The cryptocurrency landscape is witnessing significant developments with the potential introduction of XRP ETFs, which could mark a pivotal moment for Ripple’s XRP and the broader digital asset market. This survey note provides a detailed examination of the latest updates, market sentiments, legal contexts, and potential impacts as of June 3, 2025, ensuring a thorough understanding for stakeholders and enthusiasts alike.

Background and Current Status

An XRP ETF, or Exchange-Traded Fund, is a financial product that tracks the price of XRP, Ripple’s cryptocurrency, and is traded on stock exchanges. This would allow investors to gain exposure to XRP without directly holding the cryptocurrency, potentially attracting institutional and retail investors through regulated channels. As of today, the U.S. Securities and Exchange Commission (SEC) is actively reviewing several XRP ETF proposals, with WisdomTree’s spot XRP ETF application being a prominent case. The SEC has initiated this review process, which could extend up to 240 days, as outlined in their notice published under Release No. 34-103124. During this period, the SEC is seeking public comments to address concerns about market manipulation and investor protection, reflecting a cautious approach to integrating cryptocurrencies into traditional financial systems.

The review process is not limited to WisdomTree; other issuers, including 21Shares, Bitwise Invest, Canary Funds, Franklin Templeton, and Grayscale, are also awaiting SEC decisions on their XRP ETF applications. This collective effort underscores the growing interest in XRP as a viable investment vehicle, potentially paving the way for similar crypto asset products if approved.

Market Sentiment and Legal Landscape

Despite the regulatory scrutiny, market sentiment remains robustly optimistic. According to Polymarket, a prediction market platform, there is an 89% probability that the SEC will approve an XRP-spot ETF by December 2025, a record high that reflects investor confidence in the potential approval.

However, the path to approval is fraught with legal uncertainties. The ongoing legal battle between Ripple and the SEC, particularly concerning whether XRP should be classified as a security, adds significant complexity. Ripple’s Chief Legal Officer, Stuart Alderoty, has submitted a letter to the SEC’s crypto taskforce arguing against this classification, which could influence the regulatory outcome. Recent developments, such as the SEC filing an appeal notice in October 2024 challenging the Programmatic Sales of XRP ruling, and Judge Torres’ rejection of the SEC’s request for an indicative ruling on May 15, 2025, have introduced volatility. This legal tug-of-war has led to XRP’s price dropping from $2.5712 to $2.0801 by May 31, 2025. These events highlight the controversy surrounding XRP’s regulatory status and its potential impact on ETF approvals.

Recent Developments in XRP Financial Products

While the focus is on spot XRP ETFs, the market has already seen the launch of XRP futures ETFs, indicating a maturing ecosystem for XRP-based investments. On May 22, 2025, Volatility Shares introduced an XRP futures ETF, which analysts expect to enjoy demand for its services. These developments underscore the growing acceptance of XRP in financial markets and set the stage for further innovation.

Potential Impact and Market Implications

The approval of an XRP ETF could be transformative for XRP and the broader cryptocurrency market. Analysts suggest that if the SEC approves pending XRP-spot ETF applications, similar flows to the U.S. BTC-spot ETF market could drive XRP to fresh record highs, potentially reaching $5, as speculated in recent analyses. This could attract significant institutional investment, enhancing liquidity and legitimacy for XRP. Conversely, if legal challenges persist, such as the SEC successfully overturning the Programmatic Sales ruling, it might lead to disapproval of XRP ETF applications, potentially causing XRP’s price to drop to $1.50, according to market forecasts.

The introduction of an XRP ETF would provide a regulated avenue for investors, bridging the gap between traditional finance and digital assets. This could stimulate broader adoption, particularly among institutional investors wary of direct cryptocurrency holdings. However, the outcome remains uncertain, with the SEC’s decision on June 17, 2025, for other postponed ETF applications adding another layer of anticipation.

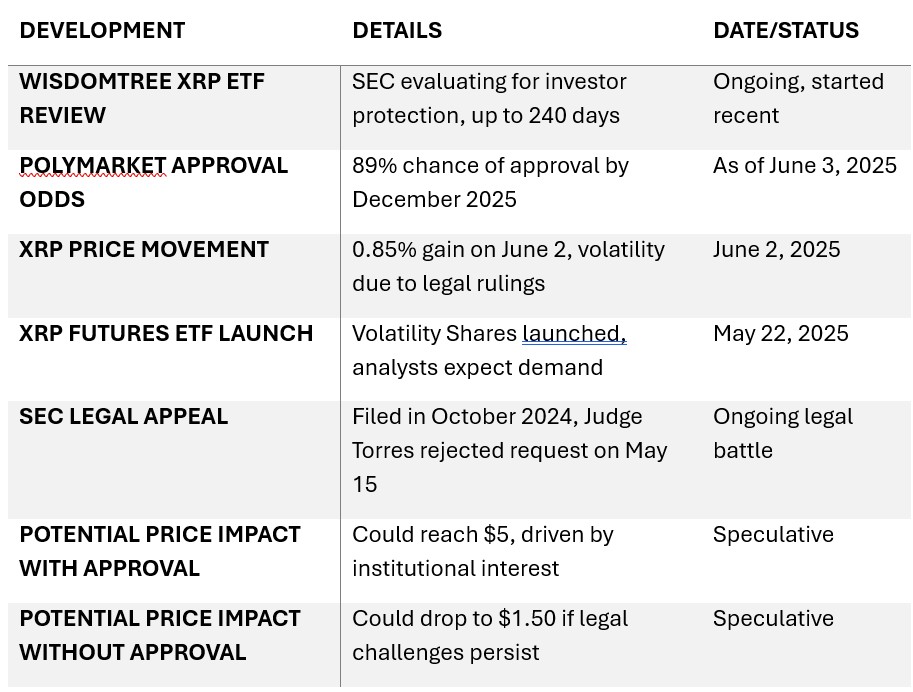

Detailed Table of Key Developments

Conclusion

As of June 3, 2025, the XRP ETF landscape is characterized by a mix of optimism and uncertainty. The SEC’s ongoing review, coupled with legal battles and recent launches of XRP futures ETFs, paints a dynamic picture. While the market leans toward approval, the legal context remains a critical factor. Stakeholders should stay informed as this story develops, with potential implications for XRP’s price and the broader adoption of cryptocurrencies in traditional finance.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.