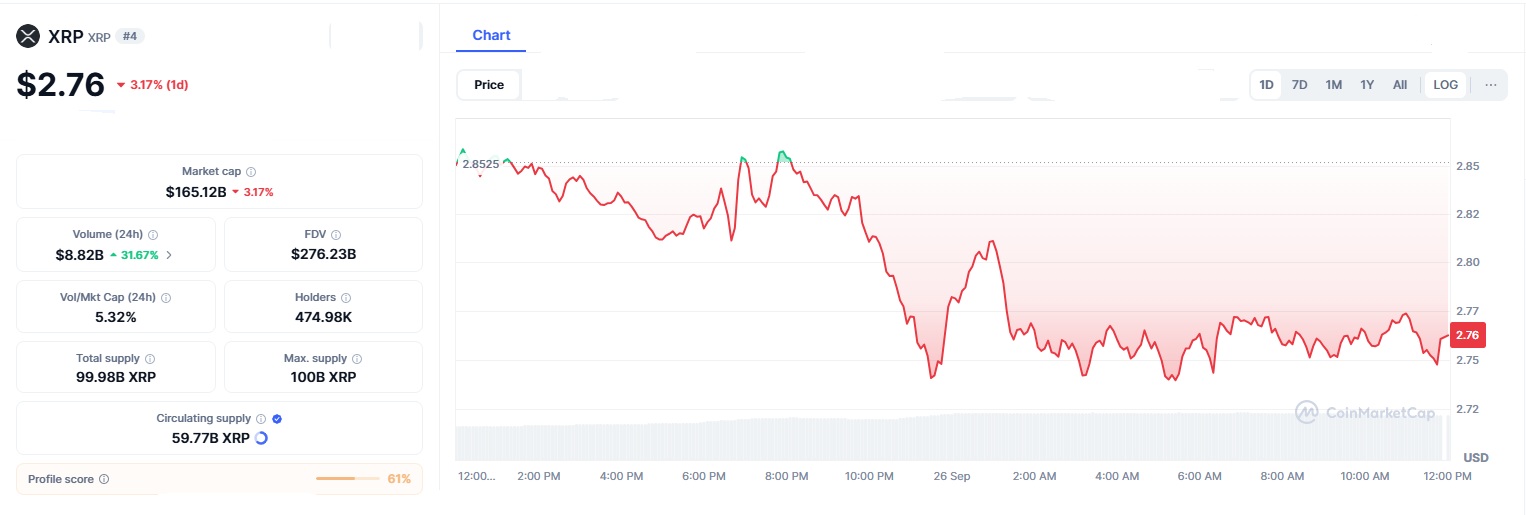

The cryptocurrency market is never short of surprises, and XRP price has just given investors another reminder of how unpredictable things can be. On September 26, 2025, the token slipped by 6%, moving from a high of about $2.92 down to $2.75. While this may not seem dramatic at first glance, the decline came with heavy trading activity and added to growing uncertainty across the market.

What Triggered the XRP Price Drop

XRP’s recent decline happened alongside a downturn in the overall crypto market. This pressure began when Bitcoin fell below $109,000, its lowest in weeks. As Bitcoin is a key player in the crypto market, its decline affected other important assets. Ethereum, for instance, dropped by about 8% to around $3,800. In total, more than $1.1 billion was lost, mainly due to traders borrowing too much to invest.

For XRP, large-scale selling by institutions was a major factor. About $277 million of XRP was traded, which was more than the usual amount. Whales, reportedly moved around 160 million coins worth $476 million over two weeks in mid-September, causing concerns of more selling. This led to XRP’s market value dropping by nearly $19 billion in a week, falling below the important $3 per token level.

The decline is also connected to broader economic issues. Comments from U.S. Federal Reserve Chair Jerome Powell indicated that inflation is still a worry and significant rate cuts are unlikely. Higher treasury yields often deter investors from riskier assets like crypto. Even the recent approval of the first U.S. XRP exchange-traded fund (ETF) could not change this cautious sentiment.

Ripple’s Progress Behind the Scenes

Despite the short-term decline, XRP is not without progress. Ripple, the company behind XRP, has been working on strengthening its ecosystem. Recent developments include the launch of its stablecoin RLUSD, the introduction of an Ethereum Virtual Machine (EVM) sidechain to attract developers, and growth in the number of wallets on the XRP Ledger, which now exceeds 7 million. These updates are not about speculation; they provide a stronger technical base for the network.

Ripple’s efforts highlight a contrast between market prices, which swing with sentiment, and long-term fundamentals, which continue to improve. This raises an important question: is the latest fall a reflection of temporary fear, or a sign of deeper weakness?

What Traders Are Watching

Right now, the key level for XRP is around $2.75. If the price holds above it, a recovery toward $3 may be possible. If it breaks below, analysts suggest that $2.70 or even lower could be tested. Much also depends on Bitcoin’s performance. With a massive $23 billion options expiry influencing prices, short-term volatility is expected.

Market opinions are divided. Some traders see this dip as a buying opportunity, believing ETF approvals and Ripple’s ongoing projects will eventually lift prices. Others argue that large holders selling millions of tokens could push the price further down in the near term.

Winners and Losers

The situation affects different groups in different ways. Retail investors, especially those trading with leverage, have faced losses from sudden liquidations. Institutions, while responsible for much of the selling, are also impacted if prices continue to fall. Altcoins like Solana and Ethereum have also suffered, showing how closely the market is tied to Bitcoin’s movements.

Ripple itself may not be directly harmed by the price swings, but investor sentiment toward XRP does matter. Enterprises considering Ripple’s technology for payments are watching for signs of stability. Developers building on its network remain focused, with smart contracts on the new EVM sidechain growing rapidly since its launch.

Potential Scenarios

The next few months could play out in different ways. If U.S. inflation data eases and more crypto ETFs gain approval, inflows from institutional investors may help XRP rebound above $3 and possibly higher. Ripple’s application for a U.S. banking license and its push for new partnerships could also provide momentum.

On the other hand, if economic data remains strong and the Federal Reserve avoids rate cuts, investor appetite for crypto could shrink further. Combined with continued whale selling, this could pull XRP down toward $2.50. Long-term forecasts remain cautiously optimistic, with some analysts predicting XRP could reach $3.5 to $5 in 2025, and even $10 by 2026 if adoption grows significantly.

Key Takeaways at a Glance

| Factor | Current Situation | Possible Impact |

|---|---|---|

| Bitcoin Price | Dropped below $109,000 | Pulls XRP and other altcoins lower |

| Institutional Selling | $277M in XRP traded, $800M moved by whales | Creates strong downward pressure |

| Market Conditions | Rising Treasury yields and Fed caution | Reduces appetite for crypto risk |

| Ripple’s Progress | Stablecoin RLUSD, EVM sidechain, 7M wallets | Strengthens long-term fundamentals |

| Near-Term Levels | $2.75 support, $2.70 next test | Determines short-term direction |

XRP’s 6% decline in late September reflects both the volatility of cryptocurrency markets and the influence of broader economic factors. While the drop may unsettle investors, Ripple’s ongoing technological progress shows that the project is far from standing still. Whether this is a short-term setback or the start of deeper losses will depend on global markets, regulatory developments, and investor confidence.

For now, the story of XRP remains one of both risk and opportunity an asset caught between the short-term pressures of market sentiment and the long-term vision of building a role in the future of global finance.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.