Get ready, crypto enthusiasts, 2025 just got a lot more exciting. The XRP Mastercard isn’t just another card tied to a token; it’s a step into the future of payments. Backed by Gemini, Ripple, and Mastercard, this card aims to make spending crypto in everyday life a reality. The buzz started with a giant billboard in New York City, located at 29th & Broadway. The ad featured a sleek black Mastercard from WebBank with the date “8.25.25” and the playful message, “Prepare your bags.”

🚨 BREAKING: XRP MASTERCARD? GEMINI JUST WENT ALL-IN 😱

A bombshell just hit NYC — Gemini (@gemini) dropped a TikTok showing a massive billboard:

“XRP + Mastercard → Launching 8.25.25” 🤯🔥

This isn’t a rumor. It’s a 50-foot neon countdown plastered over New York.

— Diana (@InvestWithD) August 21, 2025

This isn’t just flashy marketing; it’s a significant development. Soon, XRP holders may be able to tap their cards to pay for everyday items using their tokens. If this becomes a reality, it’s not just news, it’s a historic moment in the world of finance.

The Genesis of XRP Mastercard

The XRP Mastercard is born out of Ripple’s long-standing mission, turning crypto into real-world money you can actually spend. By teaming up with Mastercard, Ripple created a debit card that lets users pay with XRP at millions of merchants worldwide just like swiping any other card.

Backed by $75 million from Ripple and Gemini, the XRP Mastercard uses an innovative system to convert XRP into local currency instantly when you swipe the card. This means you can spend your XRP without worrying about exchange rate fluctuations.

For travelers, this card is a game-changer. Forget about dealing with currency exchange counters or high ATM withdrawal fees. You just load your XRP into the Gemini app and use your card anywhere that accepts Mastercard. The card has already been tested in select markets, showing transaction times under 5 seconds and fees as low as 1%, which is cheaper than most traditional cards.

As countries like Thailand explore crypto payments for tourists, the XRP Mastercard could help Ripple become a leader in connecting digital and traditional finance. With the global remittance market worth over $800 billion and Ripple handling billions in transactions, this card could bring XRP from trading charts into everyday use.

Could XRP Mastercard Spark the Next Rally?

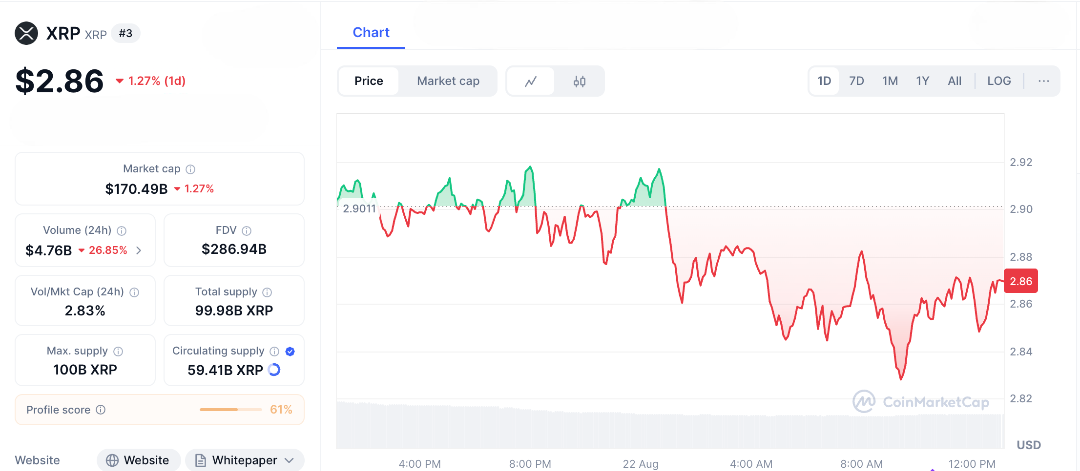

The big question on every trader’s mind, will XRP Mastercard move the price? History suggests it could. When Ripple partnered with MoneyGram, XRP skyrocketed over 300% in just a few months. Right now, XRP sits at $2.86, giving it a market cap of about $170 billion. On-chain volumes remain strong at $2 billion daily, even with recent dips. Analysts predict the card could attract 1 million users in its first year. If that happens, the extra demand plus token burns from fees could easily push XRP toward the $4 mark.

Backing from Gemini adds a layer of trust, offering secure custody for funds. Meanwhile, Mastercard’s network of 100 million merchants ensures real-world usability on a massive scale. Put together, this trio Ripple’s blockchain tech, Gemini’s exchange strength, and Mastercard’s global reach creates a recipe to mainstream crypto payments. For investors, it’s a classic case of FOMO fuel. If adoption ramps up, XRP Mastercard could rekindle echoes of 2017’s legendary 36,000% rally the kind of move that turns cautious holders into die-hard believers.

Why Timing Matters for XRP Mastercard

The excitement around the XRP Mastercard is not just about the card itself; it’s about the perfect timing. With the crypto market now worth over $4 trillion and Bitcoin ETFs attracting $60 billion, investors are looking for practical uses for crypto. If this card is successful, it could pave the way for more products that make crypto spendable worldwide, expanding XRP’s role beyond just remittances.

However, there are challenges. Regulatory issues, like Ripple’s ongoing battle with the SEC, could delay a U.S. launch, limiting short-term gains. Crypto’s volatility is also a factor; for example, XRP dropped 5% last week when Bitcoin stumbled. Despite this, support at $2.70 remains strong, and the Relative Strength Index (RSI) is at 52, suggesting it could easily turn bullish. Analysts believe that with Mastercard’s marketing power, XRP could see a 30% increase in the near future, good news for those who have held onto their tokens through legal battles and market uncertainty.

The XRP Mastercard aims to make payments borderless, instant, and mainstream. With $75 million in support, Ripple and Gemini are preparing for widespread adoption, especially as Ripple expands in Europe and Asia. Within the XRP community, this feels like a big step forward. At $2.86, many think the token is undervalued, especially if Mastercard brings in millions of new users. But there are risks: if adoption is slow or fees are too high, the excitement might fade quickly.

History shows that major product launches can lead to explosive growth. For long-term XRP holders, this could be the big catalyst that makes 2025 a standout year for Ripple. Share this news if you’re paying attention, because the XRP Mastercard could be a game-changer.

FAQs

- What is XRP Mastercard? XRP Mastercard is a debit card backed by $75 million from Gemini and Ripple, allowing users to spend XRP at Mastercard merchants with instant fiat conversion.

- When does XRP Mastercard launch? XRP Mastercard launches on August 25, 2025, starting with pilots in Thailand for tourists.

- How does XRP Mastercard work? Users load XRP into a Gemini-linked wallet, and the card converts it to local currency for payments, with 1% fees and seconds-fast transactions.

- Could XRP Mastercard spark a rally? If it attracts 1 million users, increased demand and fee burns could push XRP from $3.05 to $4 or higher.

- What risks face XRP Mastercard? Volatility in XRP’s price or regulatory delays could hinder adoption and limit the card’s impact.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.