound. Data from liquidation maps tools used to track where leveraged traders may be forced to buy or sell — shows a potential path upward toward $0.193, provided support levels remain intact. The positive funding rate also suggests that traders using leverage are still willing to bet on WLFI’s recovery, which can create upward price pressure.

The Road to Recovery — or Further Decline?

Market analysts are divided on what comes next. Optimists believe the heavy trading volume and whale accumulation are signs of resilience. If buying continues and the market stabilizes, WLFI could rise toward the $0.193 mark within weeks. A successful rebound would restore confidence and could attract new investors.

Skeptics, however, warn that the 10% drop is a sign of deeper structural weakness. If outflows continue and sentiment worsens, WLFI could fall below $0.15, erasing recent gains and discouraging new entrants. The token’s reputation, built on celebrity association, also adds an unpredictable factor public perception can shift quickly in politically linked projects.

In essence, WLFI’s future depends on whether large holders continue to support it and if developers deliver consistent progress on the ecosystem. The current volatility reflects not just price speculation, but also a broader question about whether political branding alone can sustain a digital asset.

Looking Ahead

WLFI’s performance in the coming weeks could influence the entire niche of politically inspired cryptocurrencies. A recovery to $0.193 would strengthen the argument that these tokens can survive market shocks and attract long-term capital. A deeper fall, however, could send investors back toward more established assets like Bitcoin and Ethereum, where volatility feels less unpredictable. Whichever way the chart moves, WLFI’s October dip serves as a reminder that the crypto market rewards adaptability. Even with influential backing, every token must prove its strength through consistent growth, strong liquidity, and community confidence.

In summary, WLFI’s sharp decline and $82 million outflow mark a crucial test. If whale buyers and positive funding rates sustain momentum, the rebound target of $0.193 remains possible. But if bearish sentiment continues, a slide toward $0.15 or lower could follow. For now, the token stands at a crossroads one that will reveal whether it can turn political hype into financial staying power.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.