XCN coin is making headlines again, trading around $0.013 after a significant surge thanks to Onyx Protocol’s advancements in decentralized finance (DeFi). Traders are now wondering, Could $0.05 be the next big target for this underdog? Onyx Protocol has impressed the market with a 125% price increase, driven by the launch of the Onyx Smart Wallet. This wallet simplifies DeFi interactions, making them more user-friendly and accessible. While the broader altcoin market is benefiting from Bitcoin’s stability, Onyx is standing out due to its unique features.

XCN started as a niche project, but today it is becoming a serious player in the market. Once overshadowed by giants like Aave, Onyx Protocol is now gaining traction in multi-asset lending. It offers scalable and secure borrowing options, attracting interest from big investors and regular traders alike.

Onyx Protocol Powers XCN’s Rise with Smart Wallet Launch

Onyx Protocol, the engine behind XCN crypto, started as a blockchain platform focused on peer-to-peer lending across ERC-20, ERC-721, and ERC-1155 tokens all without the usual custody hassles. With a governance system where Onyx holders get to vote on upgrades, Onyx has brought a fresh, democratic twist to decentralised finance.

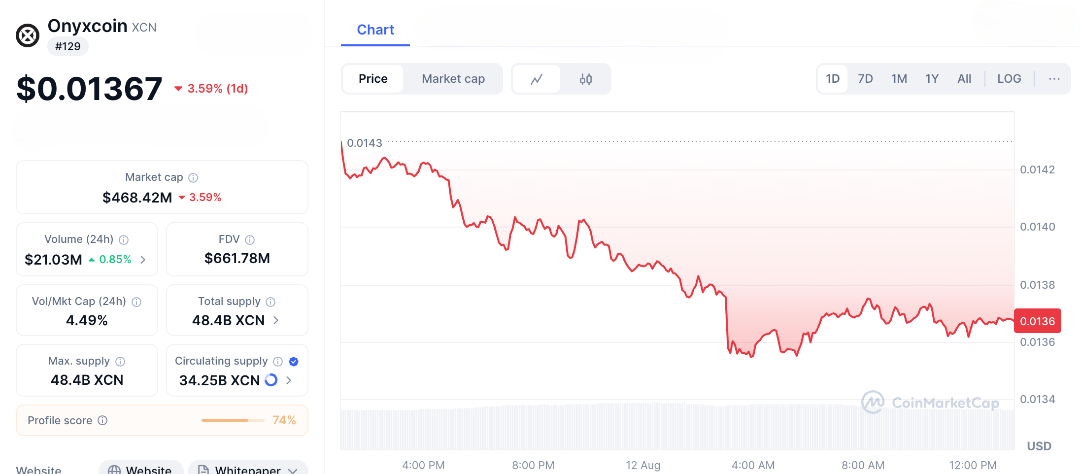

The recent price rally kicked off with the launch of the Smart Wallet, which makes entering DeFi easier by showing all your balances in one place and providing non-custodial security. This lets users lend, borrow, and earn yields on a wide variety of assets smoothly. This isn’t just hype on-chain data confirms daily trading volumes soaring past $20 million and open interest doubling as more investors jump in. Onyx’s market cap is now around $468 million, reflecting strong demand for its roughly 34 billion circulating tokens in a DeFi space that’s growing up fast.

What makes this XCN rally especially exciting is the timing. The crypto market, energised by Ethereum’s steady rise and more institutional money flowing into spot ETFs, is hungry for projects that deliver real utility. Onyx Protocol’s focus on multi-asset support like borrowing against NFTs or tokenised real-world assets positions XCN as a key bridge between traditional finance and blockchain innovation. Analysts are upbeat: they predict year-end highs around $0.0318, with more optimistic estimates reaching $0.045 if adoption speeds up. Could $0.05 be next? It’s definitely possible in a bullish scenario where Onyx’s Layer-3 tech, built on fast, low-fee networks like Arbitrum and Base, pulls ahead of the competition.

The technical charts support this view. XCN has broken through resistance levels it had struggled with for months. The Relative Strength Index (RSI) sits at a healthy 40, showing there’s room to grow without being overbought. Meanwhile, the expanding Bollinger Bands suggest volatility is picking up, which could work in favour of bulls especially if the support level at $0.012 holds strong.

But every great story has its challenges, and XCN’s journey is no different. The token’s history of wild swings like an 85% drop after a massive 1,500% surge in January reminds us that supply pressures from its 48 billion max cap can weigh heavily. Broader issues like possible interest rate hikes and increased regulatory attention on DeFi could also limit its upside. Competition is fierce, too, with established players already dominating the space. Onyx’s deflationary fees and staking rewards around 5-7% are attractive for holders, but for real growth, steady accumulation by big investors is crucial. Recent data shows net inflows hitting nearly $14 million in a day, signalling strong interest but if big players start selling, it could quickly turn the tide.

XCN’s Redemption Story

XCN crypto, previously known as Chain, has come a long way since rebranding to Onyx. Focused on cryptographic security and scalability, its recent price surge feels like the highlight of a thrilling comeback. Big partnerships with major exchanges like Coinbase and HTX have increased liquidity. Community-led token burns and AI technology integrations hint at exciting future developments.

If Onyx achieves the expected enterprise adoption, some optimistic predictions suggest XCN could reach $0.50 by 2026, making today’s price under $0.02 seem like an incredible bargain. Traders should monitor the $0.018 resistance level closely; breaking this level could trigger a rush of buying, pushing the price toward $0.05 and sparking talk of a wider altcoin rally.

XCN captures the thrill of a crypto project chasing both utility and momentum. Is $0.05 the next target? While history often rewards bold moves, smart traders diversify and ride the market waves. Share this if you’re either gearing up to invest or holding tight for the next big rise. The story of Onyx is just getting started, and in the unpredictable world of crypto, fortunes can change quickly with the next innovation.

FAQs

1. Why is XCN crypto surging?

XCN crypto surged due to the Onyx Smart Wallet launch, increased trading volume, and strong DeFi demand, pushing prices to $0.014.

2. What is XCN crypto’s role in Onyx Protocol?

XCN crypto serves as a governance and utility token, enabling voting and transactions in Onyx’s multi-asset DeFi lending ecosystem.

3. Could XCN crypto hit $0.05 soon?

Analysts predict $0.0318-$0.045 by year-end if momentum holds, with $0.05 possible in a strong bull market.

4. What’s driving the XCN crypto rally?

The Onyx Smart Wallet, high staking APR (56%), and partnerships with Coinbase and HTX boost demand and liquidity.

5. Are there risks to XCN crypto’s rise?

High token supply (48B), past volatility (85% drops), and macro pressures like rate hikes could trigger corrections.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.